Japan Dietary Supplements Market Size, Share, and COVID-19 Impact Analysis, By Type (Minerals, Vitamins, Enzymes, Probiotics, Botanicals, Amino Acids, Others), By Mode of Application (Tablets, Capsules, Liquid, Powder, Soft Gels, Gel Caps), By Distribution Channel (Pharmacy, Supermarket/Hypermarket, Online), and Japan Dietary Supplements Market Insights Forecasts to 2032

Industry: Food & BeveragesJapan Dietary Supplements Market Insights Forecasts to 2032

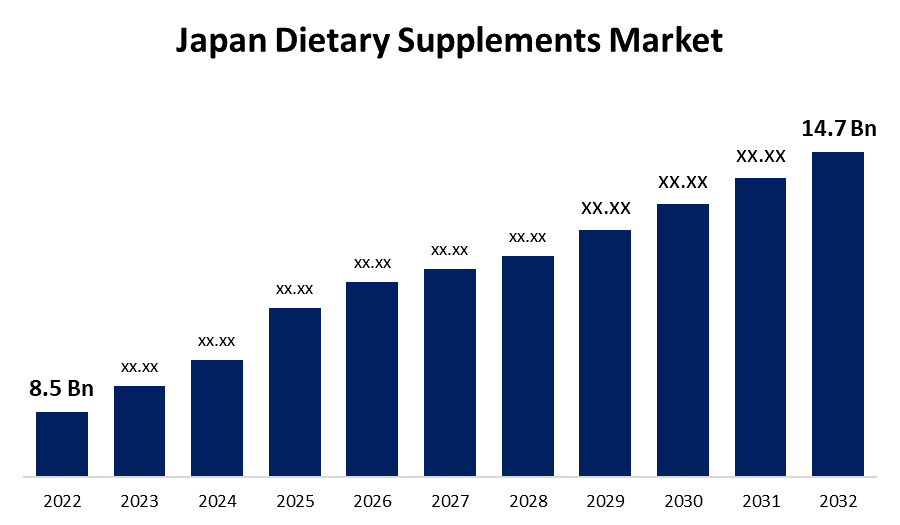

- The Japan Dietary Supplements Market Size was valued at USD 8.5 Billion in 2022.

- The Market Size is Growing at a CAGR of 5.6% from 2022 to 2032.

- The Japan Dietary Supplements Market Size is expected to reach USD 14.7 Billion by 2032.

- Japan is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Japan Dietary Supplements Market Size is expected to reach USD 14.7 Billion by 2032, at a CAGR of 5.6% during the forecast period 2022 to 2032.

Market Overview

Dietary supplements, commonly referred to as "health foods" or "functional foods," have established themselves as a major specialty market in Japan, one of these goods' largest marketplaces. The market's expansion is impacted by the country's distinct cultural, demographic, and consumption patterns. Japan has one of the world's largest percentages of elderly individuals. This age group is more likely to use dietary supplements for maintaining wellness and preventing age-related disorders. In addition, the majority of the population is shifting toward preventive healthcare, which is fuelling the demand for health supplements. The nation's determination to promote longevity and well-being, along with an eagerness to invest in quality products, is projected to render consumer demand for dietary supplements solid. Brands and goods that match the Japanese consumer's beliefs and requirements, while still providing efficacy and quality, have the potential to grow in popularity.

Report Coverage

This research report categorizes the market for Japan Dietary Supplements Market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan Dietary Supplements Market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the Japan Dietary Supplements Market.

Japan Dietary Supplements Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 8.5 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 5.6% |

| 2032 Value Projection: | USD 14.7 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Mode of Application, By Distribution Channel |

| Companies covered:: | dricos, Greenspoon, YUKASHIKADO, Ajinomoto, AsahiAstalift, Calorie Mate, DHC, Eisai, FANCL, Fine Japan, Kobayashi Pharmaceuticals, Otsuka Pharmaceuticals And other key venders |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japanese dietary supplement market has grown significantly, owing to reasons such as changing lifestyles, an elderly population, and a growing emphasis on overall wellness and health. Japan has the world's third-largest market for dietary supplements. A rising aging population, as well as an increase in health consciousness among Japanese consumers, are expected to drive the sector forward. The market has grown steadily over the years, owing to the country's emphasis on wellness and physical health. Additionally, because of a deeply embedded cultural orientation toward wellness and preventative measures, many Japanese consumers are ready to invest in high-quality dietary supplements. Furthermore, the Japanese government properly classifies dietary supplements, distinguishing them from medications. Given previous instances of food and supplement-related health crises, Japanese regulatory organizations implement stringent safety and quality control standards.

