Japan Electric Vehicle Market Size, Share, and COVID-19 Impact Analysis, By Vehicle Type (Battery Electric Vehicle, Hybrid Electric Vehicle, Plug-in Hybrid Electric Vehicle, Fuel Cell Electric Vehicle), By Application (Two-wheeler, Passenger Car, Commercial Vehicle, Others), and Japan Electric Vehicle Market Insights Forecasts to 2032.

Industry: Automotive & TransportationJapan Electric Vehicle Market Insights Forecasts to 2032

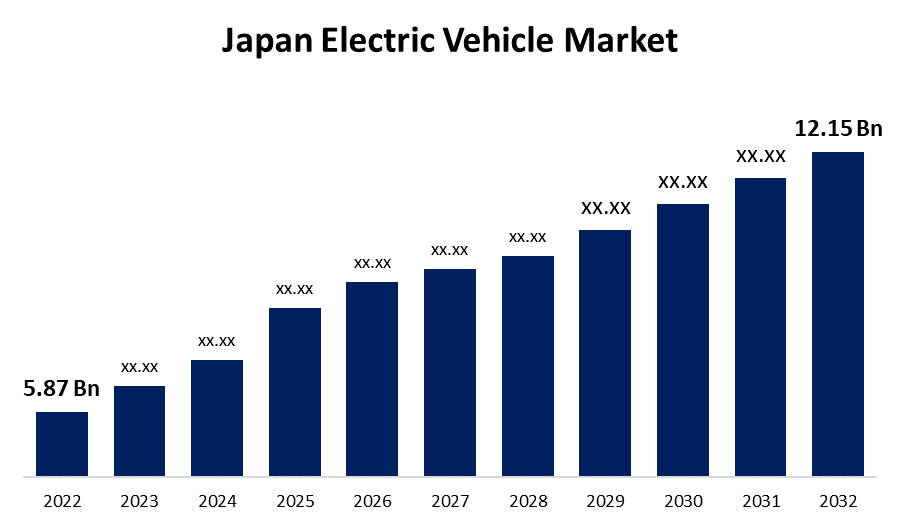

- The Japan Electric Vehicle Market Size was valued at USD 5.87 Billion in 2022.

- The Market Size is Growing at a CAGR of 7.55% from 2022 to 2032.

- The Japan Electric Vehicle Market Size is expected to reach USD 12.15 Billion by 2032.

- Japan is expected To Growth the fastest during the forecast period.

Get more details on this report -

The Japan Electric Vehicle Market Size is expected to reach USD 12.15 Billion by 2032, at a CAGR of 7.55% during the forecast period 2022 to 2032. The continuing shift from traditional gasoline-powered vehicles to electric and plugin electric vehicles, driven by rising fuel prices and growing environmental awareness, is propelling Japan's Electric Vehicle Market Growth.

Market Overview

Japan is the world's third-largest automaker, trailing only China and the United States. As a result, it is expected to lead the worldwide electric vehicles market. However, in retrospect, Japan realize that things were unable to exactly proceed as planned. Currently, electric vehicles account for about 1% of total car sales in Japan. This is because local OEMs have been unable to market EVs as a credible public choice. This trend is essentially keeping the country's low demand further reduced, which is detrimental to Japan’s goal to attain carbon neutrality. Over 8,600 of the approximately 20,000 new EVs sold in 2021 were imported. The outcome was considerable growth, with over threefold the number of international vehicle registrations of newly imported EVs in contrast to the prior year.

However, the Japanese government recently set a goal: by 2035, every new vehicle sold in Japan would be carbon-neutral. To distinguish them from fossil-fuel-powered vehicles, eco-friendly vehicles in Japan are referred to as Clean Energy Vehicles or CEVs. The Government of Japan (GOJ) is providing to subsidize a portion of the cost of purchasing CEVs such as Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), and Fuel Cell Electric Vehicles (FCEVs).

In addition, Japan has vowed to achieve net-zero greenhouse gas emissions by 2050 and to reduce emissions by 46% by 2030. The government recognizes the transition to electric vehicles as a means of assisting the country's decarbonization efforts. However, considering that hydrogen and hybrid vehicles are the primary emphasis of Japan's auto sector, Japan is unlikely to make significant progress and will lag well behind China and Western Countries.

Report Coverage

This research report categorizes the market for Japan Electric Vehicle Market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan Electric Vehicle Market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the Japan Electric Vehicle Market.

Driving Factors

The decarbonisation movement in Japan is projected to provide promising growth opportunities for the electric vehicle motor industry in Japan by expanding the sale of commercial electric cars for transportation and delivery applications. Furthermore, the rising domestic demand for products and gadgets is increasing customer demand for commercial cars for transportation. On top of that, the country's major automotive manufacturers' increasing efforts and research and development activities aimed at boosting and relaunching electrified versions of currently manufactured conventional cars are expected to significantly increase Japan electric vehicle market penetration over the forecast period.

