Japan Extended Detection and Response Market Size, Share, and COVID-19 Impact Analysis, By Component (Services and Solutions), By Deployment Type (On-Premise and Cloud), By Industry (BFSI, Retail, Healthcare, Manufacturing, IT & telecommunication, and Others), and Japan Extended Detection and Response Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyJapan Extended Detection and Response Market Insights Forecasts to 2035

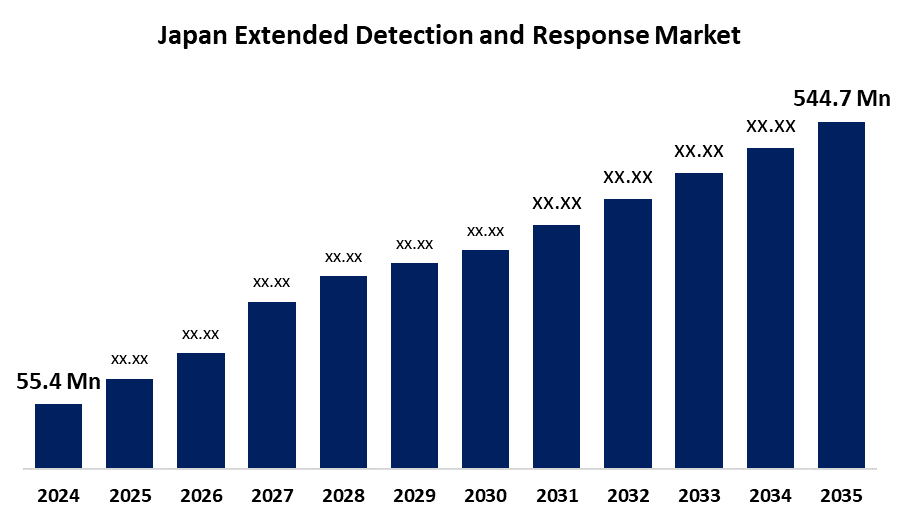

- The Japan Extended Detection and Response Market Size Was Estimated at USD 55.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 23.1% from 2025 to 2035

- The Japan Extended Detection and Response Market Size is Expected to Reach USD 544.7 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the Japan Extended Detection and Response Market Size is Anticipated to reach USD 544.7 Million by 2035, Growing at a CAGR of 23.1% from 2025 to 2035. The Japan extended detection and response market is expanding due to accelerating cyber threats, the growing adoption of the cloud, and demand for integrated security solutions, supported by the strong regulations and aggressive government supported cybersecurity efforts in Japan.

Market Overview

The Japan extended detection and response market refers to converged cybersecurity solutions that combine various security products, including endpoint, network, email, and cloud security, into one platform for more effective threat detection, investigation, and response. XDR provides greater visibility into all attack surfaces, enabling organizations to automate incident response and improve security operations efficiency. Strong IT infrastructure, enterprise digital maturity, and high cybersecurity consciousness in Japan underpin robust XDR uptake. It has opportunities in cloud-native XDR offerings, threat intelligence driven by AI, and SOC integration. The demand is fueled by rising cyber attacks, expanded digital transformation, and the necessity for quicker and more unified responses to advanced attacks. The Japanese government policies, including the Cybersecurity Strategy and digital government, support national resilience and public and private investment in advanced security technologies.

Report Coverage

This research report categorizes the market for the Japan extended detection and response market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan extended detection and response market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan extended detection and response market.

Japan Extended Detection and Response Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 55.4 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 23.1% |

| 2035 Value Projection: | USD 544.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 120 |

| Tables, Charts & Figures: | 150 |

| Segments covered: | By Deployment Type, By Component, By Industry and COVID-19 Impact Analysis. |

| Companies covered:: | Cybereason Japan, NEC Corporation, Palo Alto Networks, Trend Micro, Cisco, Microsoft, Fortinet, Symantec, RSA Security, NTT Security Holdings, AlienVault, NRI Secure Technologies and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan extended detection and response (XDR) market is driven by increasingly sophisticated cyber threats, the growing adoption of cloud services, and the rising need for integrated, concurrent threat detection and visibility across diverse IT environments. Organizations are moving towards proactive security models to improve detection and response capacities. Growth in digital transformation and hybrid work environments further drives demand at an even faster pace. Government-driven cybersecurity programs and the embracement of AI and automation within security operations are also major drivers of XDR market growth.

Restraining Factors

The Japan extended detection and response (XDR) market is constrained by high deployment and operational expenditures, integration issues with legacy technology, and limited talent in the field of cybersecurity. These constraints especially impact small and medium-sized businesses, hindering the broad adoption of XDR solutions.

Market Segmentation

The Japan extended detection and response market share is classified into component, deployment type, and industry.

- The solutions segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan extended detection and response market is segmented by component into services and solutions. Among these, the solutions segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the increasing demand for integrated, real-time threat detection solutions. Enterprises value next-generation security platforms as compared to point solutions to effectively deal with sophisticated cyber attacks and lower response times.

- The cloud segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan extended detection and response market is segmented by deployment type into on-premise and cloud. Among these, the cloud segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to the adoption of cloud technologies, scalability requirements, and remote worker trends. Cloud-based XDR is flexible, can be deployed quickly, and can be upgraded easily, rendering it the preferred among organizations looking to have efficient, real-time threat detection and response abilities.

- The BFSI segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan extended detection and response market is segmented by industry into BFSI, retail, healthcare, manufacturing, IT & telecommunication, and others. Among these, the BFSI segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the sector is prone to high cyber risk, strict regulatory compliance, and safeguarding sensitive financial information. Consequently, BFSI organizations spend quite a sum on advanced security tools such as XDR.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan extended detection and response market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cybereason Japan

- NEC Corporation

- Palo Alto Networks

- Trend Micro

- Cisco

- Microsoft

- Fortinet

- Symantec

- RSA Security

- NTT Security Holdings

- AlienVault

- NRI Secure Technologies

- Others

Recent Developments:

- In March 2024, Cybereason launched its SIEM Detection and Response (SDR) solution with Observe. This SaaS offering modernizes outdated SIEM architectures, improving SOC efficiency by automating data ingestion and enrichment across an organizations entire digital environment.

- In November 2021, Palo Alto Networks announced its Cortex® eXtended Managed Detection and Response (XMDR) Partner Specialization. This initiative enables MSSP partners to integrate Cortex XDR 3.0 with their managed services, helping customers improve SOC efficiency, detect and respond to threats across endpoints, networks, and cloud environments.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan extended detection and response market based on the below-mentioned segments:

Japan Extended Detection and Response Market, By Component

- Services

- Solutions

Japan Extended Detection and Response Market, By Deployment Type

- On-Premise

- Cloud

Japan Extended Detection and Response Market, By Industry

- BFSI

- Retail

- Healthcare

- Manufacturing

- IT & telecommunication

- Others

Need help to buy this report?