Japan Epilepsy Drugs Market Size, Share, and COVID-19 Impact Analysis, By Treatment (First-Generation Anti-epileptics, Second-Generation Anti-epileptics, and Third-Generation Anti-epileptics), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Others), and Japan Epilepsy Drugs Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareJapan Epilepsy Drugs Market Size Insights Forecasts to 2035

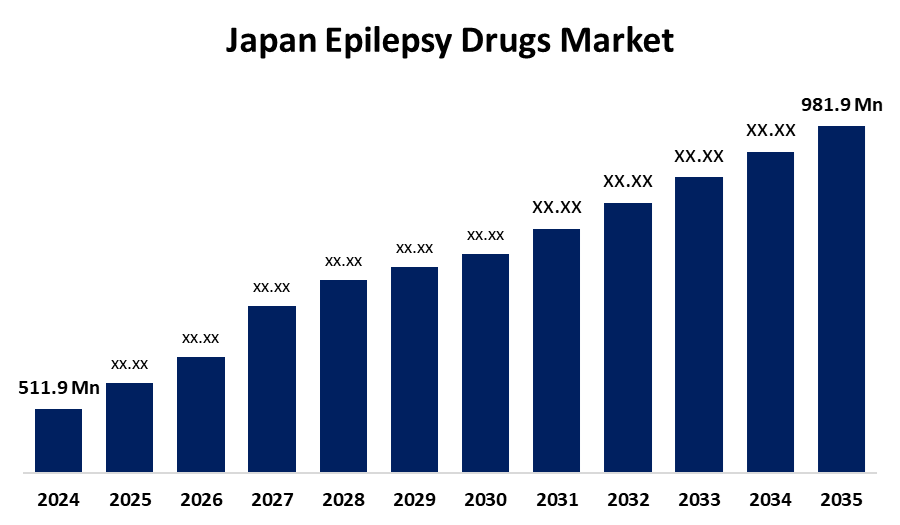

- The Japan Epilepsy Drugs Market Size Was Estimated at USD 511.9 million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.1 % from 2025 to 2035

- The Japan Epilepsy Drugs Market Size is Expected to Reach USD 981.9 million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the Japan Epilepsy Drugs Market Size is anticipated to reach USD 981.9 million by 2035, growing at a CAGR of 6.1 % from 2025 to 2035. The epilepsy drugs market in Japan is driven by various factors, including the rising incidence of epilepsy, increasing awareness and diagnosis of epilepsy, and advancements in antiepileptic drug development.

Market Overview

Epileptic medicines, often known as anti-seizure medications (ASMs) or anticonvulsants. These drugs are prescription medications used to reduce the frequency and severity of recurring seizures caused by excessive electrical activity in the brain. The Japan epilepsy drugs market refers to the industry involved in the research, development, production, and sale of antiepileptic drugs (AEDs) used to prevent and manage seizures in individuals diagnosed with epilepsy, a chronic neurological disorder. This market includes first-generation anti-epileptics, second-generation anti-epileptics, and third-generation anti-epileptics. Japan is one of the largest aging population countries, and an aging population is more prone to neurological conditions, which creates the need for efficient management solutions and treatments is one of the major contributing factors for the Japan epilepsy drugs market. Additionally, the rising prevalence of neurological conditions such as epilepsy further contributes to the market growth. The rising demand for personalized drugs is a key trend in this market. The demand for more effective and safer treatment options presents a potential opportunity for growth by developing new and innovative drugs.

Report Coverage

This research report categorizes the market for the Japan epilepsy drugs market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan epilepsy drugs market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan epilepsy drugs market.

Japan Epilepsy Drugs Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 511.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.1 % |

| 2035 Value Projection: | USD 981.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 158 |

| Tables, Charts & Figures: | 117 |

| Segments covered: | By Treatment, By Distribution Channel and COVID-19 Impact Analysis |

| Companies covered:: | Otsuka Pharmaceutical, Eisai, BristolMyers Squibb, AstraZeneca, Roche, Lundbeck, UCB, Pfizer, Teva Pharmaceuticals, Sanofi, GlaxoSmithKline, Novartis, Daiichi Sankyo, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Epilepsy diagnoses in Japan have risen by 20% over the past decade due to better awareness and education, boosting market growth. The growing elderly population, which is more likely to develop age-related illnesses like Alzheimer's or Parkinson's disease, which might raise the risk of epilepsy, is also driving market expansion. The increased use of anti-epileptic medications (AEDs) to treat epilepsy, which balance electrical activity in the brain and prevent seizures, is further boosting the market. Additionally, advancements in antiepileptic drug development play a crucial role in market growth.

Restraining Factors

The cost of advanced epilepsy drugs is high, which limits accessibility to the price-sensitive consumers. Additionally, many epilepsy drugs have several side effects like dizziness, cognitive impairment, fatigue, and mood changes, which further limit the market expansion.

Market Segmentation

The Japan epilepsy drugs market share is classified into treatment and distribution channel.

- The third-generation anti-epileptics segment held a dominant market share in 2024 and is expected to grow at a rapid CAGR during the forecast period.

The Japan epilepsy drugs market is segmented by treatment into first-generation anti-epileptics, second-generation anti-epileptics, and third-generation anti-epileptics. Among these, the third-generation anti-epileptics segment held a dominant market share in 2024 and is expected to grow at a rapid CAGR during the forecast period. This segmental growth is attributed to its superior efficacy and safety profile. Additionally, they have reduced side effects as compared to earlier generations.

- The retail pharmacies segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan epilepsy drugs market is segmented by distribution channel into hospital pharmacies, retail pharmacies, and others. Among these, the retail pharmacies segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This segmental growth is attributed to its widespread availability and convenience. Additionally, retail pharmacies frequently provide competitive prices and patient-friendly services, making them the preferred option for epilepsy medicine procurement.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan epilepsy drugs market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Otsuka Pharmaceutical

- Eisai

- BristolMyers Squibb

- AstraZeneca

- Roche

- Lundbeck

- UCB

- Pfizer

- Teva Pharmaceuticals

- Sanofi

- GlaxoSmithKline

- Novartis

- Daiichi Sankyo

- Others

Recent Developments

- In January 2024, Eisai Co., Ltd. launched the injection formulation of its antiepileptic drug Fycompa (perampanel hydrate) for IV infusion in Japan.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan epilepsy drugs market based on the below-mentioned segments:

Japan Epilepsy Drugs Market, By Treatment

- First-Generation Anti-epileptics

- Second-Generation Anti-epileptics

- Third-Generation Anti-epileptics

Japan Epilepsy Drugs Market, By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Others

Need help to buy this report?