Japan Food Packaging Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Rigid, Semi-rigid, & Flexible), By Material (Glass, Metal, Paper & Paperboard, Plastics (Non-biodegradable, Biodegradable), and Wood), By Packaging Type (Bags & Pouches, Films & Wraps, Stick Packs & Sachets, Bottles & Jars, Boxes & Cartons, Cans, Trays, and Clamshells), By Application (Fruits & Vegetables, Bakery & Confectionery, Dairy Products, Meat, Poultry & Seafood, Sauces, Dressings, and Condiments), and Japan Food Packaging Market Insights, Industry Trend, Forecasts to 2035.

Industry: Food & BeveragesJapan Food Packaging Market Insights Forecasts to 2035

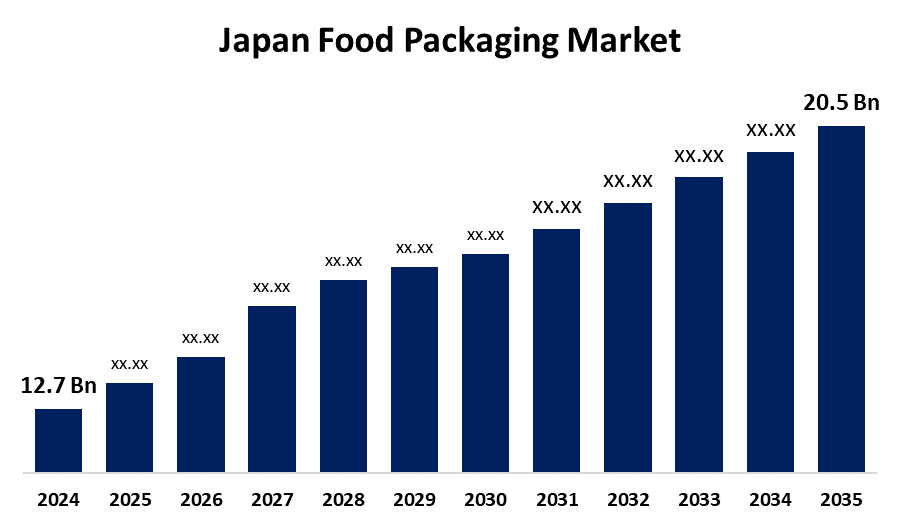

- The Japan Food Packaging Market Size was estimated at USD 12.7 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.45% from 2025 to 2035

- The Japan Food Packaging Market Size is Expected to Reach USD 20.5 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Japan Food Packaging Market Size is Anticipated to reach USD 20.5 Billion By 2035, Growing at a CAGR of 4.45% from 2025 to 2035. The Japan food packaging market is growing due to increasing consumer demand for convenience, healthiness, and sustainability, along with stringent regulations and rising e-commerce growth. Advancements in packaging technologies, particularly flexible packaging technologies, are also driving the market's growth.

Market Overview

The Japan food packaging market refers to the production and application of materials for protecting, preserving, and transporting food products safely and efficiently. It covers plastic, paper, metal, and glass types of packaging used by retail, foodservice, and logistics businesses. Japan's strengths are its advanced manufacturing technology, impeccable standards for quality control, and innovation for sustainable packaging solutions. The trend of moving towards more eco-friendly, recyclable, and biodegradable materials is driven by environment-conscious consumers and businesses that prioritize the environment. Market drivers are expanding consumers' demand for convenience foods, rising food hygiene and safety concerns, and the growth of e-commerce in the food business. Government policy further supports the trend of government encouragement of reducing waste, encouraging recycling, and providing incentives to create sustainable packaging. The Japan food packaging market is generally changing fast, finding a balance between innovation, safety, and sustainability to address the needs of contemporary consumers and regulatory systems.

Report Coverage

This research report categorizes the market for the Japan food packaging market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan food packaging market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan food packaging market.

