Japan Electric Two-Wheeler Market Size, Share, and COVID-19 Impact Analysis, By Vehicle Type (Electric Scooter/Moped, Electric Motorcycle), By Battery Type (Lithium-Ion, Sealed Lead Acid (SLA)), and Japan Electric Two-Wheeler Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationJapan Electric Two-Wheeler Market Insights Forecasts to 2035

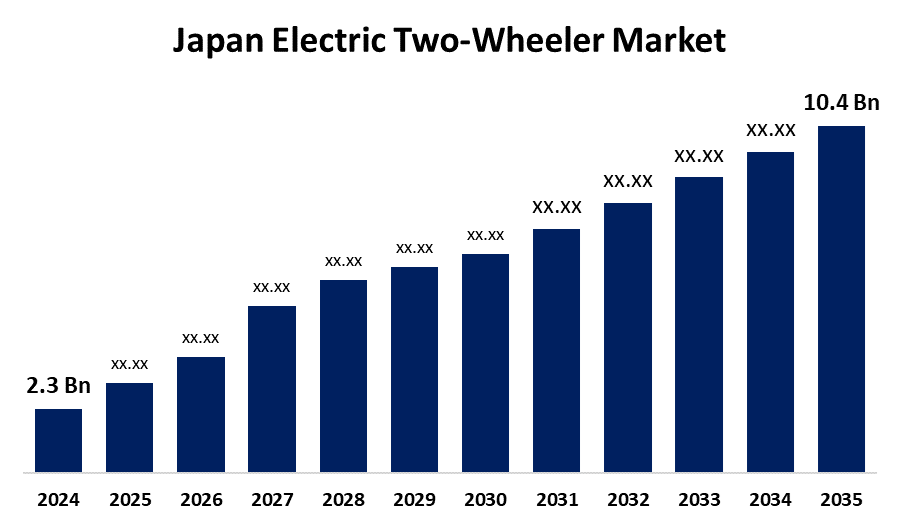

- The Japan Electric Two-Wheeler Market Size Was Estimated at USD 2.3 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 14.70% from 2025 to 2035

- The Japan Electric Two-Wheeler Market Size is Expected to Reach USD 10.4 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan Electric Two-Wheeler Market Size is anticipated to reach USD 10.4 billion by 2035, growing at a CAGR of 14.70% from 2025 to 2035. The electric two-wheeler market in Japan expands through multiple elements, which include government support, together with environmental factors and technological progress. The industry advances because of advancements in battery technology and charging infrastructure, alongside rising public environmental awareness and government rules that promote electric vehicle adoption.

Market Overview

The Electric Two-Wheeler Market represents the commercial distribution of electric scooters, together with motorcycles and additional two-wheeled vehicles that run on electrical power. Every market aspect begins at production and ends with the customer buying, while including power supply development systems. The major factors that propel this market include government pollution regulations, together with battery development and rising electric scooter and motorcycle sales among urban drivers. Environmental awareness among people, combined with their understanding of carbon emissions reduction, drives them to select sustainable transportation methods. Government policies that offer financial incentives will help the market expand its adoption of electric vehicles. The growing market demand exists because of modern features, which include smart connectivity, extended operating ranges, and quick charging systems. Better battery performance alongside extended range allows vehicles to deliver improved performance while solving range anxiety issues to enhance user satisfaction. High fuel prices drive consumers toward electric alternatives because these options provide superior economic advantages. The increasing number of people moving to cities, together with worsening traffic congestion, makes two-wheelers the preferred choice since they operate efficiently while providing superior mobility.

Japan's leading electric two-wheeler companies face various growth prospects such as battery-swapping infrastructure development, smart connectivity, AI system advancement, and expanding their market share in cargo and utility e-bikes. The market provides potential for customized products as well as personalized solutions while developing sustainable mobility alternatives. The Japanese government supports the electric two-wheeler market through multiple policies, which include financial incentives and regulations. The implementation of tough emissions standards and the goal of total vehicle electrification by 2035 drive EV technology development, while subsidies and tax cuts encourage more consumers to choose electric vehicles.

Report Coverage

This research report categorizes the market for the Japan electric two-wheeler market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan electric two-wheeler market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan electric two-wheeler market.

