Japan Dialysis Equipment Market Size, Share, and COVID-19 Impact Analysis, By Dialysis Equipment Type (Hemodialysis Equipment and Peritoneal Dialysis Equipment), By End User (Dialysis Centers & Hospitals, and Home Healthcare), and Japan Dialysis Equipment Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareJapan Dialysis Equipment Market Size Insights Forecasts to 2035

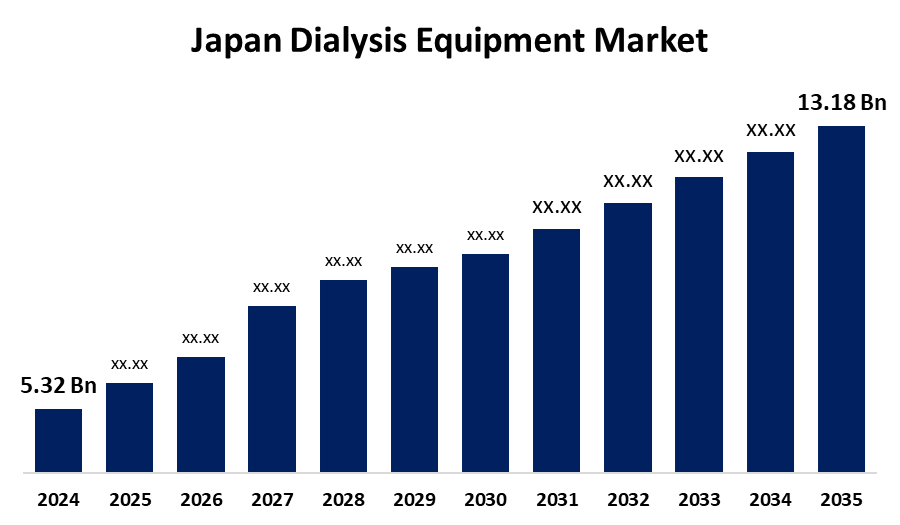

- The Japan Dialysis Equipment Market Size Was Estimated at USD 5.32 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.6% from 2025 to 2035

- The Japan Dialysis Equipment Market Size is Expected to Reach USD 13.18 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan dialysis equipment market Size is anticipated to reach USD 13.18 billion by 2035, growing at a CAGR of 8.6% from 2025 to 2035. The Japan dialysis equipment market is expanding owing to an increasing aging population, increased incidence of chronic kidney disease, and advancements in technology. Support from the government in the form of strong healthcare infrastructure and universal coverage guarantees extensive access to dialysis therapy, thus fueling further market growth.

Market Overview

The Japan dialysis equipment market refers to hemodialysis machines, peritoneal dialysis systems, consumables, and ancillary devices, provide treatment to patients suffering from chronic kidney disease (CKD) and final stage renal disease (ESRD). It is used mainly in hospitals, clinics, dialysis units, and increasingly at home to filter blood when kidneys fail, keep electrolytes balanced, and drain off toxins. The strengths of Japan are its robust healthcare infrastructure, regulatory backing, competent workforce (clinical engineers, specialist nurses), and dynamic public & private alliances. The opportunities include growth in remote dialysis, portable and wearable systems, continuous renal replacement therapy, and convergence with digital health tools. The Japan aging population and high prevalence of CKD due to diabetes and hypertension are significant market drivers; universal healthcare coverage guarantees the affordability of treatment. Government policies, such as universal care, long-term care insurance for dialysis, quality standards through PMDA and JSDT, and investment in renal care innovation, create a favorable environment.

Report Coverage

This research report categorizes the market for the Japan dialysis equipment market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan dialysis equipment market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan dialysis equipment market.

Driving Factors

The Japan dialysis equipment market is spurred by a fast-growing aging population and increasing incidence of chronic kidney disease (CKD), primarily because of lifestyle-related diseases such as diabetes and hypertension. Japan's universal healthcare system provides access to dialysis treatment to a large percentage of the population. Growing demand for home-based dialysis, technological innovation in dialysis machines, and improving patient preference for convenience and safety are further fueling market growth. Government funding, clinical creativity, and increased infrastructure further accelerate adoption in hospitals, clinics, and home care.

Restraining Factors

The Japan dialysis equipment market is constrained in terms of equipment and consumable costs that are high, approval time delays by regulators, and reduced reimbursement schedules. Notably, the high infrastructure needs for home dialysis and shortages in skilled personnel slow widespread uptake.

Market Segmentation

The Japan dialysis equipment market share is classified into dialysis equipment type and end user.

- The hemodialysis equipment segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan dialysis equipment market is segmented by dialysis equipment type into hemodialysis equipment and peritoneal dialysis equipment. Among these, the hemodialysis equipment segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to its general acceptance in hospitals and clinics, solid establishment, and higher patient demand. The presence of high-technology equipment, professional medical staff, and uniform reimbursement policies also contributes to the superiority of hemodialysis over peritoneal dialysis in the nation.

- The dialysis centers and hospitals segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan dialysis equipment market is segmented by end user into dialysis centers & hospitals, and home healthcare. Among these, the dialysis centers and hospitals segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the country's well-developed institutional healthcare facilities, good patient volume, and access to professional medical personnel. Policies for reimbursement by the government and constant monitoring requirements also make in-center dialysis more convenient and preferable compared to remote treatment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan dialysis equipment market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Asahi Kasei Medical

- Kawasumi Laboratories

- Terumo Corporation

- Fresenius Medical Care

- Hitachi Healthcare Systems

- Nikkiso Co., Ltd.

- Nipro Corporation

- Toray Medical Co., Ltd.

- JMS Co., Ltd.

- DaVita

- Nihon Kohden

- Kyowa Hakko Kirin Co., Ltd.

- Baxter International

- Others

Recent Developments:

- In December 2023, Maruishi Pharmaceutical Co., Ltd. and Kissei Pharmaceutical Co., Ltd. announced the launch of KORSUVA IV Injection Syringes for Dialysis in Japan, available in 17.5 μg, 25.0 μg, and 35.0 μg dosages.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan dialysis equipment market based on the below-mentioned segments:

Japan Dialysis Equipment Market, By Dialysis Equipment Type

- Hemodialysis Equipment

- Peritoneal Dialysis Equipment

Japan Dialysis Equipment Market, By End User

- Dialysis Centers & Hospitals

- Home Healthcare

Need help to buy this report?