Japan Food Packaging Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 12.7 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.45% |

| 2035 Value Projection: | USD 20.5 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 179 |

| Tables, Charts & Figures: | 92 |

| Segments covered: | By Product Type, By Material, By Packaging Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Nihon Cellonpack Co., Ltd., Unitika Ltd., Mitsui Chemicals Group, Sekisui Kasei Co., Ltd., Nippon Paper Industries Co., Ltd., Shikoku Kakoki Co., Ltd., Ezaki Glico Co., Ltd., Takigawa Corporation (Rengo Co., Ltd.), Ishida Co., Ltd., Toppan Inc., Toyo Seikan Group Holdings, Ltd., KOBAYASHI & CO., LTD, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The food packaging market in Japan is driven by increasing consumers' demand for convenience and ready-to-eat foods, increasing focus on food hygiene and safety, and rising online food delivery and e-commerce. Sustainability is propelling the trend toward eco-friendly, recyclable, and biodegradable packaging materials. Moreover, stringent government policies on waste reduction and recycling are stimulating the trend for green packaging solutions. All these factors stimulate market growth as well as the development of advanced, sustainable food packaging technology in Japan.

Restraining Factors

The Japan food packaging market is restrained by the high production costs of sustainable materials, severe regulation compliance problems, and resistance from consumers to changes in packaging formats. Besides this, environmental concerns surrounding the disposal of plastic waste and low recycling capacity are hindrances to market growth.

Market Segmentation

The Japan food packaging market share is classified into product type, material, packaging type, and application.

- The flexible segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan food packaging market is segmented by product type into rigid, semi-rigid, & flexible. Among these, the flexible segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributable to the growing technological developments and innovative packaging solutions for product packaging requirements. Flexible packaging consumes much less material than stiff containers and involves less energy while shaping packaging products.

- The plastics segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan food packaging market is segmented by material into glass, metal, paper & paperboard, plastics, and wood. Among these, the plastics segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Plastic used in packaging is the most viable material since it is flexible, light, economical, and does not lead to splintering, yet it safeguards food from harm. The majority of plastic resins utilized in packaging are recyclable.

- The bags & pouches segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan food packaging market is segmented by packaging type into bags & pouches, films & wraps, stick packs & sachets, bottles & jars, boxes & cartons, cans, trays, and clamshells. Among these, the bags & pouches segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Bags & pouches are lightweight and provide good product integrity. They are convenient to reseal and carry, thus boosting their application within the food segment.

- The bakery & confectionery segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan food packaging market is segmented by application into fruits & vegetables, bakery & confectionery, dairy products, meat, poultry & seafood, sauces, dressings, & condiments. Among these, the bakery & confectionery segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to their application in bakery & confectionery products, such as chewing gums, croissants, savory pastry, candies, toffees, and chocolates. Higher consumption of these food products will boost market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan food packaging market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nihon Cellonpack Co., Ltd.

- Unitika Ltd.

- Mitsui Chemicals Group

- Sekisui Kasei Co., Ltd.

- Nippon Paper Industries Co., Ltd.

- Shikoku Kakoki Co., Ltd.

- Ezaki Glico Co., Ltd.

- Takigawa Corporation (Rengo Co., Ltd.)

- Ishida Co., Ltd.

- Toppan Inc.

- Toyo Seikan Group Holdings, Ltd.

- KOBAYASHI & CO., LTD

- Others

Recent Developments:

- In February 2020, Toppan Printing (Toppan) (TSE:7911), a Japan communication, security, packaging, décor materials, and electronics solutions leader, will begin sales of a new food packaging system named Green Flat, which meets the demand for a reduction in plastic packaging and is used as an alternative to traditional skin packs.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan food packaging market based on the below-mentioned segments

Japan Food Packaging Market, By Product Type

- Rigid

- Semi-rigid

- Flexible

Japan Food Packaging Market, By Material

- Glass

- Metal

- Paper & Paperboard

- Plastics

- Wood

Japan Food Packaging Market, By Packaging Type

- Bags & Pouches

- Films & Wraps

- Stick Packs & Sachets

- Bottles & Jars

- Boxes & Cartons

- Cans, Trays

- Clamshells

Japan Food Packaging Market, By Application

- Fruits & Vegetables

- Bakery & Confectionery

- Dairy Products, Meat

- Poultry & Seafood

- Sauces

- Dressings

- Condiments

Need help to buy this report?