Japan Fire Fighting Chemicals Market Size, Share, and COVID-19 Impact Analysis, By Type (Dry Chemicals, Wet Chemicals, Dry Powder, and Foam Based), By Chemicals (Monoammonium Phosphate, Halon, Carbon Dioxide, Potassium Bicarbonate, Potassium Citrate, Sodium Chloride, and Others), By Application (Portable Fire Extinguishers, Automatic Fire Sprinklers, Fire Retardant Bulkhead, Fire Dampers, and Others), and Japan Fire Fighting Chemicals Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsJapan Fire Fighting Chemicals Market Insights Forecasts to 2035

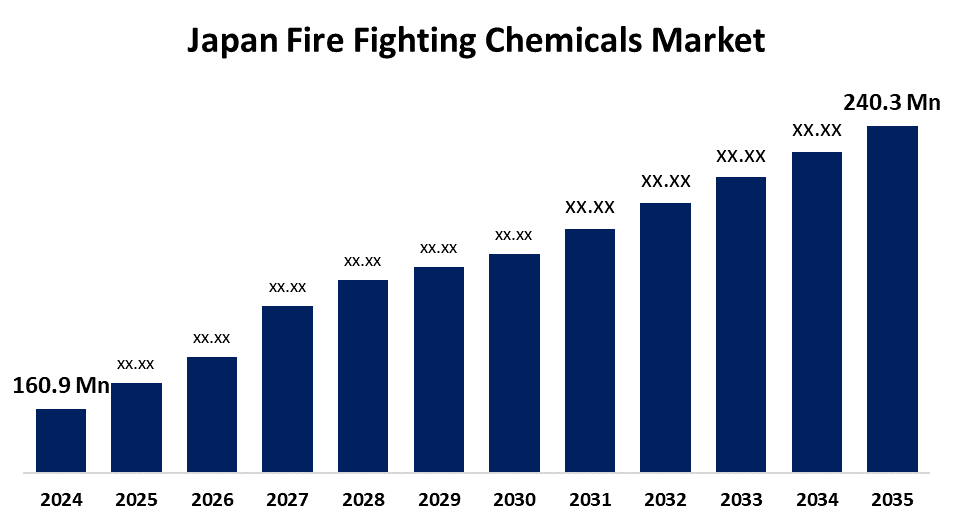

- The Japan Fire Fighting Chemicals Market Size Was Estimated at USD 160.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.71% from 2025 to 2035

- The Japan Fire Fighting Chemicals Market Size is Expected to Reach USD 240.3 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Japan Fire Fighting Chemicals Market Size is anticipated to reach USD 240.3 Million by 2035, growing at a CAGR of 3.71% from 2025 to 2035. The Japan fire fighting chemicals market is growing due to rising fire safety laws, urbanization and industrialization, and a shift towards ecological products. Technology advancements, more fire incidents, and requirements for protecting strategic infrastructure also stimulate demand.

Market Overview

The Japan fire fighting chemicals market refers to the production, manufacture, and distribution of various chemical agents that can be used to put out and smother fires. These products are significant to fire defense equipment like sprinkler systems and extinguishers, and are categorized based on chemical composition and application. The technological advancement of environmentally designed and fluorine free foams is a key strength, and they offer satisfactory performance with reduced environmental degradation. Potential exists in R&D of ecological, biodegradable alternatives, expanded use in new building sectors, aviation, vehicles, and power plants, and application with intelligent suppression systems. Market growth is spurred by improved industrialization, infrastructure, and urbanization, and expanding safety regulations necessitating better fire suppression apparatus.

Report Coverage

This research report categorizes the market for the Japan fire fighting chemicals market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan fire fighting chemicals market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan fire fighting chemicals market.

Japan Fire Fighting Chemicals Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 160.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.71% |

| 2035 Value Projection: | USD 240.3 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 170 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Type, By Chemicals and By Application |

| Companies covered:: | Asahi Kasei, Kuraray, Rengo Co. Ltd., Toray, Sealed Air, Takigawa Corporation, Amcor, Takemoto Yohki, Toyo Seikan Group Holdings, DIC Corporation, Mitsubishi Chemical Corporation, Shin Etsu Chemical Co., Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan market for fire fighting chemicals is driven by stringent fire safety regulations, growth in industrial and urban infrastructure, and enhanced awareness of workplace safety. Growing instances of fire risks in the manufacturing, energy, and aviation industries drive demand for advanced suppression agents. Developments in environmentally friendly and fluorine-free chemicals further support the market's growth. In addition, Japan commitment to disaster readiness and the government's interest in increasing fire safety standards and infrastructure significantly influence the adoption of sophisticated fire fighting chemical solutions.

Restraining Factors

The market for fire fighting chemicals in Japan is constrained by excessive costs of new and ecological agents, unstable raw material prices, and heavy R&D investment needs. Furthermore, aggressive conformity to regulations and lengthy, time-consuming approval procedures inhibit the introduction of new chemical formulations.

Market Segmentation

The Japan fire fighting chemicals market share is classified into type, chemicals, and application.

- The dry chemicals segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan fire fighting chemicals market is segmented by type into dry chemicals, wet chemicals, dry powder, and foam based. Among these, the dry chemicals segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to they possess non-conductive qualities, forming a barrier that interrupts the flow of electricity, offering safe suppression without the danger of electrocution. Dry chemical agents also extinguish Class A, B, and C fires, like combustibles, flammable liquids, and electrical devices.

- The monoammonium phosphate segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan fire fighting chemicals market is segmented by chemicals into monoammonium phosphate, halon, carbon dioxide, potassium bicarbonate, potassium citrate, sodium chloride, and others. Among these, the monoammonium phosphate segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to its multi-purpose effectiveness against all classes of fires. It is a cheap product, simple to use, and non-conductive, making it ideally suitable for residential, commercial, and industrial use, especially in the safety of electrical fires in modern infrastructure.

- The portable fire extinguishers segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan fire fighting chemicals market is segmented by application into portable fire extinguishers, automatic fire sprinklers, fire retardant bulkhead, fire dampers, and others. Among these, the portable fire extinguishers segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to they offer immediate access to fire suppression, with compact size enabling instant response at early stages of fire occurrence. They cost less to install, manufacture, and maintain than fixed systems. Visual cues and simple instructions improve usability, hence popular in domestic and business premises.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan fire fighting chemicals market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nippon Dry Chemical Co., Ltd.

- Yamato Protect

- Amerex

- Akao & Co. Ltd.

- Kureha Corporation

- Carrier (UTC)

- Bavaria firefighting

- DIC Corporation

- Hatsuta Seisakusho Co., Ltd.

- Mitsubishi Gas Chemical Company, Inc.

- Others

Recent Developments:

- In June 2025, Mitsubishi Gas Chemical and RITE signed an agreement to transfer CO2 captured via a direct air capture (DAC) system at the Osaka Kansai Expo 2025. This collaboration marks a pioneering step toward advancing carbon capture, utilization, and storage (CCUS) implementation in Japan.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan fire fighting chemicals market based on the below-mentioned segments:

Japan Fire Fighting Chemicals Market, By Type

- Dry Chemicals

- Wet Chemicals

- Dry Powder

- Foam Based

Japan Fire Fighting Chemicals Market, By Chemicals

- Monoammonium Phosphate

- Halon

- Carbon Dioxide

- Potassium Bicarbonate

- Potassium Citrate

- Sodium Chloride

- Others

Japan Fire Fighting Chemicals Market, By Application

- Portable Fire Extinguishers

- Automatic Fire Sprinklers

- Fire Retardant Bulkhead

- Fire Dampers

- Others

Need help to buy this report?