Japan DNA Polymerase Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Prokaryotic DNA Polymerase and Eukaryotic DNA Polymerase), By Application (PCR-Based Diagnostics, NGS-Based Diagnostics, Drug Discovery and Development, Clinical Research, and Forensic Science), By End User (Molecular Diagnostics Companies, Diagnostic Laboratories, Academic and Research Institutes, Biopharmaceutical Companies, and Hospitals), and Japan DNA Polymerase Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareJapan DNA Polymerase Market Size Insights Forecasts to 2035

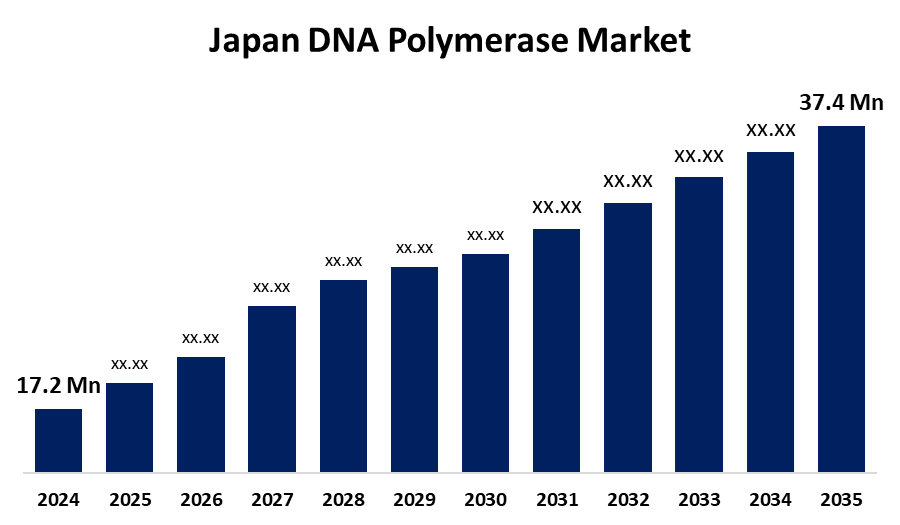

- The Japan DNA Polymerase Market Size Was Estimated at USD 17.2 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.32% from 2025 to 2035

- The Japan DNA Polymerase Market Size is Expected to Reach USD 37.4 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the Japan DNA Polymerase Market Size is anticipated to reach USD 37.4 million by 2035, growing at a CAGR of 7.32% from 2025 to 2035. The Japan DNA Polymerase market is growing on account of various factors such as advances in genomic research, rising healthcare expenditure, and the demand for personalized medicine.

Market Overview

The Japan DNA polymerases market refers to vital enzymes that amplify and replicate DNA, which are extensively used in PCR, qPCR, sequencing, cloning, and gene editing. These enzymes facilitate molecular diagnostic applications, forensic analysis, genomic research, and personalized medicine. Strengths are the strong healthcare infrastructure of Japan, precision medicine focus, and availability of top worldwide and local players such as Thermo Fisher, NEB, Takara Bio, and Fujifilm Wako. Opportunities are pinned on next generation high fidelity and thermostable polymerases, AI optimized enzyme design, and expansion in synthetic biology and gene therapy markets. Drivers include increasing infectious and genetic disease cases, growing burden of chronic disease in an aging population, and increased investments in PCR-based analysis and NGS/CRISPR pipelines. Genomics programs financed by the government, like Genome Japan Project, and grants for biomarker discovery, individualized medicine, and genome sequencing are fueling market growth.

Report Coverage

This research report categorizes the market for the Japan DNA polymerase market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan DNA polymerase market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan DNA polymerase market.

