Japan Flexible Packaging Market Size, Share, and COVID-19 Impact Analysis, By Material (Plastic, Paper, Others), By End User (Food & Beverage, Personal Care, Pet Food, Consumer Electronics, Others), By Region (Tokyo, Kanto, Kansai, Chugoku, & Others) and Japan Flexible Packaging Market Insights, Industry Trend, Forecasts to 2032.

Industry: Chemicals & MaterialsJapan Flexible Packaging Market Insights Forecasts to 2032

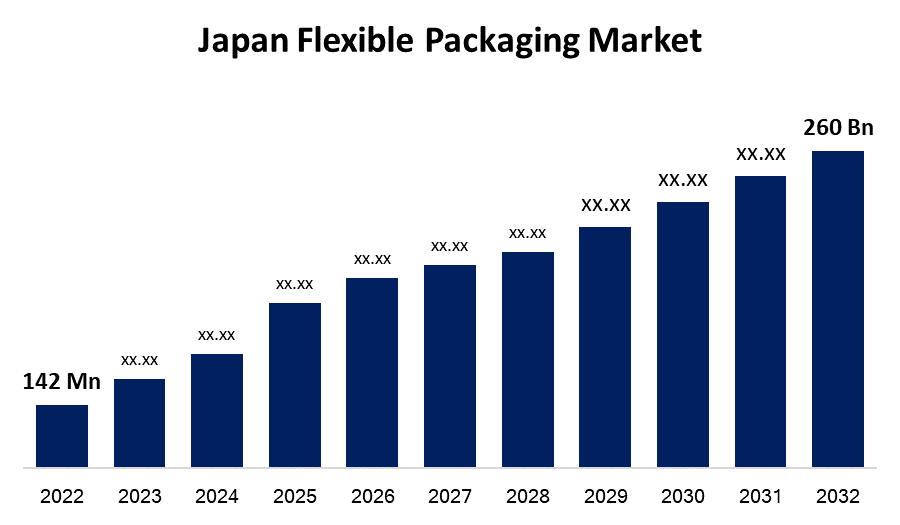

- The Japan Flexible Packaging Market Size was valued at USD 142 Million in 2022.

- The Market Size is Growing at a CAGR of 6.2% from 2022 to 2032

- The Japan Flexible Packaging Market Size is expected To reach USD 260 Million by 2032.

Get more details on this report -

The Japan Flexible Packaging Market Size was valued at USD 142 Million in 2022 and is expected To Grow to USD 260 Million by 2032, at a CAGR of 6.2% during the forecast period 2022-2032.

Market Overview

The Japan market is expected to grow as the usage of flexible packaging solutions for a wide range of end-users and sectors, including food and beverage, pet food, personal care, and others, grows. The Flexible Packaging Association estimates that the relative market size of flexible packaging in Japan in 2019 was around 72,000 million units. There have been a substantial number of firms that have been offering flexible packaging solutions to their customers. For example, Rengo Group, one of the imperative players in the market, has been offering a range of flexible packaging, which also includes cellophane, molded packaging, and film packaging. The company offers flexible flat bags, standing pouches, for respective products. Other firms and corporations have also been offering a considerable number of flexible packaging ranges and solutions. For example, Takigawa Corporation has established itself as a leader in the flexible packaging business. The firm has been providing goods for a variety of industries, including home and personal care, food and beverage, and others. During the projected period, the market is likely to grow at an exponential rate due to increased demand for new and sophisticated solutions.

Report Coverage

This research report categorizes the market of Japan flexible packaging market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan flexible packaging market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the Japan flexible packaging market.

