Japan Food Fortifying Agents Market Size, Share, and COVID-19 Impact Analysis, By Type (Vitamins, Minerals, Proteins & Amino Acids, Carbohydrates, Prebiotics & Probiotics, Lipids, and Others), By Application (Dairy & Dairy-based Products, Infant Formula, Cereals & Cereal-based Products, Beverages, Dietary supplements, Fats & oils, and Others), and Japan Food Fortifying Agents Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsJapan Food Fortifying Agents Market Insights Forecasts to 2035

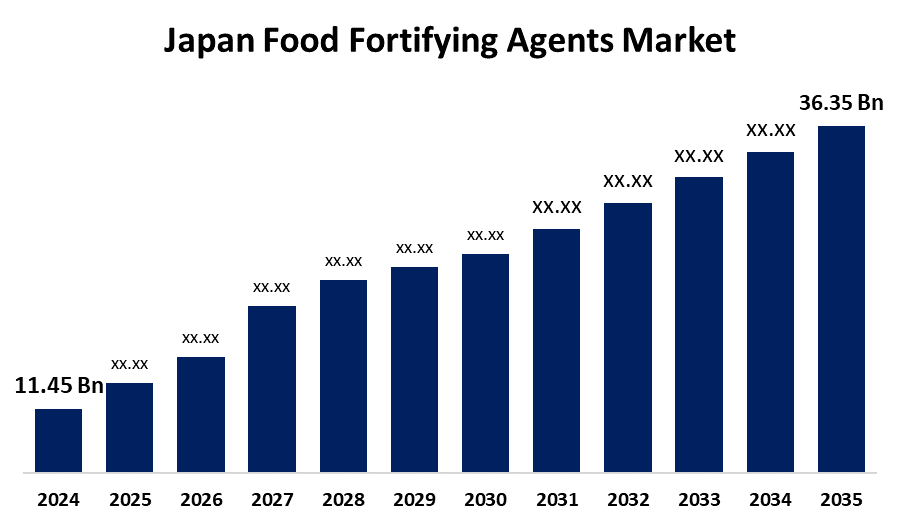

- The Food Fortifying Agents Market Size Was Estimated at USD 11.45 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 11.07% from 2025 to 2035

- The Food Fortifying Agents Market Size is Expected to Reach USD 36.35 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the Japan Food Fortifying Agents Market Sizes Anticipated to Reach USD 36.35 Billion by 2035, Growing at a CAGR of 11.07% from 2025 to 2035. The food fortifying agents market in Japan is driven by various factors, rise in the prevalence of nutritional deficiency, a rise in chronic diseases, rising awareness about food fortifying agents, rising demand for nutritionally rich food products, and advancements in fortification technologies.

Market Overview

The food fortifying agents are substances, commonly vitamins and minerals, that are added to the foodstuffs to enhance their nutritional composition. The food fortification is done in various ways, such as commercially, biofortification, as well as at home. The government and manufacturers are working together to eliminate nutritional deficiencies by developing food fortifying substances. The rise in the aging population in Japan leads to chronic conditions such as high blood pressure, CVD, and Alzheimer's disease, which increases the demand for nutrition-rich meals. The rise in the incidence of nutritional deficiencies due to unhealthy diets, changes in lifestyle, and the rise in urbanization drive the market for food fortifying agents in Japan. The rising demand for vegan and clean label products is the key trend in Japan food fortifying agents. The trend of plant-based diets presents an opportunity for manufacturers to differentiate themselves by developing fortifying plant-based food products and beverages.

Report Coverage

This research report categorizes the market for the Japan food fortifying agents market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan food fortifying agents market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan food fortifying agents market.

Japan Food Fortifying Agents Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 11.45 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 11.07% |

| 2035 Value Projection: | USD 36.35 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Type, By Application and COVID-19 Impact Analysis. |

| Companies covered:: | Ajinomoto Co., Inc., International Flavors & Fragrances, Cargill Incorporated, Asahi Group Holdings, Nippn Corporation, Nisshin OilliO Group, Ltd, Maruha Nichiro Corporation and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rise in the prevalence of nutritional deficiency in Japan is the key driver for the food fortifying agents. The rise in the consumption of processed foods with better nutrition expands the market. The rise in urbanization demands functional, convenient, and nutritionally fortified food products. The advancements in processing technologies simplify the incorporation of fortifying agents in various food products while maintaining their taste, texture, and appearance.

Restraining Factors

The Japan food fortifying agents market has several challenges. One of the major challenges is that the cost of production associated with technologies and raw materials makes the final product expensive, which limits the market growth. The excessive consumption of some nutrients owing to excessive fortification leads the toxicity, which limits the expansion of the market.

Market Segmentation

The Japan food fortifying agents market share is classified into type and application.

- The vitamins segment accounted for a significant share of the market in 2024 and is expected to grow at a rapid CAGR during the forecast period.

The Japan food fortifying agents market is segmented by type into vitamins, minerals, proteins & amino acids, carbohydrates, prebiotics & probiotics, lipids, and others. Among these, the vitamins segment accounted for a significant share of the market in 2024 and is expected to grow at a rapid CAGR during the forecast period. This is due to people are aware of the health benefits associated with vitamins for maintaining overall health.

- The dairy & dairy-based products segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan food fortifying agents market is segmented by application into dairy & dairy-based products, infant formula, cereals & cereal-based products, beverages, dietary supplements, fats & oils, and others. Among these, the dairy & dairy-based products segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to products such as milk, yoghurt, and cheese that are widely used in various diets, which are ideal for essential nutrients like calcium, vitamins, and probiotics.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan food fortifying agents market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ajinomoto Co., Inc.

- International Flavors & Fragrances

- Cargill Incorporated

- Asahi Group Holdings

- Nippn Corporation

- Nisshin OilliO Group, Ltd

- Maruha Nichiro Corporation

- Others

Recent Developments

- In April 2025, Japan tightens rules on dairy fortification, requiring detailed safety data and ingredient ratios to ensure probiotic safety and standardization, especially in infant formulas and functional drinks.

- In January 2025, Japan updated its food labelling standards, revising nutrients and requiring full disclosure of fortifying ingredients to meet global norms.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan food fortifying agents market based on the below-mentioned segments:

Japan Food Fortifying Agents Market, By Type

- Vitamins

- Minerals

- Proteins & Amino Acids

- Carbohydrates

- Prebiotics & Probiotics

- Lipids

- Others

Japan Food Fortifying Agents Market, By Application

- Dairy & Dairy-based Products

- Infant Formula

- Cereals & Cereal-based Products

- Beverages

- Dietary supplements

- Fats & oils

- Others

Need help to buy this report?