Japan DNA Polymerase Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 17.2 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.32% |

| 2035 Value Projection: | USD 37.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 123 |

| Tables, Charts & Figures: | 127 |

| Segments covered: | By Product Type, By Application, By End User and COVID-19 Impact Analysis |

| Companies covered:: | Takara Bio, Fujifilm Wako Pure Chemical, Thermo Fisher Scientific, Promega Corporation, PCR Biosystems, Toyobo Co., Ltd., Merck KGaA, Agilent Technologies, Illumina, New England Biolabs (NEB), Bio-Rad Laboratories, Qiagen, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan DNA polymerase market is spurred by increased demand for molecular diagnostics, especially PCR and qPCR, owing to increasing infectious and genetic diseases. Growth also comes from the aging population and greater focus on personalized medicine. Technological progress in genomics, CRISPR, and synthetic biology technologies increases enzyme application in research and diagnostics. In addition, robust government backing in the form of programs such as the Genome Japan Project and increased funding of life sciences and precision medicine are driving innovation and uptake of DNA polymerase throughout clinical and research uses.

Restraining Factors

The Japan DNA polymerase market is constrained by factors like high prices of sophisticated enzymes, low awareness among smaller research centers, and issues of enzyme stability and storage. Moreover, intense regulatory clearances can hinder product launches and the expansion of the market.

Market Segmentation

The Japan DNA polymerase market share is classified into product type, application, and end user.

- The prokaryotic DNA polymerase segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan DNA polymerase market is segmented by product type into prokaryotic DNA polymerase and eukaryotic DNA polymerase. Among these, the prokaryotic DNA polymerase segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to their versatility and central position in molecular biology protocols. Such enzymes, which are derived from thermophilic bacteria such as Thermus aquaticus, are highly thermally stable and are therefore appropriately suited for high-temperature processes such as PCR amplification.

- The PCR-based diagnostics segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan DNA polymerase market is segmented by application into PCR-based diagnostics, NGS-based diagnostics, drug discovery and development, clinical research, and forensic science. Among these, the PCR-based diagnostics segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to their extensive use to screen for infectious diseases, genetic diseases, and cancer. Their high specificity, fast turnaround time, and incorporation into clinical and laboratory environments propel widespread adoption.

- The molecular diagnostics companies segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan DNA polymerase market is segmented by end user into molecular diagnostics companies, diagnostic laboratories, academic and research institutes, biopharmaceutical companies, and hospitals. Among these, the molecular diagnostics companies segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the growing dependence on DNA amplification methods such as PCR for different diagnostic purposes. These companies widely utilize DNA polymerases in developing diagnostic assays for infectious diseases, genetic disorders, cancer, and various other medical conditions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan DNA polymerase market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Takara Bio

- Fujifilm Wako Pure Chemical

- Thermo Fisher Scientific

- Promega Corporation

- PCR Biosystems

- Toyobo Co., Ltd.

- Merck KGaA

- Agilent Technologies

- Illumina

- New England Biolabs (NEB)

- Bio-Rad Laboratories

- Qiagen

- Others

Recent Developments:

- In July 2024, PCR Biosystems launched sophisticated inhibitor-tolerant blends for probe-based qPCR and 1-step RT-qPCR in its Clara® and Air-Dryable ranges. They contain wide-spectrum inhibitor-tolerant chemistry, which provides high sensitivity and consistent DNA and RNA detection, even in difficult sample types, to improve performance in demanding diagnostic tests.

- In June 2024, QIAGEN introduced 35 new wet-lab validated digital PCR Microbial DNA Detection Assays for its QIAcuity platform, aimed at the broad range of pathogens and expanding microbial research capabilities.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan DNA polymerase market based on the below-mentioned segments:

Japan DNA Polymerase Market, By Product Type

- Prokaryotic DNA Polymerase

- Eukaryotic DNA Polymerase

Japan DNA Polymerase Market, By Application

- PCR-Based Diagnostics

- NGS-Based Diagnostics

- Drug Discovery and Development

- Clinical Research

- Forensic Science

Japan DNA Polymerase Market, By End User

- Molecular Diagnostics Companies

- Diagnostic Laboratories

- Academic and Research Institutes

- Biopharmaceutical Companies

- Hospitals

Need help to buy this report?