Japan Diabetic Retinopathy Market Size, Share, and COVID-19 Impact Analysis, By Type (Proliferative Diabetic Retinopathy and Non-proliferative Diabetic Retinopathy), By Management (Anti-VEGF, Intraocular Steroid Injection, Laser Surgery, and Vitrectomy), and Japan Diabetic Retinopathy Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareJapan Diabetic Retinopathy Market Insights Forecasts to 2035

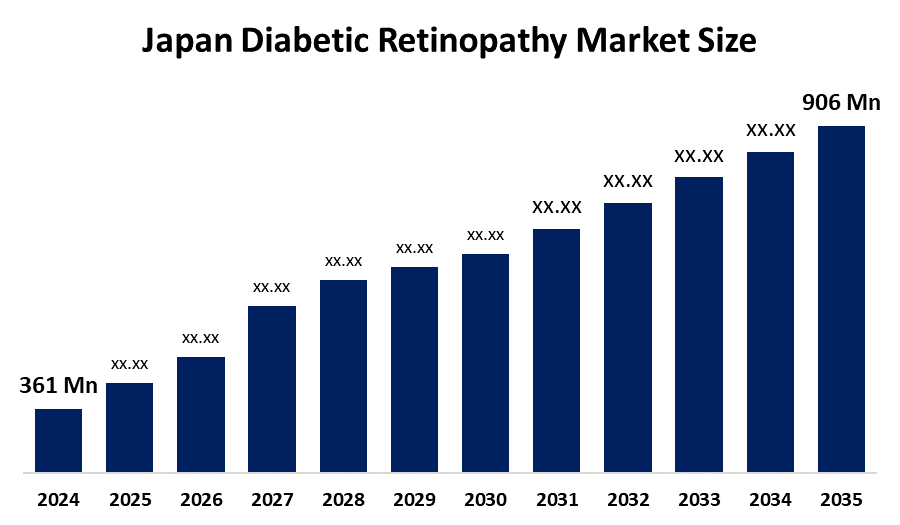

- The Japan Diabetic Retinopathy Market Size Was Estimated at USD 361 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 8.72 % from 2025 to 2035

- The Japan Diabetic Retinopathy Market Size is Expected to Reach USD 906 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Japan Diabetic Retinopathy Market Size is anticipated to reach USD 906 Million by 2035, Growing at a CAGR of 8.72 % from 2025 to 2035. The diabetic retinopathy market in Japan is driven by various factors, including the rising incidence of diabetes in older individuals, the rising prevalence of blindness caused by diabetes, growing awareness of eye-related complications, and technological advancements in ophthalmic therapies.

Market Overview

Diabetic retinopathy (DR) is a diabetes-related eye condition affecting the retina's blood vessels, potentially leading to vision impairment or blindness. Diabetes can damage blood vessels throughout the body, and the retina is particularly susceptible. The Japan diabetic retinopathy market refers to the development, production, and commercialization of therapies, diagnostics, and medical devices for the prevention, diagnosis, and treatment of diabetic retinopathy. It encompasses two primary stages: non-proliferative diabetic retinopathy (NPDR) and proliferative diabetic retinopathy (PDR). One of the main factors propelling the Japanese diabetic retinopathy market is the country's rising diabetes prevalence, which now affects 7.4 million people and has increased by 10% over the last ten years. It is anticipated that the growing number of diabetics would lead to an increased prevalence of diabetic retinopathy, increasing the need for efficient diagnostic methods and treatment approaches. The market is expanding and developing as a result of major pharmaceutical firms like Takeda Pharmaceutical Company Limited introducing novel treatment alternatives and continuing research and development projects. The rising shift towards minimally invasive treatments is one of the key trends in this market. The development of personalized treatments presents a potential opportunity for market growth.

Report Coverage

This research report categorizes the market for the Japan diabetic retinopathy market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan diabetic retinopathy market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan diabetic retinopathy market.

Japan Diabetic Retinopathy Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 361 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 8.72% |

| 2035 Value Projection: | USD 906 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By Management |

| Companies covered:: | Takeda Pharmaceutical, Chugai Pharmaceutical, Otsuka Pharmaceutical, Santen Pharmaceutical, Bayer, Novartis, Eli Lilly Japan K.K., AstraZeneca, Roche, AbbVie, Pfizer, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Japan is one of the highest aging population country and the aging population is more susceptible to chronic conditions like diabetes, which leads to higher diabetic retinopathy incidence, which further drives the demand for effective diagnosis and treatment solutions. The adoption of OCT and AI-driven imaging improves early diagnosis and reduces invasive procedures, which further drives the growth of Japan's diabetic retinopathy market. Additionally, active healthcare initiatives and national screening programs in Japan are promoting early detection of diabetic retinopathy, which has led to the market expansion.

Restraining Factors

The high cost of advanced, sophisticated therapies makes it difficult for certain patients to access the care they require, particularly in low-income areas. Additionally, a lengthy approval process for new drugs and medical devices can delay market entry and product launches, which further limit market expansion.

Market Segmentation

The Japan diabetic retinopathy market share is classified into type and management.

- The non-proliferative diabetic retinopathy segment held the dominant share in 2024 and is expected to grow at a rapid CAGR during the forecast period.

The Japan diabetic retinopathy market is segmented by type into proliferative diabetic retinopathy and non-proliferative diabetic retinopathy. Among these, the non-proliferative diabetic retinopathy segment held the dominant share in 2024 and is anticipated to grow at a rapid CAGR during the forecast period. This is due to the rising geriatric population and the rising incidence of blindness caused by diabetes.

- The anti-VEGF segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan diabetic retinopathy market is segmented by management into anti-VEGF, intraocular steroid injection, laser surgery, and vitrectomy. Among these, the anti-VEGF segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This segmental growth is attributed to the efficiency and efficacy of these drugs. Additionally, anti-VEGF medications were more helpful in PDR, particularly before the vitrectomy treatment and in instances with vitreous hemorrhage and neovascular glaucoma.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan diabetic retinopathy market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Takeda Pharmaceutical

- Chugai Pharmaceutical

- Otsuka Pharmaceutical

- Santen Pharmaceutical

- Bayer

- Novartis

- Eli Lilly Japan K.K.

- AstraZeneca

- Roche

- AbbVie

- Pfizer

- Others

Recent Developments

- In May 2025, Santen Pharmaceutical and Bayer Yakuhin launched a pre-filled EYLEA 8 mg syringe, simplifying administration of the ophthalmic VEGF inhibitor for retinal disease treatment

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan diabetic retinopathy market based on the below-mentioned segments:

Japan Diabetic Retinopathy Market, By Type

- Proliferative Diabetic Retinopathy

- Non-proliferative Diabetic Retinopathy

Japan Diabetic Retinopathy Market, By Management

- Anti-VEGF

- Intraocular Steroid Injection

- Laser Surgery

- Vitrectomy

Need help to buy this report?