Japan Diamond Jewelry Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Rings, Earrings, Necklaces, Bracelets, Pendants, and Brooches), By Product Category (Daily Wear, Work Wear, and Party & Festive Wear), By Application (Wedding, Festival, Fashion, Anniversary, Engagement, and Gifting), and Japan Diamond Jewelry Market Insights, Industry Trend, Forecasts to 2035.

Industry: Consumer GoodsJapan Diamond Jewelry Market Insights Forecasts to 2035

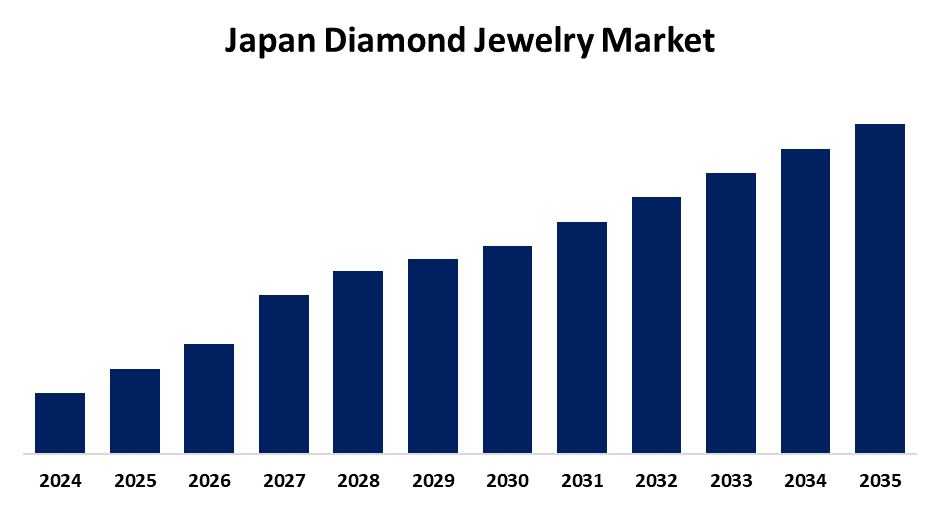

- The Japan Diamond Jewelry Market Size is Expected to Grow at a CAGR of 4.9% from 2025 to 2035

- The Japan Diamond Jewelry Market Size is Expected to Hold a Significant Share by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan Diamond Jewelry Market Size is expected to hold a significant share by 2035, at a CAGR of 4.9% during the forecast period 2025-2035. The diamond jewelry market in Japan is growing due to different reasons, including increasing disposable incomes, strong cultural emphasis on quality and design, and increased demand for custom and environmentally friendly jewelry.

Market Overview

The Japan diamond jewelry market refers to the nation's total jewelry market, including natural and artificial diamond products like engagement rings, necklaces, bracelets, and earrings, which are demanded for decoration, as presents, and symbolically. Strengths include Japan's strong cultural heritage, export momentum worldwide, and expert craftsmanship, which is viewed with admiration all over the world. There are opportunities in expanding lab-grown diamond sales, entering the bridal market more deeply, and utilizing e-commerce platforms for greater reach. Market growth is triggered by increases in disposable income, rediscovery of seasonal and bridal purchases, and heritage craftsmanship blending tradition and innovative modernity. Demand for sustainable, ethically sourced lab-grown diamonds presents a massive opportunity with CVD/HPT technology improving quality and price, and newer, eco-conscious consumers driving uptake. Support from the government encompasses stimulus measures to offset declines in consumption, export promotion measures, and attempts at digitalizing retail to promote more transparency and competitiveness.

Report Coverage

This research report categorizes the market for the Japan diamond jewelry market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan diamond jewelry market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan diamond jewelry market.

Japan Diamond Jewelry Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.9% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 223 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product Type, By Product Category, By Application |

| Companies covered:: | Mikimoto & Co., Ltd., Vendome Yamada Co., Ltd., TASAKI Co., Ltd., Niwaka, TOKYO LUXEY, Inc., Nikka Seiko, Ponte Vecchio, Fujimori, Ginza Tanaka, Tiffany & Co., Richemont Japan Co., Ltd., MARUZEN, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Demand for Japan diamond jewelry is driven by increasing disposable incomes, the resurgence of bridal and luxury gift-giving practices, and an increasingly strong demand for high-end, quality craftsmanship. Consumers accept the blending of cultural tradition and modern design, while youthful consumers are increasingly interested in responsibly sourced, lab-grown diamonds. Advances in digital technologies, such as virtual try-ons and transparent sourcing technologies, increase the consumer experience. Aside from this, Japan's worldwide reputation for high-quality craftsmanship continues to attract local and overseas consumers.

Restraining Factors

The Japan market for diamond jewelry is also limited by the premium pricing of products, economic instability affecting luxury spending, and an ageing population with evolving consumption habits. Additionally, competition from other luxury items and slow adoption of digital retail channels are issues that need to be resolved.

Market Segmentation

The Japan diamond jewelry market share is classified into product type, product category, and application.

- The rings segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan diamond jewelry market is segmented by product type into rings, earrings, necklaces, bracelets, pendants, and brooches. Among these, the rings segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to diamond rings are culturally and traditionally important in most societies. Diamond rings, especially wedding and engagement rings, are considered a symbol of commitment and love; therefore, they are highly sought after. Growing disposable income among consumers and their preference for investing in luxury products also contributed to the growth in this market.

- The daily wear segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan diamond jewelry market is segmented by product category into daily wear, work wear, and party & festive wear. Among these, the daily wear segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to the change in consumer preference for minimalist and elegant jewelry to be worn daily. Improved disposable incomes and the practice of self-purchase, especially among females, also contributed to the spurring of the segment's growth.

- The engagement segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan diamond jewelry market is segmented by application into wedding, festival, fashion, anniversary, engagement, and gifting. Among these, the engagement segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the cultural importance and historical value of diamond jewelry, particularly rings, as an engagement symbol across various societies. The increased consumer disposable income and their willingness to spend money on high-end products also contributed to stimulating the growth of this segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan diamond jewelry market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mikimoto & Co., Ltd.

- Vendome Yamada Co., Ltd.

- TASAKI Co., Ltd.

- Niwaka

- TOKYO LUXEY, Inc.

- Nikka Seiko

- Ponte Vecchio

- Fujimori

- Ginza Tanaka

- Tiffany & Co.

- Richemont Japan Co., Ltd.

- MARUZEN

- Others

Recent Developments:

- In March 2023, Primo Japan Co., Ltd., introduced the Ulysses diamond ring set under its I-PRIMO brand. With a light weight design and Comfort Fit Method, the rings have a natural fit for any finger. The set can be found at all I-PRIMO domestic stores, catering to various customer tastes.

- In April 2023, TASAKI launched three new series of its ‘M/G TASAKI’ collection, designed by Melanie Georgacopoulos. The additions include two new collections, ‘BAROQUE DROPS’ and ‘REFLECTED’, and a new variation of the iconic ‘ARLEQUIN SLASHED’, showcasing modern, artistic jewellery innovation.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan diamond jewelry market based on the below-mentioned segments:

Japan Diamond Jewelry Market, By Product Type

- Rings

- Earrings

- Necklaces

- Bracelets

- Pendants

- Brooches

Japan Diamond Jewelry Market, By Product Category

- Daily Wear

- Work Wear

- Party & Festive Wear

Japan Diamond Jewelry Market, By Application

- Wedding

- Festival

- Fashion

- Anniversary

- Engagement

- Gifting

Need help to buy this report?