Japan Enterprise Networking Market Size, Share, and COVID-19 Impact Analysis, By Component (Hardware, Software, and Services), By Enterprise Type (SMEs and Large Enterprises), By Industry Vertical (BFSI, Manufacturing, IT & Telecom, Retail & Ecommerce, Healthcare, and Others), and Japan Enterprise Networking Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyJapan Enterprise Networking Market Insights Forecasts to 2035

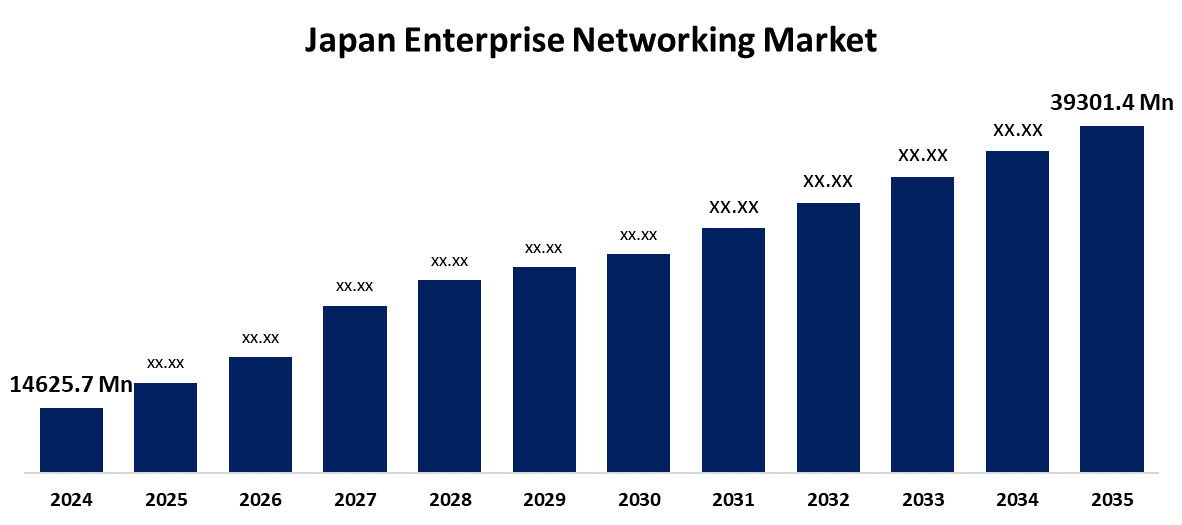

- The Japan Enterprise Networking Market Size Was Estimated at USD 14625.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 9.4% from 2025 to 2035

- The Japan Enterprise Networking Market Size is Expected to Reach USD 39301.4 Million by 2035

Get more details on this report -

According to a Research Report published by Spherical Insights & Consulting, The Japan Enterprise Networking Market Size is anticipated to Reach USD 39301.4 million by 2035, growing at a CAGR of 9.4% from 2025 to 2035. The Japan enterprise networking market is Expanding due to heightened cloud adoption, increased demand for secure and rapid connectivity, digitalization across sectors, and government efforts towards encouraging smart infrastructure and remote work technologies, driving network modernization.

Market Overview

The Japan Enterprise Networking Market refers to the infrastructure, hardware, and software solutions enabling organizations to interconnect, manage, and secure their internal and external communications and data flow. It comprises routers, switches, wireless access points, SD-WAN, and network security technologies, utilized for facilitating business operations, data exchange, cloud connectivity, and remote workspaces. Strengths are Japan sophisticated IT infrastructure, robust tech ecosystem, and high digital literacy levels at the enterprise level. Opportunities are in increasing demand for AI-based network management, integration with 5G, and scalable solutions in SMEs. The market is spearheaded by Japan swift digital evolution, mounting demand for rapid and secure networks, and the extensive implementation of cloud computing, IoT, and hybrid work modes. Government initiatives such as Society 5.0 and assistance towards smart cities also compel businesses towards modern networking technology. The increase in cyber threats has further created a demand for secure and agile network solutions.

