Japan Digital Dental X-ray Market Size, Share, and COVID-19 Impact Analysis, By Product (Intraoral and Extraoral), By Application (Medical, Cosmetic Dentistry, and Forensic), By End-use (Dental Hospitals & Clinics, Dental Diagnostic Centers, and Dental Academic & Research Institutes), and Japan Digital Dental X-ray Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareJapan Digital Dental X-ray Market Insights Forecasts to 2035

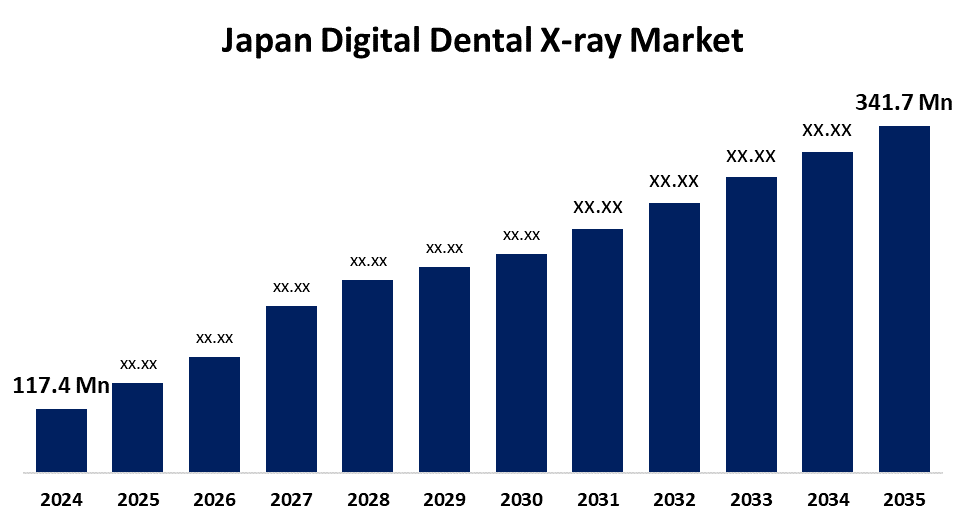

- The Japan Digital Dental X-ray Market Size Was Estimated at USD 117.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 10.2% from 2025 to 2035

- The Japan Digital Dental X-ray Market Size is Expected to Reach USD 341.7 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Japan Digital Dental X-ray Market Size is anticipated to Reach USD 341.7 Million by 2035, Growing at a CAGR of 10.2% from 2025 to 2035. The Japan digital dental X-ray market is expanding due to population aging, increasing oral health consciousness, sophisticated imaging technologies, growing demand for cosmetic dentistry, and pro-government measures to improve healthcare infrastructure and technology adoption.

Market Overview

The Japan Digital Dental X-ray Market refers to advanced intraoral and extraoral radiographic equipment used to capture and digitize dental images for diagnosis, treatment planning, and preventive or cosmetic procedures. Its primary applications include detecting cavities, periodontal disease, implant planning, as well as forensic and educational use. Key strengths of the market include direct image access, enhanced workflow through digital storage and AI-driven diagnostics, and Japan’s well-established universal healthcare system that ensures broad access. Opportunities exist in rural and underpenetrated regions, expansion of extraoral systems, and integration with telehealth dentistry and cloud infrastructure. Market drivers include Japan’s rapidly aging population, which increases demand for diagnostic services, rising oral health awareness, greater use of preventive and aesthetic dentistry, and the efficiency and lower radiation exposure offered by digital systems. Government initiatives such as reimbursement code revisions, public health education campaigns, and investments in digital healthcare infrastructure further support widespread adoption.

Report Coverage

This research report categorizes the market for the Japan digital dental X-ray market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan digital dental X-ray market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan digital dental X-ray market.

Japan Digital Dental X-ray Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 117.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 10.2% |

| 2035 Value Projection: | USD 341.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 185 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product, By Application |

| Companies covered:: | Shimadzu Corporation, Canon, Konica Minolta, Fujifilm Holdings Corporation, Hologic Inc, Carestream Health, Siemens Healthineers, Dentsply Sirona, GE Healthcare, MIKASA X-RAY Co. Ltd, J. Morita Corporation, Hitachi Medical Systems, GC Corporation, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan digital dental X-ray market is fueled by an aging population with more frequent needs for dental care, heightened awareness of oral health, and improved demand for preventive and cosmetic dentistry. Technological innovation, like low-radiation, high-resolution imaging and the use of AI, improves diagnostic performance and workflow effectiveness. Support from governments in the form of healthcare reform, insurance coverage, and digital health programs also increases broader adoption. The change from analog to digital systems also speeds up market growth in clinics and hospitals.

Restraining Factors

The Japan digital dental X-ray market is constrained by factors like the cost of equipment being too high, training and maintenance costs discouraging small clinics, reimbursement policies being restrictive, low clinical awareness, data privacy issues, and integration difficulties with existing healthcare systems, all discouraging widespread adoption.

Market Segmentation

The Japan digital dental X-ray market share is classified into product, application, and end-use.

- The intraoral segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan digital dental X-ray market is segmented by product into intraoral and extraoral. Among these, the intraoral segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to they provide high-definition imaging, enabling dentists to diagnose cavities and evaluate teeth and jawbone health. Used extensively in dentistry, it aids procedures such as the diagnosis of caries and endodontic file checks. High spatial and contrast resolution propel its increased usage, and strong market growth is expected.

- The medical segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan digital dental X-ray market is segmented by application into medical, cosmetic dentistry, and forensic. Among these, the medical segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Digital dental radiography is essential in diagnosing tooth decay, tumors, fractures, and cavities, and to diagnose cysts, abscesses, and missing or impacted teeth. It aids in the diagnosis of bone loss due to periodontal disease and is instrumental in the diagnosis and treatment of most oral diseases.

- The dental hospitals & clinics segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan digital dental X-ray market is segmented by end-use into dental hospitals & clinics, dental diagnostic centers, and dental academic & research institutes. Among these, the dental hospitals & clinics segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to Japan advanced health infrastructure, increased investments in dental facilities, and the increasing number of qualified professionals make care more accessible. Technologically advanced clinics provide new treatments for oral illnesses with the focus on better patient care.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan digital dental X-ray market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Shimadzu Corporation

- Canon

- Konica Minolta

- Fujifilm Holdings Corporation

- Hologic Inc

- Carestream Health

- Siemens Healthineers

- Dentsply Sirona

- GE Healthcare

- MIKASA X-RAY Co. Ltd

- J. Morita Corporation

- Hitachi Medical Systems

- GC Corporation

- Others

Recent Developments:

- In August 2024, Dentsply Sirona launched two new endodontic solutions in the US: The X-Smart Pro+ motor with integrated apex locator and the universal Reciproc Blue file. The X-Smart Pro+ powers the Reciproc Blue, enabling efficient root canal shaping without an initial glidepath for a simplified, single-file workflow.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan digital dental X-ray market based on the below-mentioned segments:

Japan Digital Dental X-ray Market, By Product

- Intraoral

- Extraoral

Japan Digital Dental X-ray Market, By Application

- Medical

- Cosmetic Dentistry

- Forensic

Japan Digital Dental X-ray Market, By End-use

- Dental Hospitals & Clinics

- Dental Diagnostic Centers

- Dental Academic & Research Institutes

Need help to buy this report?