Japan Embolic Protection Devices Market Size, Share, and COVID-19 Impact Analysis, By Product (Distal Filter Devices, Distal Occlusion Devices, and Proximal Occlusion Devices), By Material (Nitinol and Polyurethane), By Application (Coronary Artery Treatment, Carotid Artery Treatment, and Others), and Japan Embolic Protection Devices Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareJapan Embolic Protection Devices Market Insights Forecasts to 2035

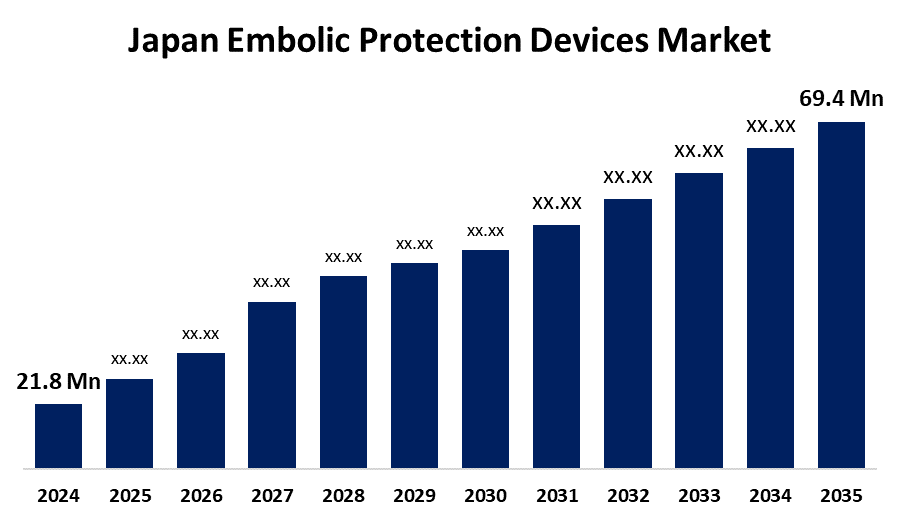

- The Japan Embolic Protection Devices Market Size Was Estimated at USD 21.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 11.1% from 2025 to 2035

- The Japan Embolic Protection Devices Market Size is Expected to Reach USD 69.4 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the Japan Embolic Protection Devices Market Size is Anticipated to Reach USD 69.4 Million by 2035, Growing at a CAGR of 11.1% from 2025 to 2035. The Japan embolic protection devices market is expanding due to population aging, the growing number of cardiovascular disease cases, and the augmented use of minimally invasive procedures such as TAVR and carotid stenting, which need devices to avoid procedural complications.

Market Overview

The Japan embolic protection devices market refers to dedicated medical devices, including distal filters, proximal occlusion systems, and occlusion balloons, used in vascular interventions to trap debris and minimize the risk of embolic stroke or organ injury. Strengths comprise sophisticated local R&D by industry leaders like Terumo and Asahi Intecc, and an advanced healthcare infrastructure to facilitate the uptake of minimally invasive techniques. Opportunities include increased utilization in TAVR, LAAC, neurovascular, and peripheral procedures, as well as digitalization and accuracy materials. Aging populations in Japan and increasing cardiovascular and neurovascular disease burden, particularly atrial fibrillation and ischemic stroke, are fueling high demand. Government support through Clinical guidelines revisions and cardiovascular innovation backing is driving uptake.

Report Coverage

This research report categorizes the market for the Japan embolic protection devices market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan embolic protection devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan embolic protection devices market.

Japan Embolic Protection Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 21.8 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 11.1% |

| 2035 Value Projection: | USD 69.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Material By Application and COVID-19 Impact Analysis. |

| Companies covered:: | Asahi Intecc, Penumbra, Inc., Medtronic, Nipro, Abbott Laboratories, B. Braun Melsungen, Cardinal Health, Cordis, Silk Road Medical, Inc., Terumo Corporation, Boston Scientific, Edwards Lifesciences Corporation and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Growth in Japan embolic protection devices market is fueled by the aging population of the country and increasing incidence of cardiovascular and neurovascular disease, stroke, and coronary artery disease in particular. Increased use of minimally invasive procedures like carotid artery stenting and transcatheter aortic valve replacement (TAVR) stimulates demand for embolic protection. Advances in technology in the form of filter-based and dual-occlusion systems improve procedural safety. Furthermore, supportive government healthcare policies and reimbursement schemes encourage early diagnosis and intervention, thus accelerating market growth.

Restraining Factors

The Japan embolic protection devices market is restrained by high device and procedural costs, coupled with limited and declining reimbursement policies tied to strict, efficient assessments. Additionally, complex device integration and clinician training challenges impede broader adoption

Market Segmentation

The Japan embolic protection devices market share is classified into product, material, and application.

- The distal filter devices segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan embolic protection devices market is segmented by product into distal filter devices, distal occlusion devices, and proximal occlusion devices. Among these, the distal filter devices segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Distal filter devices are an important tool in the elimination of embolic events during interventions. Placed distally, these intricately designed filters trap debris that is released during procedures such as angioplasty and TAVR, successfully preventing emboli from entering critical vessels and appreciably reducing the risk of strokes.

- The nitinol segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan embolic protection devices market is segmented by material into nitinol and polyurethane. Among these, the nitinol segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the thermally responsive and flexible shape memory alloy, which plays a critical role in the design of embolic protection devices. Its capacity to deform and recover shape allows for sensitive, durable filters that can traverse tortuous vessels, maintaining structural integrity, maximal vessel coverage, and efficient debris capture during interventions.

- The coronary artery treatment segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan embolic protection devices market is segmented by application into coronary artery treatment, carotid artery treatment, and others. Among these, the coronary artery treatment segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Coronary artery treatment devices play a major role in the embolic protection devices market through the risk of embolic events during procedure interventions. Technologies such as stents, balloons, and atherectomy systems have the potential to dislodge debris, triggering the deployment of embolic protection devices to catch it, stop migration, and minimize procedure-related complications.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan embolic protection devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Asahi Intecc

- Penumbra, Inc.

- Medtronic

- Nipro

- Abbott Laboratories

- B. Braun Melsungen

- Cardinal Health

- Cordis

- Silk Road Medical, Inc.

- Terumo Corporation

- Boston Scientific

- Edwards Lifesciences Corporation

- Others

Recent Developments:

- In September 2022, Asahi Intecc partnered with Penumbra to introduce the Indigo Aspiration System in Japan. After receiving regulatory approval, this minimally invasive system restores blood flow by removing emboli and thrombi from peripheral arterial and venous systems, offering a treatment option for pulmonary embolism.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan embolic protection devices market based on the below-mentioned segments:

Japan Embolic Protection Devices Market, By Product

- Distal Filter Devices

- Distal Occlusion Devices

- Proximal Occlusion Devices

Japan Embolic Protection Devices Market, By Material

- Nitinol

- Polyurethane

Japan Embolic Protection Devices Market, By Application

- Coronary Artery Treatment

- Carotid Artery Treatment

- Others

Need help to buy this report?