Japan Electric Motor For Household Appliances Market Size, Share, and COVID-19 Impact Analysis, By Type (AC Motors and DC Motors), By Power Output (500W and Above 500W), and Japan Electric Motor For Household Appliances Market Insights, Industry Trend, Forecasts to 2035.

Industry: Semiconductors & ElectronicsJapan Electric Motor For Household Appliances Market Insights Forecasts to 2035

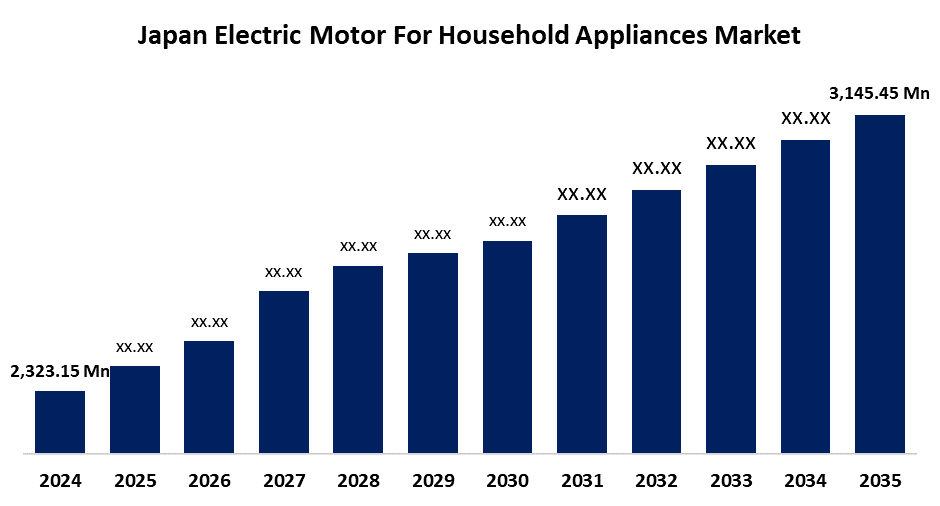

- The Japan Electric Motor For Household Appliances Market Size Was Estimated at USD 2,323.15 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 2.79% from 2025 to 2035

- The Japan Electric Motor For Household Appliances Market Size is Expected to Reach USD 3,145.45 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan Electric Motor For Household Appliances Market Size is anticipated to reach USD 3,145.45 Million by 2035, growing at a CAGR of 2.79% from 2025 to 2035. Key drivers include the rising demand for energy-efficient and smart appliances, supported by government incentives and increasing consumer awareness.

Market Overview

The Japan electric motor for household appliances market refers to the segment of the electric motor industry that supplies motors used in domestic appliances such as refrigerators, washing machines, vacuum cleaners, and air conditioners. These motors convert electrical energy into mechanical motion, enabling the core functions of these appliances. Japanese consumers are increasingly choosing energy-efficient home equipment, according to government polls. The need to lower electricity prices and heightened environmental awareness are the main drivers of this movement. An essential part of increasing appliance efficiency is electric motors. According to data, air conditioners, washing machines, refrigerators, and other new appliance categories now account for a sizable share of sales of energy-efficient models. To meet this need, manufacturers are giving priority to the development of high-efficiency motor technology, according to industry reports. Energy efficiency ratings are now a big factor when buying large appliances, according to consumer research.

Report Coverage

This research report categorizes the market for the Japan electric motor for household appliances market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan electric motor for household appliances market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan electric motor for household appliances market.

Japan Electric Motor For Household Appliances Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2,323.15 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 2.79% |

| 2035 Value Projection: | USD 3,145.45 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 238 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Power Output |

| Companies covered:: | Johnson Electric Holdings Limited, Nidec Corporation, Mitsubishi Electric Corporation, Panasonic Corporation, Hitachi Ltd., Sanyo Denki Co., Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Japanese consumers are increasingly choosing energy-efficient home equipment, according to government polls. The need to lower electricity prices and heightened environmental awareness are the main drivers of this movement. An essential part of increasing appliance efficiency is electric motors. According to data, air conditioners, washing machines, refrigerators, and other new appliance categories now account for a sizable share of sales of energy-efficient models. To meet this need, manufacturers are giving priority to the development of high-efficiency motor technology, according to industry reports. Energy efficiency ratings are now a big factor when buying large appliances, according to consumer research. Government incentive schemes that support energy-efficient goods have also helped the market expand.

Restraining Factors

High production costs linked to advanced motor technology, however, are a barrier to the market that may restrict price and uptake. Furthermore, the aging population and declining family sizes in Japan would lower the country's total need for large equipment. Challenges include fierce manufacturer rivalry and the requirement for ongoing innovation to satisfy changing customer demands. Furthermore, fluctuations in raw material prices and supply chain interruptions might affect output and profitability.

Market Segmentation

The Japan electric motor for household appliances market share is classified into type and power output.

- The AC motors segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan electric motor for household appliances market is segmented by type into AC motors and DC motors. Among these, the AC motors segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of their robustness and effective handling of high voltage levels. AC motors are frequently found in home appliances like stoves, washing machines, and refrigerators.

- The 500W segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan electric motor for household appliances market is segmented by power output into 500W and above 500W. Among these, the 500W segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Electric fans, vacuum cleaners, and range hoods are just a few of the small home appliances that employ motors up to 500W, which dominate the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan electric motor for household appliances market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Johnson Electric Holdings Limited

- Nidec Corporation

- Mitsubishi Electric Corporation

- Panasonic Corporation

- Hitachi Ltd.

- Sanyo Denki Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Electric motor for household appliances Market based on the following segments:

Japan Electric Motor For Household Appliances Market, By Type

- AC Motors

- DC Motors

Japan Electric Motor For Household Appliances Market, By Power Output

- 500W

- Above 500W

Need help to buy this report?