Japan Disposable Inflation Devices Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Syringe-Based Inflation Devices, Balloon Inflation Devices, and Others), By Application (Cardiology, Radiology, Urology, Gastroenterology, and Others), By End-User (Hospitals, Ambulatory Surgical Centers, Specialty Clinics, and Others), and Japan Disposable Inflation Devices Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareJapan Disposable Inflation Devices Market Insights Forecasts to 2035

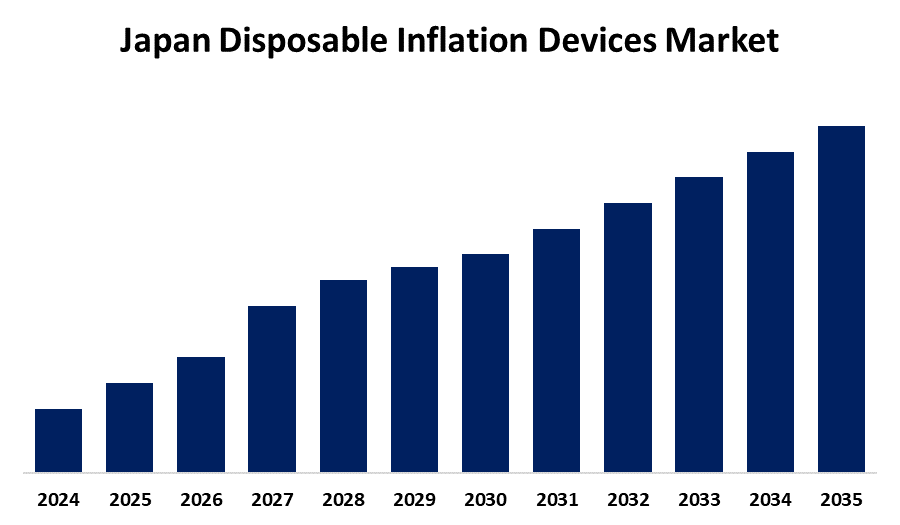

- The Japan Disposable Inflation Devices Market Size is Expected to Grow at a CAGR of 4.9% from 2025 to 2035

- The Japan Disposable Inflation Devices Market Size is Expected to Hold a Significant Share by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the Japan Disposable Inflation Devices Market Size is Expected to Hold a Significant Share by 2035, at a CAGR of 4.9% during the forecast period 2025-2035. The Japan disposable inflation devices market is growing due to rates of cardiovascular disease, greater utilization of minimally invasive techniques, and medical practitioners' preference for using disposable devices to decrease infection risks and increase procedural efficiency in clinics and hospitals.

Market Overview

The Japan disposable inflation devices market refers to single use medical devices utilized for inflating balloons during minimally invasive procedures such as angioplasty and stent placement. These products provide accurate pressure control and promote procedural safety, as well as minimal infection risk through disposable use. There are opportunities in designing smart inflation devices with digital technologies such as IoT and AI, allowing real time monitoring and demonstrating decision making. The market is also driven by technological advancements in the medical field, resulting in the creation of more efficient and convenient devices. Also, increased focus on infection control and patient safety has boosted demand for single use, disposable equipment since they remove the requirement to sterilize and minimize cross contamination risk. Government policies, including positive reimbursement policies for cardiovascular procedures and investment in healthcare facilities, are also fuelling market growth.

Report Coverage

This research report categorizes the market for the Japan disposable inflation devices market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan disposable inflation devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan disposable inflation devices market.

Japan Disposable Inflation Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2024-2035 |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 160 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Product Type, By End-User and COVID-19 Impact Analysis. |

| Companies covered:: | Terumo Medical Corporation, Merit Medical Systems, Nihon Kohden Corporation, Olympus Corporation, Boston Scientific, Atrion, Medtronic, CONMED, B. Braun Melsungen AG, Nipro Corporation and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan disposable inflation devices market is spurred by increased demand for minimally invasive procedures and complex cardiovascular procedures that necessitate reliable inflation devices. Increased incidence of cardiovascular diseases and an aging population drive market growth. Technological innovations are increasing the safety and simplicity of devices, and increased healthcare spending further sustains demand. Hospitals and clinics also focus on infection prevention and single-use items, which encourage the use of disposable devices. Government policies encouraging cutting-edge medical technology also drive market growth.

Restraining Factors

The Japan disposable inflation devices market is constrained by high R&D and production expenses, rigorous regulatory standards, and the threat of used-device competition. Supply chain disruptions and restricted reimbursement policies might also slow down market development and uptake.

Market Segmentation

The Japan disposable inflation devices market share is classified into product type, application, and end-user.

- The syringe-based inflation devices segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan disposable inflation devices market is segmented by product type into syringe-based inflation devices, balloon inflation devices, and others. Among these, the syringe-based inflation devices segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to their ease of use and affordability; syringe type disposable inflation devices are widely used for procedures that require accurate volume and constant pressure. Increased demand coupled with innovative technology has enhanced their reliability, and as such, they form the backbone of cardiology and radiology for precise and value-for-money patient care solutions.

- The cardiology segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan disposable inflation devices market is segmented by application into cardiology, radiology, urology, gastroenterology, and others. Among these, the cardiology segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the high rates of cardiovascular disease and their critical contribution to angioplasty; inflation devices are now more in demand than ever before. Increasing heart procedures caused by aging populations and lifestyle-related diseases increase demand for accurate, dependable devices that provide controlled pressure during key cardiac intervention procedures.

- The hospitals segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan disposable inflation devices market is segmented by end-user into hospitals, ambulatory surgical centers, specialty clinics, and others. Among these, the hospitals segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to their extensive procedure list and large patient base. Equipped with sophisticated infrastructure and experts, hospitals focus on cutting-edge, efficient medical products like disposable inflation devices to provide maximum patient care and effective procedural success, maintaining high adoption and ongoing demand in clinical practice.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan disposable inflation devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Terumo Medical Corporation

- Merit Medical Systems

- Nihon Kohden Corporation

- Olympus Corporation

- Boston Scientific

- Atrion

- Medtronic

- CONMED

- B. Braun Melsungen AG

- Nipro Corporation

- Others

Recent Developments:

- In December 2023, Terumo Medical Corporation launched the AZUR HydroPack Peripheral Coil System in the US. This soft, platinum, and hydrogel coil uniquely uses proprietary hydrogel technology to create a gel core for mechanical occlusion, effectively filling vessel spaces during procedures.

- In September 2022, Olympus Corporation launched VISERA ELITE III, a surgical visualization platform for endoscopic procedures. It integrates multiple imaging functions into one system, supporting minimally invasive therapies like laparoscopic colectomy and cholecystectomy, enhancing precision and efficiency across medical disciplines.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan disposable inflation devices market based on the below-mentioned segments:

Japan Disposable Inflation Devices Market, By Product Type

- Syringe-Based Inflation Devices

- Balloon Inflation Devices

- Others

Japan Disposable Inflation Devices Market, By Application

- Cardiology

- Radiology

- Urology

- Gastroenterology

- Others

Japan Disposable Inflation Devices Market, By End-User

- Hospitals

- Ambulatory Surgical Centers

- Specialty Clinics

- Others

Need help to buy this report?