Japan Electric Two-Wheeler Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.3 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 14.70% |

| 2035 Value Projection: | USD 10.4 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 192 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Vehicle Type, By Battery Type and COVID-19 Impact Analysis |

| Companies covered:: | Yamaha Motor Co.,, Hero Electric, Pedego Electric Bikes, Vmoto Limited, Zero Motorcycles, Emco Electroroller GmbH and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rising electric two-wheeler market exists primarily because Japan pursues its goal of carbon emission reduction. The government enforces rigorous emission standards because of environmental policies that promote electric vehicle use for reducing greenhouse gas emissions. The Japanese government provides electric two-wheeler buyers with financial support that includes subsidies along with tax breaks, and grant funding. The implemented measures have substantially lowered consumer expenses while making electric options more appealing and accessible to the market. People have shifted their understanding of environmental sustainability toward electric two-wheelers, which now serve as their main transportation choice. Educational campaigns conducted by various groups effectively spread knowledge about electric vehicles because they show the advantages of these vehicles when compared to traditional fuel-powered vehicles. The Japanese electric two-wheeler market benefits from new battery technology advancements. Modern lithium-ion batteries provide enhanced power storage capabilities, together with shorter recharge durations and extended operational durations. Electric two-wheelers have become more convenient for everyday use because of battery improvements and enhanced charging systems, which fuel market expansion and customer acceptance. Japan's electric two-wheeler industry advances at a fast pace because of technological development. The manufacturer's data shows that modern vehicles now include safety features, together with smartphone integration and digital control panels. The rising demand for smart features stands as a key factor that most buyers consider essential for their purchase decisions.

Restraining Factors

The main reason preventing electric two-wheelers from gaining market traction in Japan stems from their initial high purchase price. Modern batteries and electric drivetrains cost more than traditional components, so electric two-wheelers maintain higher starting prices even after government funding programs. The price difference between electric and conventional vehicles discourages price-sensitive customers, especially when electric vehicle infrastructure remains under development. The general population remains unaware of the complete cost savings that electric two-wheelers offer through their lower fuel expenses and reduced maintenance requirements. The Japanese electric two-wheeler market faces substantial growth restrictions because of its incomplete charging infrastructure network. The expansion of charging stations in major cities faces opposition from suburban and rural regions, where these facilities remain scarce, which hinders widespread adoption. Potential buyers experience range anxiety because they fear power depletion when charging stations remain unavailable within their reach. The quick and easy refuelling process of conventional vehicles creates a strong concern among consumers when considering electric two-wheelers.

Market Segmentation

The Japan electric two-wheeler market share is classified into vehicle type and battery type.

- The electric scooter/moped segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan electric two-wheeler market is segmented by vehicle type into electric scooter/moped, electric motorcycle. Among these, the electric scooter/moped segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. Electric scooters and mopeds have experienced a surge in popularity because they deliver adaptable performance along with user-friendly features for metropolitan areas. Customers find numerous attractive benefits in these products. These vehicles represent an affordable and efficient solution for traveling distances that range from short to medium. The vehicles operate effectively in urban settings because they solve two major problems, which are parking limitations and traffic congestion. The cost of electric scooters and mopeds stands lower than electric motorcycles and cars, thus enabling more customers to purchase them.

- The sealed lead acid segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan electric two-wheeler market is segmented by battery type into lithium-ion, sealed lead acid (SLA). Among these, the sealed lead acid segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The widespread availability combined with reasonable pricing makes them a preferred choice for many users, which drives the segmental growth. People who have limited funds for buying batteries will choose these because their initial expenses remain lower than lithium-ion alternatives in price-sensitive areas. SLA batteries are recognized for their durable design, together with their easy recycling process and stable performance during standard applications. These batteries maintain their leading position because of their widespread distribution network and compatibility with existing charging systems. The current choice for cost-focused locations remains SLA batteries despite their higher weight and shorter operational duration when compared to advanced battery options.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan electric two-wheeler along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Yamaha Motor Co.,

- Hero Electric

- Pedego Electric Bikes

- Vmoto Limited

- Zero Motorcycles

- Emco Electroroller GmbH

- Others

Recent Developments:

- In September 2024, the electric scooter rental service Lime established operations in Japan for its worldwide network of 280 cities. Customers who use the ride-sharing service Lime through its app can book electric micro-mobility vehicles at various city ports before returning them to any nearby port after their trip. The service from Lime delivers customized road conditions and user-specific features through vehicles that the company independently created, while other micro-mobility organizations use third-party products.

- In October 2023, Suzuki introduced the e-BURGMAN electric scooter prototype at the Japan Mobility Show 2023 while working toward its carbon neutrality targets. Suzuki performs real-world testing of the 125cc equivalent scooter, which uses Gachaco's battery-swapping system to enhance future electric motorbike designs.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Water Purifier Market based on the below-mentioned segments:

Japan Electric Two-Wheeler Market, By Vehicle Type

- Electric Scooter/Moped

- Electric Motorcycle

Japan Electric Two-Wheeler Market, By Battery Type

- Lithium-Ion

- Sealed Lead Acid (SLA)

Need help to buy this report?