Japan Flexible Packaging Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 142 Million |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 6.2% |

| 2032 Value Projection: | USD 260 Million |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Material, By End User, By Region, and Country Statistics (Demand, Price, Growth, Trends, Competitors, Challenges) |

| Companies covered:: | Toyo Seikan Group Holdings, DNP, Toyobo, Sekisui Plastics, Nikkiso, JSP |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market is likely to grow in the future years as demand for flexible packaging solutions in convenience shops grows. According to the Japan Franchise Association, the country has over 55,000 convenience shops that generate approximately US$100 billion in annual sales. With the country's elderly population and declining birthrate, convenience shops have emerged as a leader in social and societal development. According to figures from the United Nations and the World Bank, 28.39% of the country's population is 65 or older. Because of the fall in appetite and demand for bulk items, consumer retailers have begun to provide meals and other products in smaller and more flexible containers. Furthermore, the Japan Franchise Association reported that single families account for around 35.3% of total nation households, boosting the need for smaller flexible packaging options. Several companies have been providing their clients with flexible packaging solutions and products. Toppan, for example, has made significant investments in flexible packaging production, particularly for fast-moving consumer items such as food and drinks. Other businesses, such as Nippon Group, have also invested significantly in the development of flexible packaging solutions for certain industries.

Restraining Factors

Recyclability limitations connected with flexible packaging are projected to hinder the industry expansion. The multi-layers of flexible post-consumer usage cannot be easily recycled. Furthermore, plastic-metal packaging and plastic paper packaging are difficult to recycle, which has a detrimental influence on the environment. This is projected to restrain the growth of the Japan flexible packaging industry.

COVID 19 Impacts

The impact of the coronavirus pandemic was felt throughout several industries in Japan, particularly in the need for flexible packaging. The market was disrupted by the deployment of a lockdown to control the spread of the deadly virus, which resulted in a stop in activities across multiple industrial sectors. The lockout badly harmed production in industries such as personal care, consumer electronics, and others, decreasing demand for flexible packaging. However, demand for food, beverages, and pet food increased, boosting the industry.

Market Segment

- In 2022, plastic segment is influencing the largest market share over the forecast period.

Based on the material, the Japan flexible packaging market is segmented into plastic, paper, others. Among these segments, plastic segment dominates the largest market share during the forecast period, due to the increasing requirement for novel products like flexitanks and retort pouches for bulk transportation and storage of drinks and semi-solid food products is likely to drive demand for plastic packaging in food and beverage applications. Also, Plastic offers good shock absorption, and structural and thermal stability, and may function as an insulator, making it an appropriate packaging alternative for perishable products such as fruits, meat, and dairy products. The widespread usage of these items adds to a large market share.

- In 2022, food & beverage is dominating the largest market growth during the forecast period.

Based on end users, the Japan flexible packaging market is classified into several factors such as food & beverage, personal care, pet food, consumer electronics, others. Among these, food & beverage segment held the largest market share during the forecast period, due to increased spending on bakery and cereal bars, ready-to-cook meals and coffee or hot chocolate sticks and pouches, dehydrated and instant food snack foods & nuts, spice foods, chocolates & sweets, ice-cream novelties, and others. This will have a favorable effect on the growth of the flexible packaging industry in Japan. Also, the product's large use for food and beverage packaging because of its sustainability, lightweight, cost-effectiveness, and non-fragility adds to a high market share during the forecast period.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan flexible packaging market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Toyo Seikan Group Holdings

- DNP

- Toyobo

- Sekisui Plastics

- Nikkiso

- JSP

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2021, under their sustainability commitment, Kao Corporation announced intentions to adopt an eco-friendly packaging alternative to plastic packaging, after noticing the rising plastic waste concerns and solutions.

- In April 2021, Unilever Japan announced the use of PET-based flexible packaging for the sale of its personal care products.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2022 to 2032. Spherical Insights has segmented the Japan Flexible Packaging Market based on the below-mentioned segments:

Japan Flexible Packaging Market, By Product

- Plastic

- Paper

- Others

Japan Flexible Packaging Market, By Application

- Food & Beverage

- Personal Care

- Pet Food

- Consumer Electronics

- Others

Japan Flexible Packaging Market, By Region

- Tokyo

- Kanto

- Kansai

- Chugoku

- Others

Need help to buy this report?