Japan Endoscopy Devices Market Size, Share, and COVID-19 Impact Analysis, By Devices Type (Endoscopes, Endoscopy Visualization Systems), By Application (Gastrointestinal Endoscopy, Laparoscopy, Arthroscopy, Urology Endoscopy, Obstetrics/Gynecology Endoscopy, Bronchoscopy, Mediastinoscopy, Otoscopy, Laryngoscopy, Others), By End-Users (Hospitals, Clinics, Ambulatory Surgery Centers, Others), and Japan Endoscopy Devices Market Insights Forecasts to 2032

Industry: HealthcareJapan Endoscopy Devices Market Insights Forecasts to 2032

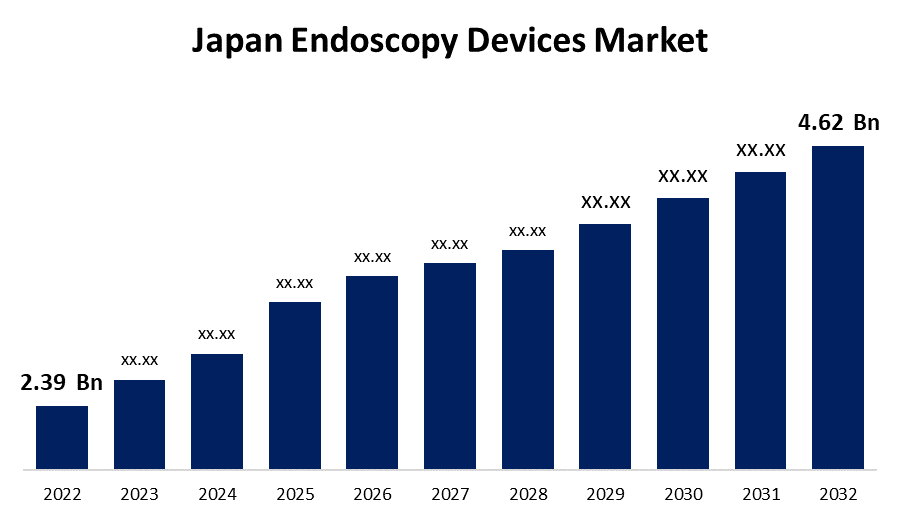

- The Japan Endoscopy Devices Market Size was valued at USD 2.39 Billion in 2022.

- The Market is Growing at a CAGR of 6.8% from 2022 to 2032.

- The Japan Endoscopy Devices Market Size is expected to reach USD 4.62 Billion by 2032.

- Japan is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Japan Endoscopy Devices Market Size is expected to reach USD 4.62 Billion by 2032, at a CAGR of 6.8% during the forecast period 2022 to 2032.

Market Overview

In Japan, the endoscopy device industry is significant in medical practice across numerous disciplines. Japan has one of the world's largest percentages of old people. As the population ages, so do the number of age-related diseases and ailments that demand endoscopic operations. Endoscopy is heavily used in gastroenterology for the diagnosis and treatment of gastrointestinal problems. Endoscopy devices are employed for therapeutic operations in Japan in addition to diagnostics. Endoscopic submucosal dissection (ESD), a minimally invasive procedure for eliminating early-stage gastrointestinal cancers, was developed in Japan, for example. Many medical technological advances emerged from Japanese firms. The market for endoscopic devices is no different, with Japan providing some of the nation's most advanced and sophisticated instruments available. Japan lays a high value on regulatory requirements and quality control in the manufacture and use of medical devices, including endoscopes. Furthermore, Japan's emphasis on innovation and R&D provides enormous opportunities for the market introduction of next-generation endoscopic devices.

Report Coverage

This research report categorizes the market for Japan Endoscopy Devices Market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan Endoscopy Devices Market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the Japan Endoscopy Devices Market.