Additionally, the Japanese government's favorable regulations aiming at lowering their carbon footprint and greenhouse gas emissions are expected to boost sales of these vehicles during the projection period. Some of the critical Japan electric car market drivers include increased brand recognition, rising disposable income, solid car manufacturers infrastructure, and an aging workforce. As more Japanese people gain awareness of the benefits of electric vehicles over regular automobiles, they will be more likely to acquire electric vehicles in future years.

Furthermore, Japanese automakers have collaborated with technology firms to develop innovative EV solutions and services. Toyota, for example, has teamed with Panasonic to create EV batteries, while Honda is collaborating with General Motors for the development of next-generation EVs. Also, the Japanese government has introduced a variety of incentives to stimulate the adoption of electric vehicles, including tax reductions, reimbursements for the purchase of electric vehicles and the installation of electric vehicle charging stations, and exclusions from specific duties and taxes. As a result of these reasons, the Japanese electric vehicle market will likely grow rapidly over the forecast period.

Market Segmentation

- In 2022, the battery electric vehicle segment accounted for the largest revenue share of more than 37.8% over the forecast period.

On the basis of vehicle type, the Japan Electric Vehicle Market is segmented into battery electric vehicles, hybrid electric vehicles, plug-in hybrid electric vehicles, and fuel cell electric vehicles. Among these, the industrial batteries segment is dominating the market with the largest revenue share of 37.8% over the forecast period. Battery electric vehicles are without conventional gearboxes, noiseless, emission-free, simple to operate, lightweight, tax effective, and inexpensive in maintenance costs. The constant developments in battery technology targeted at enhancing the operating range of automobiles after a complete charge while reducing weight to improve the overall driving experience of customers are further assisting the segment's growth. On the other hand, demand for plugin electric vehicles is predicted to rise during the projection period as it assists the gas engine, resulting in increased vehicle efficiency and Japan electric vehicle market expansion.

- In 2022, the passenger car segment accounted for the largest revenue share of more than 57.2% over the forecast period.

On the basis of end-users, the Japan Electric Vehicle Market is segmented into two-wheeler, passenger cars, commercial vehicles, and others. Among these, the passenger car segment is dominating the market with the largest revenue share of 57.2% over the forecast period. The country's stronghold of premier manufacturers of electric vehicles is fueling demand for innovative electric vehicles such as the MAZDA SEDAN X and the HYBRID X Honda SENSING, among others. Because of the expanding eco-friendly views among the Japanese population, the ongoing transition from conventional fuel-based to electric vehicles is further boosting demand for passenger electric vehicles, boosting the majority of the Japan electric vehicle motor market value. The rising number of hybrid electric vehicles in Japan is likely to drive population acceptance of these vehicles.

Furthermore, the two-wheeler category is predicted to develop the fastest in the Japan Electric Vehicle Market during the period of forecasting. The upward trend can be linked to an increase in demand for electric bikes among elderly individuals and employed parents with young children. Electric scooters, commonly known as e-scooters, must be operated on roadways and carry license plates under current Japanese law, and users should have a motorcycle registration. Furthermore, easing regulations on e-scooters would boost the market even further.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan Electric Vehicle Market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Honda Motor

- DENSO Corporation

- Kawasaki

- Aspark Co., Ltd.

- Nippon Sharyo

- Suzuki

- SkyDrive

- Luup

- Subaru

- Daihatsu Motor Co., Ltd.

- Nissan Motor

- FOMM

- Hino Motors

- Niigata Transys

- Lexus

- Kinki Sharyo

- Yamaha

- Toyota Motor Corporation

- Mitsubishi Fuso Truck and Bus Corporation

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- On June 2023, U Power Limited announced the Company entered into a framework strategic cooperation agreement with Quantum Solutions Co., Ltd., to develop business initiatives relating to marketing, research and development of new energy vehicles, financial technologies, battery banks, EV charging and battery-swapping operations and services in Japan.

- In November 2022, Japanese Mazda Motor Corporation unveiled its plan to spend $10.6 billion to execute its plan on electrifying its vehicle and on electrifying battery production. With this initiative, Mazda believes it to raise its target for Electric vehicles by up to 40% in 2030 surpassing its previous record of setting a sales record of 25% in 2030 for the whole global supply of electric vehicles.

- In May 2022, Marriott has partnered with Plugo, a Japanese electric vehicle (EV) charging service company that only uses renewable energy such as solar and wind power. In support of the hospitality company’s targets to reduce its environmental footprint by 2025 and reach net-zero greenhouse gas emissions by no later than 2050, the collaboration will introduce EV charging stations to 30 Marriott hotels in Japan by 2024.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the Japan Electric Vehicle Market based on the below-mentioned segments:

Japan Electric Vehicle Market, By Vehicle Type

- Battery Electric Vehicle (BEV)

- Hybrid Electric Vehicle (HEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

- Fuel Cell Electric Vehicle (FCEV)

Japan Electric Vehicle Market, By Application Type

- Two-wheeler

- Passenger Car

- Commercial Vehicle

- Others

Need help to buy this report?