Japan Electric Bus Market Size, Share, and COVID-19 Impact Analysis, By Consumer (Government, Fleet Operator), By Propulsion Type (Battery electric Bus, Hybrid Electric Bus, Fuel Cell Electric Bus), and Japan Electric Bus Market Insights Forecasts to 2033

Industry: Automotive & TransportationJapan Electric Bus Market Insights Forecasts to 2033

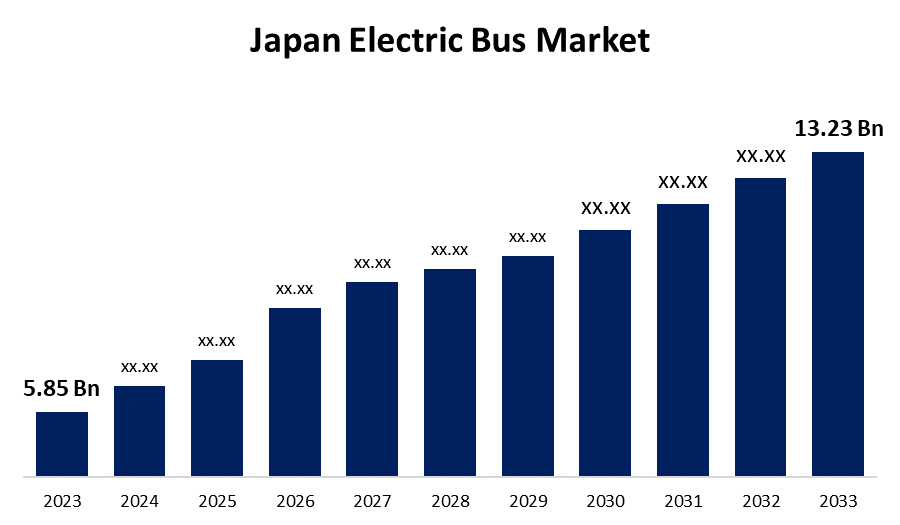

- The Japan Electric Bus Market Size was valued at USD 5.85 Billion in 2023.

- The Market Size is Growing at a CAGR of 8.5% from 2023 to 2033.

- The Japan Electric Bus Market Size is Expected to Reach USD 13.23 Billion by 2033.

Get more details on this report -

The Japan Electric Bus Market Size is expected to reach USD 13.23 Billion by 2033, at a CAGR of 8.5% during the forecast period 2023 to 2033.

Market Overview

Buses are an everyday part of life in many parts of the region, serving as a convenient and environmentally friendly mode of transportation. These large vehicles are designed to transport multiple passengers, making them a cost-effective option for both local and long-distance travel. Buses range in size and shape, from compact city buses to luxurious coaches for intercity and cross-country travel. They provide a viable alternative to private cars, reducing traffic congestion and pollution. Furthermore, buses allow individuals who do not have access to personal vehicles to travel, promoting inclusivity in transportation. Passengers on a bus will find comfortable seating, safety features, and, in many cases, amenities such as air conditioning and Wi-Fi. A smooth and reliable journey is ensured by friendly bus drivers or automated systems. Whether traveling to work, school, or on a scenic adventure, buses are a dependable mode of transportation that fosters connectivity and community as they roll down the road.

Report Coverage

This research report categorizes the market for Japan electric bus market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan electric bus market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the Japan electric bus market.

Japan Electric Bus Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 5.85 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.5% |

| 2033 Value Projection: | USD 13.23 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Consumer, By Propulsion Type |

| Companies covered:: | BYD Company Limited, Ankai Automobile Co. Ltd, Nissan Motor Co., Ltd., Toyota Motor Corporation, Hino Motors Ltd., Isuzu Motors Limited, Proterra Inc., GreenPower Motor Company Inc., Blue Bird Corporation, Mitsubishi Fuso Truck and Bus Corporation, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Driving Factors

The Japanese government's commitment to lowering greenhouse gas emissions and improving air quality is a major driving factor in the electric bus market. The Japanese government has set lofty goals for achieving carbon neutrality and reducing emissions, particularly in cities. Stricter emissions regulations and environmental policies encourage the use of cleaner transportation options, such as electric buses. These regulations, which align with Japan's broader sustainability goals, create a favorable environment for electric bus manufacturers and operators. The Japanese government provides a variety of incentives and subsidies to encourage the use of electric vehicles, such as electric buses. These incentives can help to offset the higher initial costs of electric buses when compared to traditional diesel buses. Grants, tax breaks, reduced vehicle taxes, and subsidies for charging infrastructure development are examples of financial incentives. These incentives encourage public transportation agencies and private operators to invest in electric bus fleets by lowering the total cost of ownership.

Restraining Factors

The operational range of electric buses is critical, especially for longer routes and intercity travel. It is critical for the viability of electric buses to ensure that they can travel necessary distances on a single charge. While battery technology has advanced, additional research and development is required to improve energy density, charging speed, and overall battery performance. Overcoming operational range limitations will increase the practicality of electric buses and drive their adoption.

Market Segment

- In 2023, the government segment accounted for the largest revenue share over the forecast period.

Based on the consumer, the Japan electric bus market is segmented into government and fleet operator. Among these, the government segment has the largest revenue share over the forecast period. Owing to the country's unwavering commitment to combating climate change and lowering carbon emissions. The government's proactive approach includes strict regulations and incentives for public transportation agencies to transition to electric buses. Furthermore, significant infrastructure investments, such as charging stations and maintenance facilities, have played an important role in facilitating this transition.

- In 2023, the battery electric bus segment accounted for the largest revenue share over the forecast period.

Based on the propulsion type, the Japan electric bus market is segmented into battery electric bus, hybrid electric bus, and fuel cell electric bus. Among these, the battery electric bus segment has the largest revenue share over the forecast period. Battery electric buses (BEBs) have gained popularity among commuters and environmentalists alike due to their zero tailpipe emissions and remarkably quiet operation. Battery electric buses (BEBs) are an excellent choice for sustainable transportation due to Japan's unwavering commitment to reducing greenhouse gas emissions and its densely populated urban areas. Furthermore, ongoing technological advances have resulted in batteries with longer life spans and faster charging capabilities, making battery electric buses (BEBs) even more efficient and cost-effective in the long run. Battery electric buses (BEBs) are revolutionizing the way we commute and shaping a greener future for public transportation in Japan and beyond due to their superior performance and eco-friendly features.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan electric bus market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BYD Company Limited

- Ankai Automobile Co. Ltd

- Nissan Motor Co., Ltd.

- Toyota Motor Corporation

- Hino Motors Ltd.

- Isuzu Motors Limited

- Proterra Inc.

- GreenPower Motor Company Inc.

- Blue Bird Corporation

- Mitsubishi Fuso Truck and Bus Corporation

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2023, BYD provided a batch of electric buses for the city of Kitahiroshima, Hokkaido prefecture in view of the rising use of electric vehicles and environmentally friendly efforts.

- In July 2023, Mitsubishi Fuso Truck and Bus Corporation has teamed up with a US-based startup called "Ample Inc." to create battery swapping technology for electric buses in Japan.

Market Segment

This study forecasts country revenue from 2022 to 2033. Spherical Insights has segmented the Japan electric bus market based on the below-mentioned segments:

Japan Electric Bus Market, By Consumer

- Government

- Fleet Operator

Japan Electric Bus Market, By Propulsion Type

- Battery Electric Bus

- Hybrid Electric Bus

- Fuel Cell Electric Bus

Need help to buy this report?