Japan Energy Drink Market Size, Share, and COVID-19 Impact Analysis, By Type (Non-Alcoholic Energy Drinks, and Functional Energy Drink), By Format (Ready-to-Drink Beverages, Energy Shots, Powdered Mixes, and Drink Mixers), and Japan Energy Drink Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesJapan Energy Drink Market Insights Forecasts to 2035

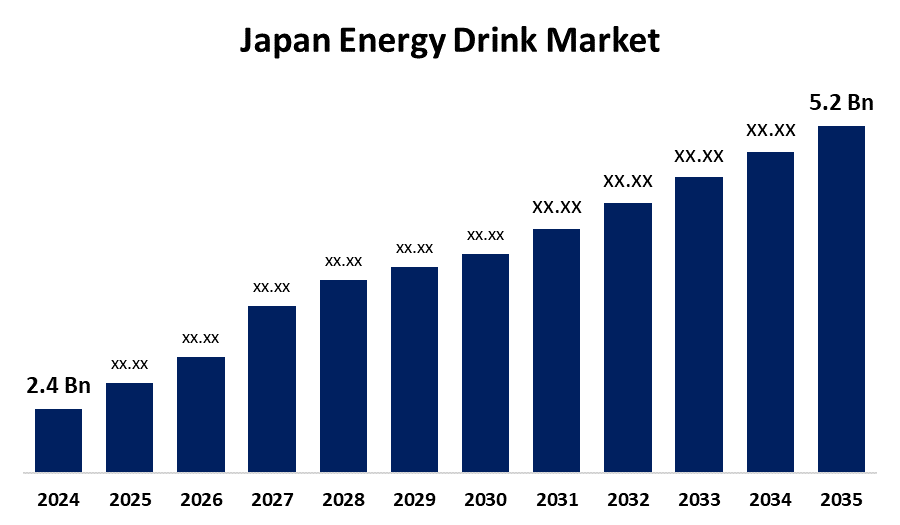

- The Japan Energy Drink Market Size Was Estimated at USD 2.4 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.28% from 2025 to 2035

- The Japan Energy Drink Market Size is Expected to Reach USD 5.2 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the Japan Energy Drink Market Size is Anticipated to Reach USD 5.2 Billion by 2035, Growing at a CAGR of 7.28% from 2025 to 2035. There are many factors contributing to the strong growth in the energy drink sector of Japan's beverage segment, including rising health consciousness, evolving consumer lifestyles, and product innovation. Consumers are looking for functional beverages like energy drinks as healthier alternatives to regular sodas, mostly because they want to obtain instant energy in their busy lifestyles.

Market Overview

An energy drink is a beverage designed to give a user an instant burst of energy. Energy drinks can be made of an array of ingredients such as sugar, caffeine, vitamins, amino acids, and herbal extracts. Since energy drinks focus on improving energy, focus, stamina, and performance, their consumer base is changing for those customers purchasing for a quick burst of energy for any instance of physical activity, work, or play, as they're becoming more popular. Energy drinks in Japan are growing rapidly as a result of changing health awareness among users, shifts in active lifestyles, and demand for functional beverages like energy drinks. Energy drinks are being marketed in Japan towards younger generations, fitness enthusiasts, and busy working professionals in any instance of needed focus and energy. Japanese consumers are increasingly looking for energy drinks that are low or no sugar, no artificial flavorings, and with plant-based caffeine sources (i.e. matcha, guarana).

Increasing demand for functional drinks among the older population offers a unique opportunity for large companies. A market for energy drinks that provide features like increased endurance, increased metabolism, and improved mental clarity has been created by Japan's aging population and health-conscious seniors. Increased e-commerce platform penetration is one of the other major opportunities. Energy drink flavors and potency may also be impacted by Japan's strict laws limiting the amount of sugar and caffeine ingredients. In addition, eco-friendly energy drink packaging is going through changes to comply with Japan's strict environmental restrictions and rising consumer demand for environmentally conscious products.

Report Coverage

This research report categorizes the market for the Japan energy drink market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan energy drink market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan energy drink market.