Japan Endoscopy Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 2.39 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 6.8% |

| 2032 Value Projection: | USD 4.62 Billion |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | COVID-19 Impact Analysis, By Devices Type, By Application, By End-Users |

| Companies covered:: | Shimadzu Corporation, Konica Minolta, Menicon, Omron, Fukuda, Nihon Kohden, Sysmex, Terumo, Olympus, Fujifilm, Pentax, Machida Endoscope Co., Ltd., and Other key venders |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

In Japan, the endoscopy device industry is significant in medical practice across numerous disciplines. Japan has one of the world's largest percentages of old people. As the population ages, so do the number of age-related diseases and ailments that demand endoscopic operations. Endoscopy is heavily used in gastroenterology for the diagnosis and treatment of gastrointestinal problems. Endoscopy devices are employed for therapeutic operations in Japan in addition to diagnostics. Endoscopic submucosal dissection (ESD), a minimally invasive procedure for eliminating early-stage gastrointestinal cancers, was developed in Japan, for example. Many medical technological advances emerged from Japanese firms. The market for endoscopic devices is no different, with Japan providing some of the nation's most advanced and sophisticated instruments available. Japan lays a high value on regulatory requirements and quality control in the manufacture and use of medical devices, including endoscopes. Furthermore, Japan's emphasis on innovation and R&D provides enormous opportunity for the market introduction of next-generation endoscopic devices.

Market Segment

- In 2022, the endoscopy visualization systems segment accounted for the largest revenue share of more than 37.8% over the forecast period.

On the basis of devices type, the Japan Endoscopy Devices Market is segmented into endoscopes and endoscopy visualization systems. Among these, the endoscopy visualization systems segment is dominating the market with the largest revenue share of 37.8% over the forecast period. This is due to their widespread use in endoscopy operations as well as their expanding application for the imaging and diagnosis of complex illness states such as cancer, GI diseases, urinary disorders, and lung disorders. Furthermore, the advent of next-generation endoscopic visualization devices, which allow surgeons to examine the internal organ of choice with a very minimally invasive process, is increasing its acceptance and indicating an increased prevalence in Japan.

- In 2022, the gastrointestinal endoscopy segment is witnessing a higher growth rate over the forecast period.

Based on the Application, the Japan Endoscopy Devices Market is segmented into gastrointestinal endoscopy, laparoscopy, arthroscopy, urology endoscopy, obstetrics/gynecology endoscopy, bronchoscopy, mediastinoscopy, otoscopy, laryngoscopy, and others. Among these, the gastrointestinal endoscopy segment is witnessing a higher growth rate over the forecast period. This is due to an aging population and an increase in the prevalence of chronic gastrointestinal (GI) disorders. Additionally, increased preference for endoscopy as the primary treatment for early identification and identification of functional gastrointestinal problems, as well as the affordability of technologically sophisticated endoscopes, constitute significant factors boosting segment expansion in Japan.

- In 2022, the hospitals segment accounted for the largest revenue share of more than 44.8% over the forecast period.

On the basis of end-users, the Japan Endoscopy Devices Market is segmented into hospitals, clinics, ambulatory surgery centers, and others. Among these, the electronics segment is dominating the market with the largest revenue share of 44.8% over the forecast period. Hospitals are widely regarded as major healthcare systems, and the hospitalized population's demand for hospitals for the diagnosis and treatment of long-term illnesses is also supporting sector expansion. Furthermore, a significant number of hospital surgeries, including endoscopic procedures, enhance endoscopy equipment usage, consequently promoting the expansion of the segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan Endoscopy Devices Market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Shimadzu Corporation

- Konica Minolta

- Menicon

- Omron

- Fukuda

- Nihon Kohten

- Sysmex

- Terumo

- Olympus

- Fujifilm

- Pentax

- Machida Endoscope Co., Ltd.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the Japan Endoscopy Devices Market based on the below-mentioned segments:

Japan Endoscopy Devices Market, By Devices Type

- Endoscopes

- Rigid Endoscopy Devices

- Flexible Endoscopy Devices

- Capsule Endoscopy Devices

- Disposable Endoscopy Devices

- Robot Assisted Endoscopy Devices

- Endoscopy Visualization Systems

- Standard Definition (SD) Visualization Systems

- High Definition (HD) Visualization Systems

- Endoscopy Visualization Component

- Operative Devices

Japan Endoscopy Devices Market, By Application

- Gastrointestinal Endoscopy

- Laparoscopy

- Arthroscopy

- Urology Endoscopy

- Obstetrics/Gynecology Endoscopy

- Bronchoscopy

- Mediastinoscopy

- Otoscopy

- Laryngoscopy

- Others

Japan Endoscopy Devices Market, By End-Users

- Hospitals

- Clinics

- Ambulatory Surgery Centers

- Others

Need help to buy this report?