Japan Food Preservatives Market Size, Share, and COVID-19 Impact Analysis, By Type (Natural Preservatives, Synthetic Preservatives), By Application (Beverage, Dairy and Frozen Products, Bakery, Meat, Poultry and Seafood, Confectionery, and Sauces and Salad Mixes), and Japan Food Preservatives Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesJapan Food Preservatives Market Insights Forecasts to 2035

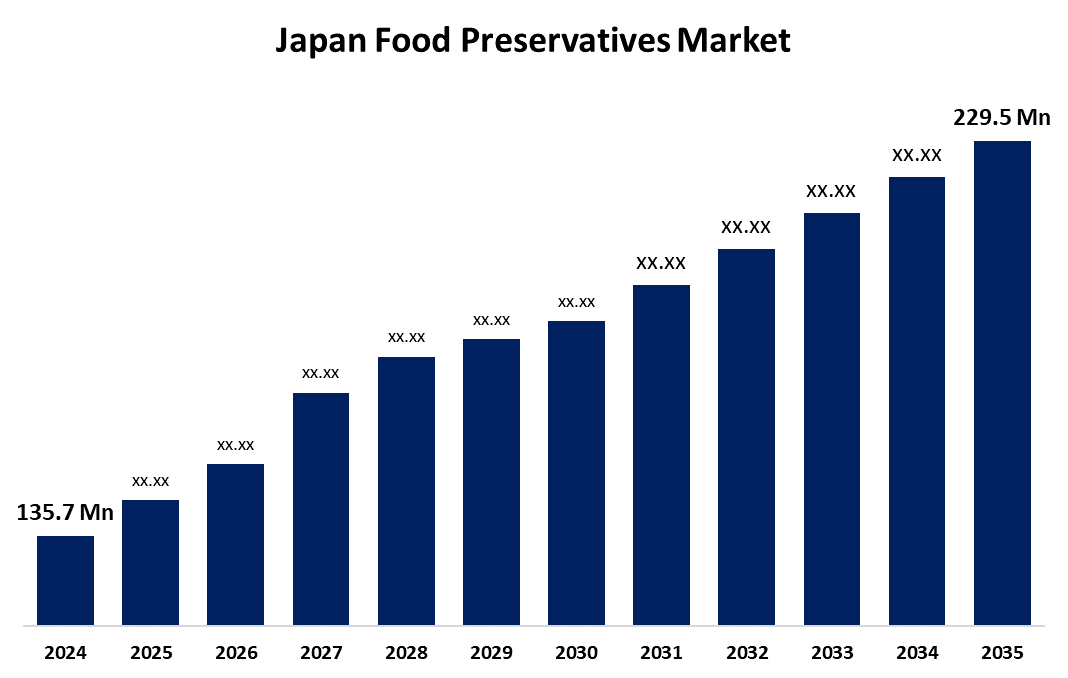

- The Japan Food Preservatives Market Size Was Estimated at USD 135.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.89% from 2025 to 2035

- The Japan Food Preservatives Market Size is Expected to Reach USD 229.5 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan Food Preservatives Market Size is anticipated to reach USD 229.5 Million by 2035, Growing at a CAGR of 4.89% from 2025 to 2035. The growing demand for convenience food, the increase in demand for natural and healthy foods, and the need to reduce food waste are factors that are promoting the growth of the food preservatives industry in Japan. In Japan, food waste reduction is a key priority, and preservatives can help enhance shelf life and limit spoiling.

Market Overview

The overall market for chemicals and other materials that help food stay fresher for the longest time is referred to as the food preservatives market. The rising demand for eating meat, the need for products to last longer, and the need for processed food is directly contributing to this industry. Food preservatives throughout the food industry include canned goods, dairy products, baked goods, processed meats, beverages, minimal processing, and fresh fruit and vegetables. Preservatives aid in reducing food waste because they extend the time that food is safe to consume. Food preservatives can also assist with the logistics and distribution of items.

The food preservatives market in Japan is growing at a steady pace since many products are being used for food waste prevention and sustaining life. On the other hand, projected growth in online grocery shopping would also increase the market for food preservatives required to have a longer shelf life for standard transport time. Consumers are thus able to afford better-quality preservative food products due to the availability of funds in the market, thus accelerating the growth of the regional market. With green ways of healthy living being contemplated, the consumption of natural preservatives such as ascorbic acid and tocopherol has also risen, pushing the market forward. Growing acceptance of modern preservation techniques, such as controlled release and nanotechnology, that are effective, environmentally friendly, and health-conscious, is thus also expected to aid in further developing the Japanese market for food preservatives during the forecast period.