Report Coverage

This research report Categorizes the Market Size for the Japan enterprise networking market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan enterprise networking market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan enterprise networking market.

Japan Enterprise Networking Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 14625.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 9.4% |

| 2035 Value Projection: | USD 39301.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 120 |

| Companies covered:: | Fujitsu Limited, NTT Ltd., Hitachi, Ltd., Equinix, NEC Corporation, Cisco Systems, Inc., KDDI Corporation, Dell Technologies Inc., Cloudflare, Nokia Corporation, Huawei Technologies Co., Ltd., ZTE Corporation, Mitsubishi Electric Corporation, and Other Key Companies |

| Growth Drivers: | Convertible Roof System Market Dynamics |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan enterprise networking market is fueled by fast digital transformation, growing cloud computing adoption, and rising remote and hybrid work models. The demand for secure, rapid, and scalable connectivity drives demand for modern networking solutions such as SD-WAN and 5G integration. Furthermore, growing data traffic from IoT devices and enterprise applications requires network infrastructure with efficient operations. Government policies promoting digital innovation and smart city growth further drive market expansion, with networking becoming a key element of Japan emerging digital economy.

Restraining Factors

The Japan enterprise networking market is constrained by exorbitant infrastructure costs, interoperability issues with legacy infrastructures, limited skilled professionals, and cybersecurity issues, which can impede the uptake of advanced networking technologies in traditional sectors.

Market Segmentation

The Japan enterprise networking market share is classified into component, enterprise type, and industry vertical.

- The hardware segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan enterprise networking market is segmented by component into hardware, software, and services. Among these, the hardware segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the high demand for physical equipment such as routers, switches, and access points fuels Japan's enterprise networking market growth. With network expansions by companies for remote work, IoT, and cloud services, hardware spending continues to be important. Growth in 5G and Wi-Fi 6 further fuels hardware upgrades for speedier, more reliable connections.

- The large enterprises segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan enterprise networking market is segmented by enterprise type into SMEs and large enterprises. Among these, the large enterprises segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Large enterprises need huge networking equipment and large data capacity to facilitate multi-location operations, communication, and data protection. With digital transformation progressing, they spend extensively on technologies such as 5G, SD-WAN, and cloud apps to maximize scalability, productivity, and customer support across worldwide operations.

- The IT & telecom segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan enterprise networking market is segmented by industry vertical into BFSI, manufacturing, IT & telecom, retail & ecommerce, healthcare, and others. Among these, the IT & telecom segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to its extensive dependence on high-speed, secure, and scalable connectivity. Enduring demand for data centers, cloud computing, and real-time communications drives massive investments in innovative networking technologies to enable digital infrastructure and operations.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan enterprise networking market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Fujitsu Limited

- NTT Ltd.

- Hitachi, Ltd.

- Equinix

- NEC Corporation

- Cisco Systems, Inc.

- KDDI Corporation

- Dell Technologies Inc.

- Cloudflare

- Nokia Corporation

- Huawei Technologies Co., Ltd.

- ZTE Corporation

- Mitsubishi Electric Corporation

- Others

Recent Developments:

- In November 2022, Equinix announced its 15th IBX® data center in Tokyo, TY15, with a $115 million investment. Located near its existing Tokyo campus, TY15 increases connectivity for worldwide cloud, network providers, and enterprises, supporting Japan’s growing digital economy and enabling scalable, advanced digital infrastructure.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan enterprise networking market based on the below-mentioned segmentsapan Enterprise

Networking Market, By Component

- Hardware

- Software

- Services

Japan Enterprise Networking Market, By Enterprise Type

- SMEs

- Large Enterprises

Japan Enterprise Networking Market, By Industry Vertical

- BFSI

- Manufacturing

- IT & Telecom

- Retail & Ecommerce

- Healthcare

- Others

Need help to buy this report?