Market Segment

- In 2022, the vitamins segment is witnessing a higher growth rate over the forecast period.

Based on the type, the Japan Dietary Supplements Market is segmented into minerals, vitamins, enzymes, probiotics, botanicals, amino acids, and others. Among these, the vitamins segment is witnessing a higher growth rate over the forecast period. The vitamins segment consists mostly of a diverse range of vitamins, ranging from vitamin C and vitamin D to multivitamin combos. Vitamins are prominent among Japanese consumers due to their extensive perception, availability, and perceived health advantages. The vitamin industry is popular among people of all ages due to its adaptability and general awareness of vitamins.

- In 2022, the tablets segment accounted for the largest revenue share of more than 37.8% over the forecast period.

On the basis of the mode of application, the Japan Dietary Supplements Market is segmented into tablets, capsules, liquid, powder, soft gels, gel caps, and others. Among these, the tablets segment is dominating the market with the largest revenue share of 37.8% over the forecast period. This is primarily due to their widespread presence, low cost, and consumer-established routine. The tablet section is one of the most conventional types of dietary supplements, providing dosage precision. Tablets have been a popular alternative due to their established nature and consumer familiarity. Furthermore, tablets provide the advantages of simple swallowing, disguising the taste of substances, and formulation versatility.

- In 2022, The pharmacy segment accounted for the largest revenue share of more than 34.2% over the forecast period.

On the basis of distribution channel, the Japan Dietary Supplements Market is segmented into pharmacy, supermarket/hypermarket, and online. Among these, the pharmacy segment is dominating the market with the largest revenue share of 34.2% over the forecast period. Pharmacies are traditional locations where customers commonly look for health-related products, such as dietary supplements. Because of the confidence associated with pharmacies, as well as the benefit of professional assistance, they are frequently visited for health-related purchases. The pharmacy segment has been a favored alternative for many Japanese consumers shopping for nutritional supplements due to its longstanding presence and the convenience of having educated personnel on-site.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan Dietary Supplements Market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- dricos

- Greenspoon

- YUKASHIKADO

- Ajinomoto

- Asahi

- Astalift

- Calorie Mate

- DHC

- Eisai

- FANCL

- Fine Japan

- Kobayashi Pharmaceuticals

- Otsuka Pharmaceuticals

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- On April 2023, Kirin Holdings has agreed to acquire Australian vitamin manufacturer Blackmores as part of the Japanese brewer's drive into health products in order to minimize its dependency on beer. Kirin is expanding into health care as the alcoholic beverage sector becomes more regulated. Kirin's shift away from beer contrasts with larger competitors such as Anheuser-Busch InBev and Asahi Group Holdings, which are doubling down on alcohol and investing in higher-end sectors such as craft breweries.

- On January 2023, Yoshitsu Co., Ltd., a Japanese retailer and wholesaler of Japanese beauty and health products, sundry products, and other products, announced that it will diversify its product portfolio with a diverse food product segment, which it expects will allow it to achieve higher sales volume and thus increase the Company's profitability.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the Japan Dietary Supplements Market based on the below-mentioned segments:

Japan Dietary Supplements Market, By Type

- Minerals

- Vitamins

- Enzymes

- Probiotics

- Botanicals

- Amino Acids

- Others

Japan Dietary Supplements Market, By Mode of Application

- Tablets

- Capsules

- Liquid

- Powder

- Soft Gels

- Gel Caps

Japan Dietary Supplements Market, By Distribution Channel

- Pharmacy

- Supermarket/Hypermarket

- Online

Need help to buy this report?