Japan Fiber Optic Gyroscope Market Size, Share, and COVID-19 Impact Analysis, By Sensing Axis (1-Axis, 2-Axis, and 3-Axis), By Device Type (Gyrocompass, Inertial Navigation Systems, and Inertial Measurement Units), By Vertical (Aerospace & Defense, Automotive, Robotics, Mining, Healthcare, and Transportation & Logistics), and Japan Fiber Optic Gyroscope Market Insights, Industry Trend, Forecasts to 2035

Industry: Semiconductors & ElectronicsJapan Fiber Optic Gyroscope Market Insights Forecasts to 2035

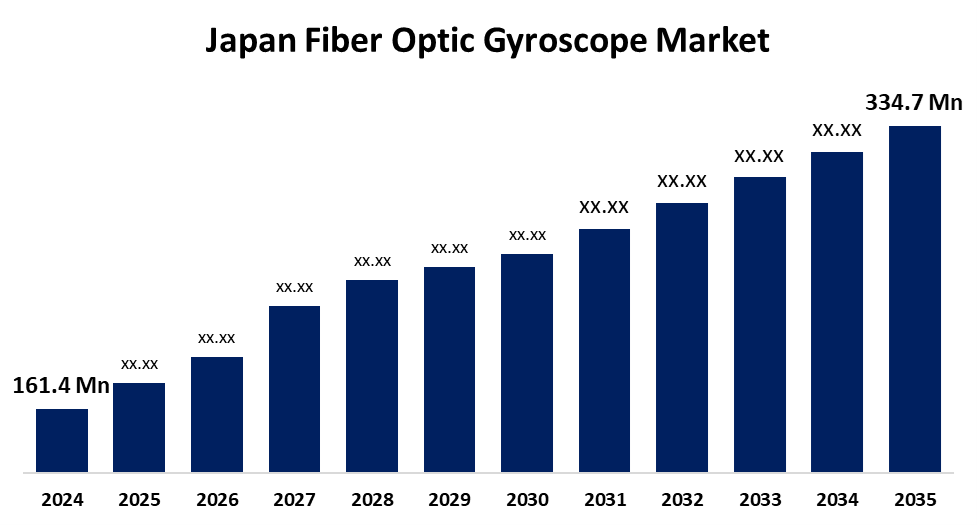

- The Japan Fiber Optic Gyroscope Market Size Was Estimated at USD 161.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.86% from 2025 to 2035

- The Japan Fiber Optic Gyroscope Market Size is Expected to Reach USD 334.7 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Japan Fiber Optic Gyroscope Market Size is anticipated to Reach USD 334.7 Million by 2035, Growing at a CAGR of 6.86% from 2025 to 2035. The market for fiber optic gyroscope in Japan is expanding owing to increased demand from aerospace, defense, and autonomous vehicle industries, complemented by technology advancements in miniaturization and sensing. Japans focus on technological progress and favorable government policies similarly contributes to market growth.

Market Overview

The Fiber Optic Gyroscope Market Size in Japan refers to an emerging industry that takes advantage of advanced optical technology to establish angular velocity and orientation with high accuracy. Fiber optic gyroscopes have extensive applications in areas like aerospace, defense, navigation systems, robotics, and the auto industry. The strong defense and aerospace industries of Japan also support FOG market development. The nations continued development of autonomous technology, including autonomous cars and drones, is driving the use of FOGs for accurate motion measurement. FOGs are also increasingly being used in robotics and consumer devices as they are much smaller, more reliable, and less subject to mechanical degradation than standard gyroscopes. Future opportunities exist for expanding use in burgeoning markets such as IoT and smart technologies. The major market drivers are the growing need for precise and dependable navigation systems, especially in autonomous automobiles, defense technology, and space systems. Government programs sponsoring high-tech industry development, such as defense modernization and autonomous vehicle initiatives, also contribute significantly to the growth of the FOG market.

Report Coverage

This research report categorizes the market for the Japan fiber optic gyroscope market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan fiber optic gyroscope market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan fiber optic gyroscope market.

