Japan Dicyclopentadiene Market Size, Share, and COVID-19 Impact Analysis, By Grade (DCPD Resin, DCPD Unsaturated Polyester Resin (UPR), and DCPD High Purity), By Application (Unsaturated Polyester Resin (UPR), Hydrocarbon Resins, Cyclic Olefin, Poly-DCPD, and Other), and Japan Dicyclopentadiene Market Insights, Industry Trend, Forecasts to 2035.

Industry: Chemicals & MaterialsJapan Dicyclopentadiene Market Insights Forecasts to 2035

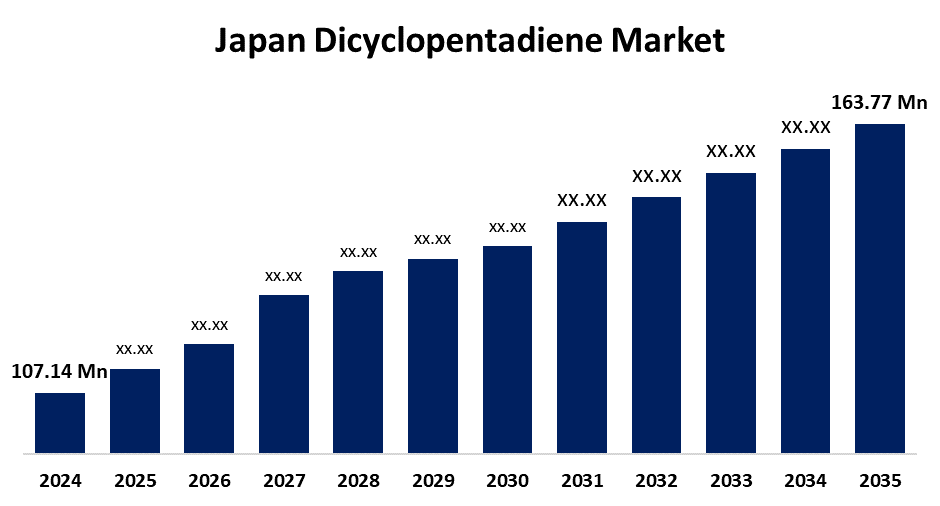

- The Japan Dicyclopentadiene Market Size Was Estimated at USD 107.14 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.93% from 2025 to 2035

- The Japan Dicyclopentadiene Market Size is Expected to Reach USD 163.77 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan Dicyclopentadiene Market Size is anticipated to reach USD 163.77 Million by 2035, growing at a CAGR of 3.93% from 2025 to 2035. Technological advancements in resin formulation and increased focus on sustainability are also fueling market expansion.

Market Overview

The Japan dicyclopentadiene (DCPD) market refers to the industry segment focused on the production, distribution, and application of DCPD a dimer of cyclopentadiene used in manufacturing resins, elastomers, and specialty chemicals. Japan's construction industry is expanding rapidly because of a number of infrastructure development projects and urban regeneration programs. Dicyclopentadiene is widely utilized in the manufacturing of adhesives, resins, and other building materials that provide exceptional performance attributes like resistance to mechanical stress, heat, and corrosion. Demand for DCPD-based materials, which are prized for their longevity and environmental advantages, is further fueled by the government's emphasis on sustainable building methods and the creation of smart cities. It is projected that the growth of the construction sector will propel the dicyclopentadiene market due to ongoing projects associated with the 2025 World Expo in Osaka and preparations for upcoming major events.

Report Coverage

This research report categorizes the market for the Japan dicyclopentadiene market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan dicyclopentadiene market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan dicyclopentadiene market.

Japan Dicyclopentadiene Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 107.14 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.93% |

| 2035 Value Projection: | USD 163.77 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 236 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Grade, By Application |

| Companies covered:: | Braskem, Chevron Phillips Chemical Company LLC, Cymetech (Sojitz Corporation), Dow Chemical Company, ENEOS Corporation, LyondellBasell Industries Holdings BV, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Dicyclopentadiene (DCPD) is used extensively in the Japanese automotive sector, which is motivated by the need for strong, lightweight materials in the production of automobiles. In order to produce high-performance polymers and unsaturated polyester resins, which are being used more and more to lighten cars and improve fuel economy, DCPD is an essential ingredient. As manufacturers look for materials that offer both strength and lightness to maximize battery life and performance, the push for electric vehicles (EVs) intensifies this demand even more. Furthermore, the automobile industry is adopting DCPD-based materials at a rapid pace due to stricter emissions laws and the demand for energy-efficient solutions, which is significantly driving market expansion. It is anticipated that demand for dicyclopentadiene would increase gradually as long as Japan maintains its position as the world leader in automobile production and innovation.

Restraining Factors

Profitability may be impacted by market constraints including high production costs and raw material price volatility. Adoption may also be constrained by environmental laws and the availability of substitute materials. Furthermore, reliance on petrochemical feedstocks raises worries amid global changes toward greener alternatives, and Japan's older industrial base means slower growth compared to rising economies.

Market Segmentation

The Japan dicyclopentadiene market share is classified into grade and application.

- The DCPD resin segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan dicycloentadiene market is segmented by grade into DCPD resin, DCPD unsaturated polyester resin (UPR), and DCPD high purity. Among these, the DCPD resin segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to its widespread use in coatings, adhesives, and plastics applications where its excellent heat resistance and impact strength are crucial DCPD.

- The unsaturated polyester resin (UPR) segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan dicyclopentadiene market is segmented by application into unsaturated polyester resin (UPR), hydrocarbon resins, cyclic olefin, poly-DCPD, and other. Among these, the unsaturated polyester resin (UPR) segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to its application in marine components, automobile parts, and building and construction materials, the unsaturated polyester resin (UPR) sector leads the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan dicyclopentadiene market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Braskem

- Chevron Phillips Chemical Company LLC

- Cymetech (Sojitz Corporation)

- Dow Chemical Company

- ENEOS Corporation

- LyondellBasell Industries Holdings BV

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Dicyclopentadiene Market based on the below-mentioned segments:

Japan Dicyclopentadiene Market, By Grade

- DCPD Resin

- DCPD Unsaturated Polyester Resin (UPR)

- DCPD High Purity

Japan Dicyclopentadiene Market, By Application

- Unsaturated Polyester Resin (UPR)

- Hydrocarbon Resins

- Cyclic Olefin

- Poly-DCPD

- Other

Need help to buy this report?