Japan Digital Video Content Market Size, Share, and COVID-19 Impact Analysis, By Type (Video-on-Demand (VOD) and Online Video), By Device (Laptop, Personal Computers (PC), Mobile, and Others), By Business Model (Subscription, Advertising, Download-to-Own (DTO), and Others), and Japan Digital Video Content Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyJapan Digital Video Content Market Insights Forecasts to 2035

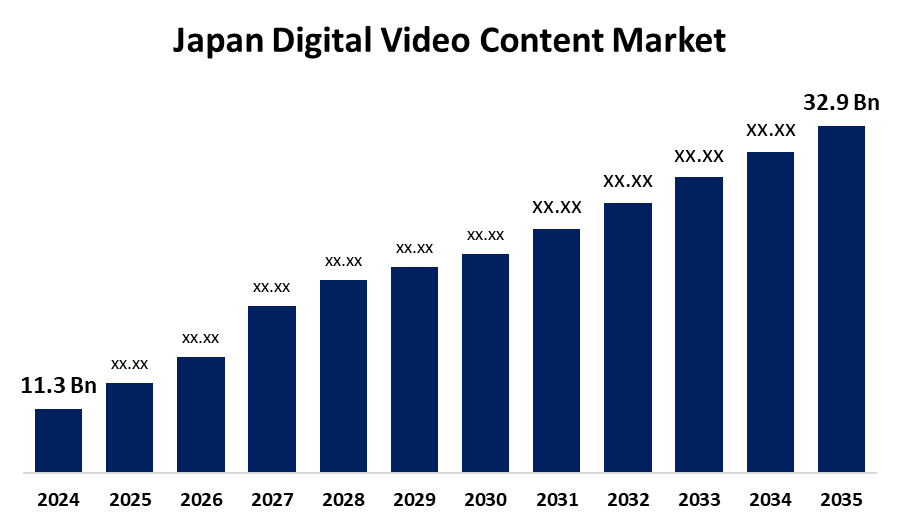

- The Japan Digital Video Content Market Size Was Estimated at USD 11.3 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 10.2% from 2025 to 2035

- The Japan Digital Video Content Market Size is Expected to Reach USD 32.9 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Japan digital video content market size is anticipated to reach USD 32.9 billion by 2035, growing at a CAGR of 10.2% from 2025 to 2035. The market for digital video content in Japan is expanding as a result of various factors, including high internet and smartphone penetration, increasing demand for streaming services, and advances in 5G and AI technologies.

Market Overview

The Japan Digital Video Content Market Size refers to streaming and downloadable video services on platforms like smartphones, PCs, smart TVs, and gaming consoles. It supports diverse applications, such as entertainment and news, learning, and health, with on-demand streaming of films, series, anime, live sport, and user-generated content. Strengths are a robust local content environment, especially anime, which captures a 36% share of premium VOD consumption, and world-class infrastructure to facilitate high-quality streaming. Opportunities are continuous anime monetization, consolidation of splintered platforms, and cross-border distribution. The industry is fueled by high smartphone, broadband, and 5G penetration that are conducive to easy video consumption and drive a good trend for streaming services. The Government initiatives, such as the "Cool Japan" policy and the support from the Digital Agency and METI, stimulate IP production, worldwide content exportation, and piracy prevention through AI.

Report Coverage

This research report categorizes the market for the Japan digital video content market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan digital video content market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan digital video content market.

Japan Digital Video Content Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 11.3 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 10.2% |

| 2035 Value Projection: | USD 32.9 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 206 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Device, By Business Model |

| Companies covered:: | Dentsu Inc., Sony Corporation, NHK (Japan Broadcasting Corporation), YouTube, Shimauma, Netflix, Inc., Hulu Japan, Next Frontier, Amazon.com, Inc., Rakuten TV, Krows Digital, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The digital video content market in Japan is driven by strong internet and smartphone penetration, the expanding 5G networks, and rising consumer demand for on-demand viewing. The popularity of drama series, live sports, and anime has massively boosted viewership. Additionally, business growth is fostered by the expansion of subscription and ad-supported streaming services. Technological development, including AI-based content recommendations and high-quality video streaming infrastructure, also increases user experience, increasing ease of use and personalization of digital content consumption on a broad demographic base.

Restraining Factors

The Japan market for digital video content is constrained by platform fragmentation, content licensing complexity, and strong competition. In addition, fear of piracy in the digital space, low take-up among older segments, and rising subscription fatigue all inhibit broader take-up of the market and long-term user growth.

Market Segmentation

The Japan digital video content market share is classified into type, device, and business model.

- The video-on-demand (VOD) segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan digital video content market is segmented by type into video-on-demand (VOD) and online video. Among these, the video-on-demand (VOD) segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to they contain a vast library of pre-recorded content, including films, television programs, documentaries, and consumer-generated video. The viewers can watch this content at their own pace and watch it on demand, pausing, rewinding, or fast-forwarding as desired. Popular VOD websites provide customers with a wide selection of content, typically ad-free.

- The laptop segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan digital video content market is segmented by device into laptop, personal computers (PC), mobile, and others. Among these, the laptop segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to they provide a flexible and portable viewing experience, which makes them a users choice when they desire the flexibility of viewing content in various places, either at home, in cafés, or on the move. The bigger screen size of laptops over smartphones offers a better viewing experience, particularly for long-form content such as video movies and television shows.

- The subscription segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan digital video content market is segmented by business model into subscription, advertising, download-to-own (DTO), and others. Among these, the subscription segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to they have limitless access to a huge library of films, television series, and original content free of ads. This creates customer loyalty and consistent revenue for content providers. It also compels platforms to invest in high-quality and exclusive programming to retain and gain subscribers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations or companies involved within the Japan digital video content market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Dentsu Inc.

- Sony Corporation

- NHK (Japan Broadcasting Corporation)

- YouTube

- Shimauma

- Netflix, Inc.

- Hulu Japan

- Next Frontier

- Amazon.com, Inc.

- Rakuten TV

- Krows Digital

- Others

Recent Developments:

- In November 2024, Japanese-themed skincare and grooming brand Ileum Japan launched a new digital video campaign (DVC) featuring actor Jim Sarbh in honor of International Mens Day. The campaign spotlights the Sumuuzu Bento grooming set as a convenient and efficient solution for mens grooming habits that reflects the evolving concept of masculinity.

- In October 2024, Dentsu Group Inc. and Bunka Fashion College debuted Japans first Roblox-backed "Digital Fashion Program". As part of Bunkas new Virtual Fashion Course, the program cultivates creators and promotes careers digitally with cooperation from GeekOut Inc., a Roblox content creator.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan digital video content market based on the below-mentioned segments:

Japan Digital Video Content Market, By Type

- Video-on-Demand (VOD)

- Online Video

Japan Digital Video Content Market, By Device

- Laptop

- Personal Computers (PC)

- Mobile

- Others

Japan Digital Video Content Market, By Business Model

- Subscription

- Advertising

- Download-to-Own (DTO)

- Others

Need help to buy this report?