The various major players in the Japan food preservatives industry have many opportunities in the future, including a focus on food functional ingredients, the development of new natural preservatives, growing focus on prepared foods, etc. In Japan, the government-run food policy is managed by the Ministry of Health, Labour and Welfare (MHLW), and food additives are regulated under the Food Sanitation Act (1958). The MHLW compiles a list of allowable food additives, and only those substances which are provided on the list can be used in food.

Report Coverage

This research report categorizes the market for the Japan food preservatives market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan food preservatives market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan food preservatives market.

Japan Food Preservatives Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 135.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.89% |

| 2035 Value Projection: | USD 229.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 189 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, and COVID-19 Impact Analysis |

| Companies covered:: | DuPont de Nemours, Inc., Kerry Group, Cargill, Inc., BASF SE, Nissin Foods Holdings Co., Ltd, Ajinomoto Co., Inc., Corbion NV, Chr. Hansen Holding A/S, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The majority of the food preservatives market is influenced by Japan's aging population and national healthcare inclination. A rising elderly population creates increasing demand for convenient pre-processed meals, and food preservatives contribute to the taste and shelf-life of such meals and beverages. Preventive care and health consciousness are also fueling the demand for natural ingredients and functional foods. Another factor is advanced food processing and technology, because it helps companies adopt an increasingly complicated natural preservation process while retaining the nutritional and quality levels of the food. In developing modern preservative solutions, many manufacturers have invested heavily in research. Food products that use natural food preservation methods and have a limited number of identifiable ingredients are trending among Japanese consumers. This trend is driving the development of clean-label and plant-matter preservative options in the food industry. The strong growth in the food export market will also create a requirement for preservatives in the food science field to maintain the condition of food stocks during storage and shipping abroad. As a result, many new opportunities exist for innovative food preservation solutions stemming from this export growth.

Restraining Factors

The stringent regulatory compliance is the primary condition hindering market growth. Producers have to ride the tight compliance bandwagon, owing to Japan's stringent food safety standards that impose a tedious, time-consuming, and expensive process of bringing a product into the market. While some natural food preservatives may require certain agricultural inputs, these natural inputs probably have low availability within Japan, so availability should be considered as price hike can occur. Natural preservatives may also be too costly to produce compared to synthetic additives, which would hinder the utility of the application of these products, especially in terms of certain food categories. Small and medium-sized food businesses face difficulties allocating the regular amount of funding toward extensive research on preservatives. High costs impose a barrier to innovation and market entry for any potential new preservation technologies.

Market Segmentation

The Japan food preservatives market share is classified into type and application.

- The synthetic preservatives segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan food preservatives market is segmented by type into natural preservatives, synthetic preservatives. Among these, the synthetic preservatives segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The main drivers for segment growth include the relatively affordable prices, long shelf life, and the ability to preserve a larger range of food items. Such preservatives may be found in processed foods and drinks to augment their flavor, diminish spoilage, and keep the products for a longer possible time. It generally has better antibacterial properties as compared to its natural counterparts, hence extending shelf life and preservation of targeted foods.

- The beverage segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan food preservatives market is segmented by application into beverage, dairy and frozen products, bakery, meat, poultry and seafood, confectionery, and sauces and salad mixes. Among these, the beverage segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. Hence, there is an increasing need for food additives as functional beverages are getting popular, such as fortified juices, energy drinks, and more healthful teas. Japanese consumers are becoming increasingly health-conscious, thus looking for therapeutic-type products to help them in achieving their own wellness goals. These beverages with additives impart taste and offer worthy nutritional properties and medicinal advantages. Continued innovations in beverage formulations, in the case of plant-based and functional beverages, lead to the beverage category being the largest in the food marketplace.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan food preservatives market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- DuPont de Nemours, Inc.

- Kerry Group

- Cargill, Inc.

- BASF SE

- Nissin Foods Holdings Co., Ltd

- Ajinomoto Co., Inc.

- Corbion NV

- Chr. Hansen Holding A/S

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Food Preservatives Market based on the below-mentioned segments:

Japan Food Preservatives Market, By Type

- Natural Preservatives

- Synthetic Preservatives

Japan Food Preservatives Market, By Application

- Beverage

- Dairy and Frozen Products

- Bakery

- Meat

- Poultry and Seafood

- Confectionery

- Sauces and Salad Mixes

Need help to buy this report?