Japan Fiber Optic Gyroscope Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 161.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.86% |

| 2035 Value Projection: | USD 334.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 192 |

| Tables, Charts & Figures: | 91 |

| Segments covered: | By Sensing Axis, By Device Type |

| Companies covered:: | Mitsubishi Heavy Industries, Fujikura Ltd., Japan Aviation Electronics Industry, Ltd., Tamagawa Seiki Co. Ltd., NEC Corporation, Furukawa Electric Co., Ltd., Hitachi Cable, KVH Industries, Murata Manufacturing Co. Ltd., NTT TechnoCross, TDK Corporation, Sumitomo Electric Industries, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan fiber optic gyroscope market is led by the growing need for accurate navigation systems in industries such as aerospace, defense, and autonomous vehicles. FOG adoption is further accelerated by the advancement of autonomous driving technology, robotics, and satellite systems, thanks to their precision and reliability. The transition towards high-tech use in consumer electronics and robotics also stimulates growth. Furthermore, government programs aimed at supporting defense modernization and driverless car development provide opportunities for fiber optic gyroscope applications in industries.

Restraining Factors

The Japan fiber optic gyroscope market has challenges like high cost of production, intricate manufacturing process, and shortage of skilled personnel. Moreover, competition from other gyroscope technologies and slow uptake of advanced systems in certain industries can be limiting.

Market Segmentation

The Japan fiber optic gyroscope market share is classified into sensing axis, device type, and vertical.

- The 1-Axis segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan fiber optic gyroscope market is segmented by sensing axis into 1-Axis, 2-Axis, and 3-Axis. Among these, the 1-Axis segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to its use in aerospace, defense, and industrial automation. The compact, low-power, and affordable nature of the design is suitable for applications like missile guidance, UAV stabilization, and robotics. The expanding need for accurate detection of angular motion in navigation and IMUs further propels its uptake.

- The inertial measurement units segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan fiber optic gyroscope market is segmented by device type into gyrocompass, inertial navigation systems, and inertial measurement units. Among these, the inertial measurement units segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to high-precision motion sensing and navigation are of utmost importance in industrial automation, aerospace, defense, and automobiles. As gyroscopes cannot supply all the motion parameters required, IMUs combine accelerometers with fiber optic gyros to give accurate angular velocity and acceleration measurements for improved performance and reliability.

- The aerospace & defense segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan fiber optic gyroscope market is segmented by vertical into aerospace & defense, automotive, robotics, mining, healthcare, transportation & logistics. Among these, the aerospace & defense segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to they provide reliability, longevity, and resistance to electromagnetic interference, thus being critical to fighter jets, UAVs, submarines, and space vehicles. Industry growth is fueled by GPS-denied navigation demand, advanced INS, and unmanned defense technology, as well as increasing defense budgets, modernization initiatives, and AI-enabled navigation technologies.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan fiber optic gyroscope market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mitsubishi Heavy Industries

- Fujikura Ltd.

- Japan Aviation Electronics Industry, Ltd.

- Tamagawa Seiki Co. Ltd.

- NEC Corporation

- Furukawa Electric Co., Ltd.

- Hitachi Cable

- KVH Industries

- Murata Manufacturing Co. Ltd.

- NTT TechnoCross

- TDK Corporation

- Sumitomo Electric Industries

- Others

Recent Developments:

- In February 2025, Tamagawa Seiki collaborated with the JAXA (Japan Aerospace Exploration Agency) to design radiation-hardened fiber optic gyroscopes for use in low-Earth orbit satellites to provide long-term drift stability and consistent performance in high-radiation space environments essential to advanced satellite navigation systems.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan fiber optic gyroscope market based on the below-mentioned segments:

Japan Fiber Optic Gyroscope Market, By Sensing Axis

- 1-Axis

- 2-Axis

- 3-Axis

Japan Fiber Optic Gyroscope Market, By Device Type

- Gyrocompass

- Inertial Navigation Systems

- Inertial Measurement Units

Japan Fiber Optic Gyroscope Market, By Vertical

- Aerospace & Defense

- Automotive

- Robotics

- Mining

- Healthcare

- Transportation & Logistics

Need help to buy this report?