Japan Digital Payment Market Size, Share, and COVID-19 Impact Analysis, By Mode of Payment (Bank Cards, Digital Currencies, Digital Wallets, Net Banking, and Others), By Organization Size (SMEs and Large Enterprises), and Japan Digital Payment Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyJapan Digital Payment Market Insights Forecasts to 2035

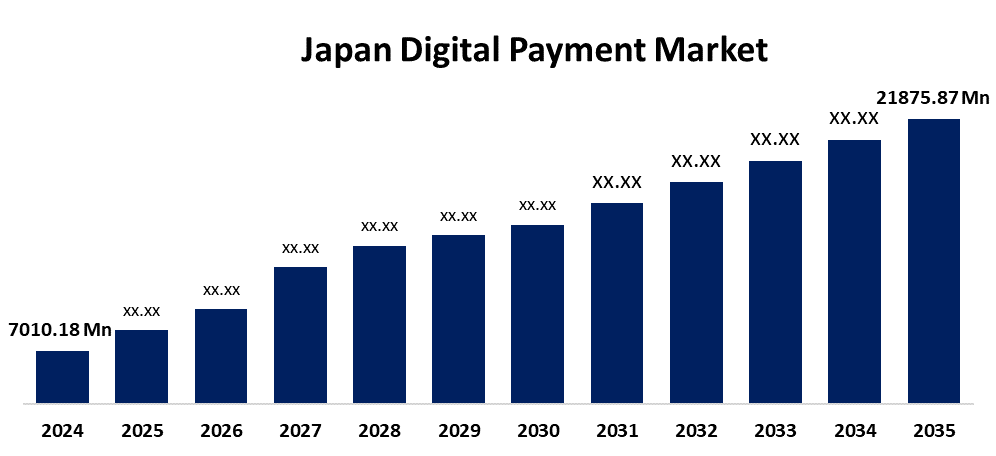

- The Japan Digital Payment Market Size was estimated at USD 7010.18 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 10.90% from 2025 to 2035

- The Japan Digital Payment Market Size is Expected to Reach USD 21875.87 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Japan Digital Payment Market Size is anticipated to reach USD 21875.87 Million by 2035, growing at a CAGR of 10.90% from 2025 to 2035. The Japan digital payment market is driven by technological advancements such as biometric authentication and blockchain, government initiatives promoting cashless transactions, and the rapid expansion of e-commerce, which fuels demand for secure and seamless digital payment solutions.

Market Overview

The Japan digital payment (payment facilitator) market refers to the industry focused on facilitating cashless transactions through card payments, POS systems, QR payments, and digital wallets for businesses and consumers in Japan. The market for offline payment services in Japan is mostly driven by government laws and initiatives. With lofty goals like reaching a 40% cashless payment ratio by 2025, the Japanese government has placed a great deal of focus on promoting the shift to cashless payments. The government has implemented a number of incentives to accomplish this goal, such as financial aid for businesses who use cashless payment methods and advertising efforts meant to raise customer awareness. Due to incentives for businesses and customers to switch to digital payment methods, these policies have fostered an atmosphere that has allowed payment facilitators to flourish and supported a strong market expansion.

Report Coverage

This research report categorizes the market for the Japan digital payment market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan digital payment market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan digital payment market.

Japan Digital Payment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 7010.18 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 10.90% |

| 2035 Value Projection: | USD 21875.87 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 265 |

| Tables, Charts & Figures: | 113 |

| Segments covered: | By Mode of Payment and By Organization Size |

| Companies covered:: | Rakuten Pay, LINE Pay, Origami, PayPal Holdings, Inc., Smartpay Bank Direct, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for digital payments in Japan is expanding due to a number of important factors. Biometric authentication, contactless payments, and blockchain technology are just a few examples of the technological breakthroughs that have significantly improved the security and effectiveness of digital payment systems. This has promoted consumer confidence and made adoption more widely possible. The Japanese government has also played a significant role in advancing a cashless society by establishing aggressive goals for cashless transactions and providing incentives to consumers and businesses alike. This policy-driven strategy has expedited the shift to electronic payments. Furthermore, the need for easy and safe online payment options has grown dramatically as e-commerce continues to grow. Mobile wallets and digital payment apps are becoming more and more popular, especially among younger demographics, as consumers place a higher value on convenience.

Restraining Factors

The widespread use of digital payment systems is significantly hampered by Japan's deeply ingrained cultural fondness for cash, despite the global shift towards digital payments. Many consumers, particularly those from older generations, prefer cash over digital alternatives since it is frequently seen as tangible and safe. Compared to other wealthy countries, this inclination causes a delayed move to cashless transactions.

Market Segmentation

The Japan digital payment market share is classified into mode of payment and organization size.

- The digital currencies segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan digital payment market is segmented by mode of payment into bank cards, digital currencies, digital wallets, net banking, and others. Among these, the digital currencies segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to increased interest in cryptocurrencies, digital currencies are becoming more and more popular as alternate forms of payment.

- The large enterprises segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan digital payment market is segmented by organization size into SMEs and large enterprises. Among these, the large enterprises segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Large enterprises process significantly more transactions compared to small and medium-sized enterprises (SMEs), leading to a greater reliance on digital payment solutions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan digital payment market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Rakuten Pay

- LINE Pay

- Origami

- PayPal Holdings, Inc.

- Smartpay Bank Direct

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Digital Payment Market based on the below-mentioned segments:

Japan Digital Payment Market, By Mode of Payment

- Bank Cards

- Digital Currencies

- Digital Wallets

- Net Banking

- Others

Japan Digital Payment Market, By Organization Size

- SMEs

- Large Enterprises

Need help to buy this report?