Japan Energy Drink Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.4 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 7.28% |

| 2035 Value Projection: | USD 5.2 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Type, By Format and COVID-19 Impact Analysis. |

| Companies covered:: | Coca-Cola, Otsuka Pharmaceutical (Pocari Sweat), DyDo Drinco, Red Bull, Monster Beverage Corporation, Meiji Holdings, Taisho Pharmaceutical Holdings, Pokka Sapporo Food & Beverage, Kirin Holdings and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

In Japan, the energy drink market is closely tied to busy lifestyles and urbanization, which is the primary factor driving the growth of the market. The selling point of ready-to-drink formats appeals to white-collar workers, commuters, and students. Energy drinks provide a quick way to ensure energy and productivity throughout the day. Growth is supported by the increasing availability of convenience stores and vending machines in urban areas where energy drink consumption thrives. Increased health awareness among consumers is another driver. On the consumer health front, Japanese consumers are considering drinks that are more than energizing. There is a rising demand for energy drinks that use all-natural caffeine, vitamins, amino acids, and plant ingredients. With concerns about the harmful health impact of consuming sugar and artificial ingredients, it will add pressure on manufacturers to develop cleaner, healthier energy drink formulations. The trend supports many healthier outcomes for consumers and leads to changes in the product development strategy of more mature players in the energy drink marketplace in Japan. Furthermore, the widespread availability and acceptance of energy drinks is supported by the hundreds of thousands of convenience shops throughout Japan.

Restraining Factors

The energy drink market in Japan is heavily regulated by laws related to labeling, caffeine, and sugar levels, which ultimately limits market expansion. While regulations serve an important role in maintaining public safety, they carry costs for companies at the aggregate level in terms of compliance and innovation. Regulations help restrict the types of beverages that can be produced, decrease time to market for new products, and increase the costs associated with production by having products reformulated to meet the above regulations. Perhaps the most challenging dilemma for industry participants is reconciling regulatory compliance with consumer demand for incredibly delicious and potent products. Furthermore, Energy drinks are increasingly competing with types of beverages, including functional waters, sports drinks, and herbal tea. These alternatives emphasize health and heritage in beverages, and are becoming increasingly popular in Japan through positioning as being healthier or at least more "natural", Sports drinks.

Market Segmentation

The Japan energy drink market share is classified into type and format.

- The functional energy drink segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan energy drink market is segmented by type into non-alcoholic energy drinks and functional energy drinks. Among these, the functional energy drink segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. Functional energy drink options continue to appeal to fitness-goers who establish better ways to improve performance and recovery, tapping into a broader health trend, while finding success with segmental growth. Beverage products with components that support vitality and wellness is another underlying trend in the category and are relevant to the aging population in Japan. The recency of marketing campaigns highlighting these two benefits strengthened their relevance, supporting the appeal for once again reaffirming the position for the consumer.

- The ready-to-drink beverages segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan energy drink market is segmented by format into ready-to-drink beverages, energy shots, powdered mixes, and drink mixers. Among these, the ready-to-drink beverages segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. Unmatched convenience and appeal are responsible for the growth of the ready-to-drink segment with busy, metropolitan consumers. Because RTD beverages require no preparation, they fit perfectly in Japan's fast-paced society when consumers are always on the lookout for an immediate energy boost. RTD products have also kept up with the contemporary trends in the market toward portability and convenience, both of which are vital for growth for the foreseeable future. RTD items are even more in demand because they tend to be marketed with functional benefits that incorporate energy and health.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan energy drink market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Coca-Cola

- Otsuka Pharmaceutical (Pocari Sweat)

- DyDo Drinco

- Red Bull

- Monster Beverage Corporation

- Meiji Holdings

- Taisho Pharmaceutical Holdings

- Pokka Sapporo Food & Beverage

- Kirin Holdings

- Others

Recent Developments:

- In October 2024, Red Bull GmbH launched a limited-edition yuzu-flavored energy drink tailored specifically for the Japanese market. This product introduction capitalized on the local preference for citrus-based flavors, aligning with Japan’s seasonal trends and cultural affinity for unique and refreshing beverages.

- In April 2024, Suntory Beverage & Food Ltd. launched a new energy drink brand, 'ZON e SPORTS', targeting gamers, formulated with caffeine, guarana extract, and B vitamins. This points towards the growing energy drink market segment focused on gamers and eSports enthusiasts.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Energy Drink Market based on the below-mentioned segments:

Japan Energy Drink Market, By Type

- Non-Alcoholic Energy Drinks

- Functional Energy Drink

Japan Energy Drink Market, By Format

- Ready-to-Drink Beverages

- Energy Shots

- Powdered Mixes

- Drink Mixers

Need help to buy this report?