Japan Electrical Steel Coatings Market Size, Share, and COVID-19 Impact Analysis, By Coating Type (C2, C3, C4, C5, C6, and Others), By Electrical Steel Type (Grain-oriented, Non-grain Oriented, and Silicon Steel), By Application (Transformers, Motors, Generators, Inductors, and Others), and Japan Electrical Steel Coatings Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsJapan Electrical Steel Coatings Market Insights Forecasts to 2035

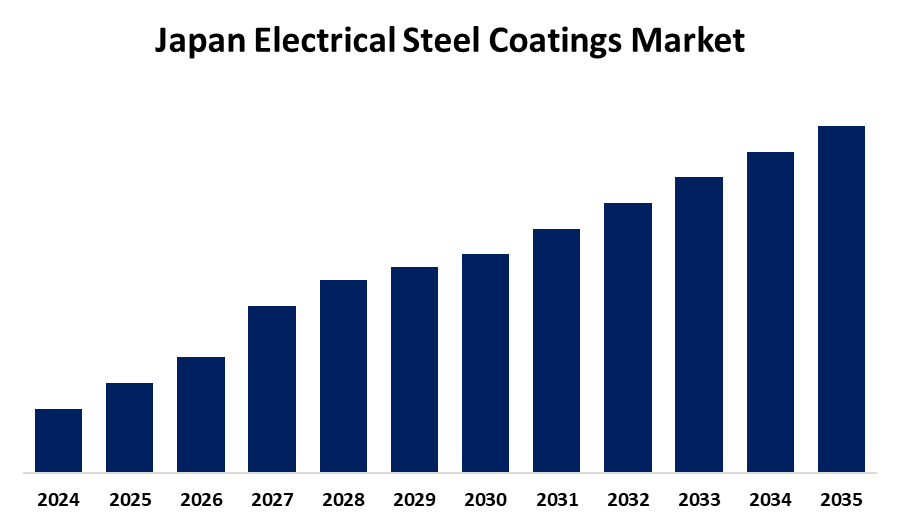

- The Japan Electrical Steel Coatings Market Size is Expected to Grow at a CAGR of 5.1% from 2025 to 2035

- The Japan Electrical Steel Coatings Market Size is Expected to Hold a Significant Share by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Japan Electrical Steel Coatings Market Size is Expected to Hold a Significant Share by 2035, at a CAGR of 5.1% during the forecast period 2025-2035. The Japan market for electrical steel coatings is growing due to increasing demand for energy-efficient parts in EVs, renewable energy, and industrial equipment. Expansion is driven by electric vehicle growth, government incentives, and ongoing improvements in steel and coating technology.

Market Overview

The Japan Market Size for Electrical Steel Coatings refers to protective and insulating coatings on electrical steel used in transformers, motors, and generators to increase efficiency, minimize energy loss, and prolong equipment life. These coatings are used extensively in power transmission infrastructure, electric vehicle (EV) motors, household appliances, and renewable energy equipment. The main strengths are Japans leading-edge manufacturing, extreme accuracy coatings, and robust integration of automation and nanotechnology in the production process. Rising EV manufacture, where coated steel motors are a requirement, and explosive renewable power project installations create sizeable opportunities. The growth in the market is caused by the countrys drive towards electrification and clean energy, such as smart grids and EV penetration, sustained by tight environmental policies and significant investment in infrastructure. Industry giants such as JFE Steel of Japan are heavily investing to increase capacity to manufacture efficicent coated electrical steels for EVs and power systems, with government eco-friendly initiatives and grants supporting the effort.

Report Coverage

This research report categorizes the market for the Japan electrical steel coatings market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan electrical steel coatings market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan electrical steel coatings market.

Japan Electrical Steel Coatings Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 193 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Coating Type, By Electrical Steel Type |

| Companies covered:: | Sumitomo Metal Corporation, Nippon Steel, KOBE Steel, ArcelorMittal, JFE Steel Corporation, POSCO, Voestalpine, ThyssenKrupp, Filtra Catalysts and Chemicals Ltd., Novolipetsk Steel, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan electrical steel coatings industry is fueled by the increasing need for energy-saving electrical parts in EVs, power transformers, and renewable energy systems. The governments aggressive drive towards carbon neutrality, smart grid development, and electric mobility further expedites industry growth. Developments in chrome-free, environmentally friendly coatings and the requirement for lower core losses in high-frequency applications improve product performance. Moreover, growing investment by steel producers in sophisticated coating solutions enhances market growth and complies with strict environmental and efficiency regulations.

Restraining Factors

The electrical steel coatings market in Japan is restrained by unpredictable raw material prices, particularly silicon, resins, and chemicals, which contribute to the cost of production. Moreover, increased manufacturing complexity and regulatory requirements further amplify costs and present challenges for adoption.

Market Segmentation

The Japan electrical steel coatings market share is classified into coating type, electrical steel type, and application.

- The C3 segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan electrical steel coatings market is segmented by coating type into C2, C3, C4, C5, C6, and others. Among these, the C3 segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to their good insulation, heat resistance, and flexibility. They are prevalent in transformers, motors, and generators, and their use is increasing with the requirement for high-performance materials in sophisticated power systems and electric vehicles to ensure increased efficiency and reliability.

- The grain-oriented segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan electrical steel coatings market is segmented by electrical steel type into grain-oriented, non-grain oriented, and silicon steel. Among these, the grain-oriented segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to its aligned grain structure, which possesses superior magnetic characteristics in the rolling direction. Coatings ensure greater insulation between laminations, minimizing core losses and maximizing energy efficiency. Its extensive application in reactors and transformers enables high-performance and low-loss power systems and sustains its position as a leader in current grid applications.

- The transformers segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan electrical steel coatings market is segmented by application into transformers, motors, generators, inductors, and others. Among these, the transformers segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to they are crucial to electricity supply systems, generating robust demand for coated electrical steel, particularly grain-oriented materials. Coatings insulate between laminations, minimizing eddy current loss and heat. They also improve corrosion resistance and wear, providing reliable transformers for the long term under heavy loads and varied conditions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan electrical steel coatings market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sumitomo Metal Corporation

- Nippon Steel

- KOBE Steel

- ArcelorMittal

- JFE Steel Corporation

- POSCO

- Voestalpine

- ThyssenKrupp

- Filtra Catalysts and Chemicals Ltd.

- Novolipetsk Steel

- Others

Recent Developments:

- In January 2024, JFE Steel, with JFE Techno-Research and Armis Corporation, developed an axial-gap motor using Denjiro® pure-iron powder. The prototype matches larger radial-gap motors power but is 48% thinner and 40% lighter. Axial-gap motors, or pancake motors, offer a compact design with magnetic flux aligned to the rotation axis.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan electrical steel coatings market based on the below-mentioned segments:

Japan Electrical Steel Coatings Market, By Coating Type

- C2

- C3

- C4

- C5

- C6

- Others

Japan Electrical Steel Coatings Market, By Electrical Steel Type

- Grain-oriented

- Non-grain Oriented

- Silicon Steel

Japan Electrical Steel Coatings Market, By Application

- Transformers

- Motors

- Generators

- Inductors

- Others

Need help to buy this report?