Japan ENT Device Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Diagnostic Devices, Surgical Devices, Hearing Aids, Hearing Implants, and Others), By End-User (Hospitals, Clinics, Research Laboratories, and Others), and Japan ENT Device Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareJapan ENT Device Market Insights Forecasts to 2035

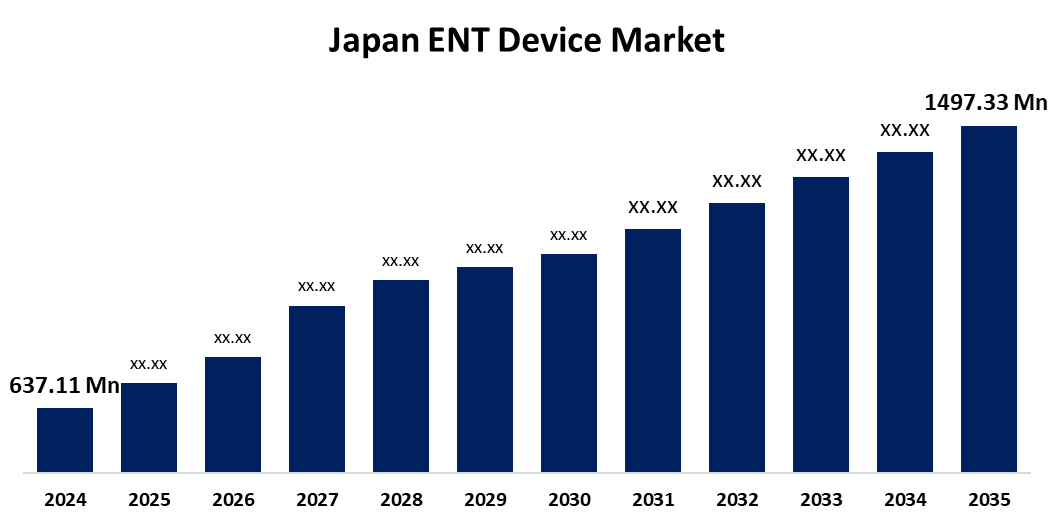

- The Japan ENT Device Market Size Was Estimated at USD 637.11 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.08% from 2025 to 2035

- The Japan ENT Device Market Size is Expected to Reach USD 1497.33 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Japan ENT Device Market Size is anticipated to Reach USD 1497.33 Million by 2035, Growing at a CAGR of 8.08% from 2025 to 2035. The market is also driven by advancements in minimally invasive surgical procedures and the rising adoption of ENT devices in emerging economies.

Market Overview

The Japan ENT (Ear, Nose, and Throat) Device Market Size refers to the segment of medical technology focused on diagnostic, surgical, and therapeutic devices used to treat ENT-related conditions such as hearing loss, sinusitis, and laryngeal disorders. The market is expanding steadily due to Japans aging population—over 30% aged 65 and above—who are more prone to ENT issues. Rising demand for minimally invasive procedures, AI-powered diagnostics, and hearing restoration technologies is also fueling growth. Government initiatives promoting early diagnosis and the integration of digital health tools like image-guided surgery systems further support market development.

Report Coverage

This research report categorizes the market for the Japan ENT device market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan ENT device market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan ENT device market.

Japan ENT Device Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 637.11 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 8.08% |

| 2035 Value Projection: | USD 1497.33 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 212 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Product Type, By End-User |

| Companies covered:: | Olympus Corporation, HOYA Corporation, Fukuda Denshi Co., Ltd., Nakanishi Medical Co., Ltd., HAKKO Corporation, Cochlear Japan K.K., Smith & Nephew Japan, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

One of the main drivers of the market expansion for ENT devices in Japan is the quick development of technology. Advanced endoscopic gadgets and other cutting-edge diagnostic and surgical instruments in Japan have increased the safety and accuracy of ENT treatments, which has increased their uptake. Additionally, the efficiency and efficacy of treatments are being improved by the digitization of healthcare and the use of artificial intelligence (AI) and machine learning (ML) in diagnostic instruments in Japan. The need for contemporary ENT devices in Japan is fueled by these technologies, which enable better patient outcomes through early and precise diagnosis. Furthermore, the ongoing creation of innovative implants and hearing aids with better sound quality and connectivity features in Japan drives market expansion by increasing their accessibility and allure for patients across the globe.

Restraining Factors

Japans stringent regulatory approval process often delays the entry of innovative devices, limiting timely access to advanced care. High costs of premium ENT equipment and limited reimbursement coverage can deter adoption, especially in smaller clinics. A shortage of ENT specialists in rural areas creates disparities in access to care. Additionally, the dominance of established players and slow innovation in traditional hand instruments restrict opportunities for new entrants. These challenges collectively temper the markets full growth potential.

Market Segmentation

The Japan ENT device market share is classified into product type and end-user.

- The diagnostic devices segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan ENT device market is segmented by product type into diagnostic devices, surgical devices, hearing aids, hearing implants, and others. Among these, the diagnostic devices segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The ENT markets diagnostic devices category is crucial since it includes a variety of instruments and technologies necessary for precise ENT problem diagnosis. In order to diagnose conditions pertaining to hearing, balance, and sinuses, this section comprises imaging systems, audiometers, and endoscopes.

- The hospitals segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan ENT device market is segmented by end-user into hospitals, ambulatory surgical centers, ENT clinics, and others. Among these, the hospitals segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of their responsibility for managing chronic diseases, emergency situations, and comprehensive treatment for both in-patients and out-patients; hospitals are significant users of diagnostic services.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan ENT device market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Olympus Corporation

- HOYA Corporation

- Fukuda Denshi Co., Ltd.

- Nakanishi Medical Co., Ltd.

- HAKKO Corporation

- Cochlear Japan K.K.

- Smith & Nephew Japan

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan ENT device Market based on the following segments:

Japan ENT Device Market, By Product Type

- Diagnostic Devices

- Surgical Devices

- Hearing Aids

- Hearing Implants

- Others

Japan ENT Device Market, By End Users

- Hospitals

- Clinics

- Research Laboratories

- Others

Need help to buy this report?