Japan Diabetic Neuropathy Treatment Market Size, Share, and COVID-19 Impact Analysis, By Disease Type (Peripheral Neuropathy, Autonomic Neuropathy, Proximal Neuropathy, and Focal Neuropathy), By Treatment (Drug Class, Radiotherapy and Physiotherapy, and Other Treatments), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies), and Japan Diabetic Neuropathy Treatment Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareJapan Diabetic Neuropathy Treatment Market Insights Forecasts to 2035

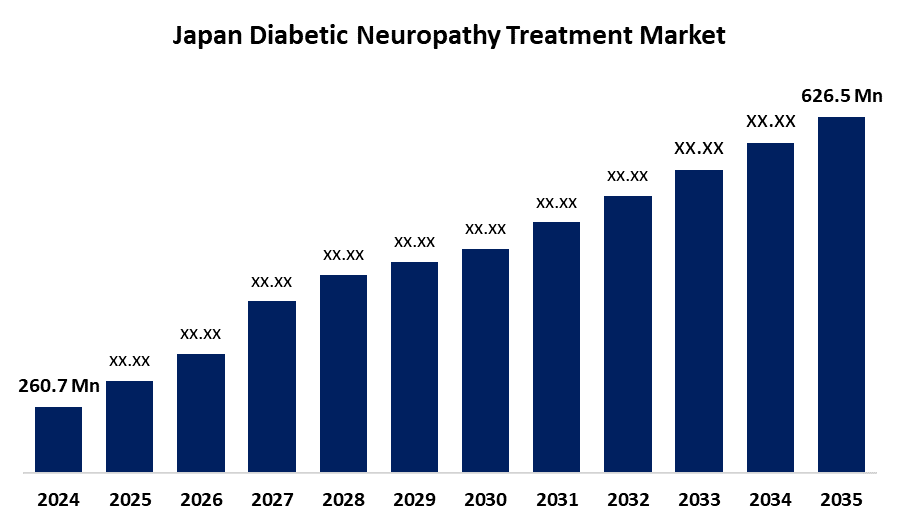

- The Japan Diabetic Neuropathy Treatment Market Size Was Estimated at USD 260.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.3% from 2025 to 2035

- The Japan Diabetic Neuropathy Treatment Market Size is Expected to Reach USD 626.5 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan diabetic neuropathy treatment market is anticipated to reach USD 626.5 million by 2035, growing at a CAGR of 8.3% from 2025 to 2035. The Japan market for the treatment of diabetic neuropathy expands with the growing prevalence of diabetes, a growing population, and heightened awareness. Technological improvements in therapies, continued research, and robust support from the government for diabetes care fuel the market growth and improved patient care.

Market Overview

The Japan diabetic neuropathy treatment market refers to the care for nerve damage resulting from long-term elevated blood sugar levels in diabetic patients. Therapies focus on pain relief, restoration of nerve function, and the avoidance of additional complications. The typical treatments involve oral drugs, topical treatments, and novel gene therapies. Japan strong healthcare system, sophisticated pharmaceutical research facilities, and strong presence of local players such as Astellas and Takeda are the strengths. There are opportunities in creating new, tailored treatments and broadening early diagnostic methods. Growth is fueled by Japan's aging population, higher incidence of diabetes, and raised awareness of diabetic complications. The Japanese government fosters this development through programs intended to enhance elder care within healthcare, promote medical research, and drive technology innovation across the healthcare industry.

Report Coverage

This research report categorizes the market for the Japan diabetic neuropathy treatment market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan diabetic neuropathy treatment market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan diabetic neuropathy treatment market.

Japan Diabetic Neuropathy Treatment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 260.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.3% |

| 2035 Value Projection: | USD 626.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Disease Type, By Treatment, By Distribution and COVID-19 Impact Analysis |

| Companies covered:: | Daiichi Sankyo Company Limited, Pfizer Inc., Astellas Pharma Inc., Teva Pharmaceutical Industries Ltd., Eli Lilly and Company, Mitsubishi Tanabe Pharma Corporation, Janssen Pharmaceutica, Novartis, Abbott, Boehringer Ingelheim GmbH, Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The Japan diabetic neuropathy treatment market is accelerated by the nation's fast-growing population of elderly citizens and growing cases of diabetes, which boost neuropathy instances. Treatment advances, such as new oral medicines and genetics treatments, drive patient improvement and market development. Increased awareness among patients and physicians regarding early diagnosis and treatment also sustains demand. Other government efforts aimed at age-related healthcare and healthcare innovation also increase access to efficient diabetic neuropathy therapy, driving overall market growth.

Restraining Factors

The Japan diabetic neuropathy treatment market is hindered by limited physician awareness, causing misdiagnosis, high cost of treatment, limited reimbursement on some drugs, and strict regulatory barriers, which cumulatively decelerate market growth and restrict patient entry to effective treatments.

Market Segmentation

The Japan diabetic neuropathy treatment market share is classified into disease type, treatment, and distribution channel.

- The peripheral neuropathy segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan diabetic neuropathy treatment market is segmented by disease type into peripheral neuropathy, autonomic neuropathy, proximal neuropathy, and focal neuropathy. Among these, the peripheral neuropathy segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Peripheral neuropathy, the most prevalent diabetic neuropathy, exists mainly in the legs and feet, and is hence the biggest chunk. It is fueled by a myriad of treatment methodologies available, ranging from drugs, physiotherapy, and modification of lifestyle, which endear it to patients as well as professionals.

- The drug class segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan diabetic neuropathy treatment market is segmented by treatment into drug class, radiotherapy and physiotherapy, and other treatments. Among these, the drug class segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to a broad spectrum of drug classes, including anticonvulsants, antidepressants, and analgesics, which allows personalized treatment for diabetic neuropathy. Oral drugs are easy, with no special equipment or expertise needed, facilitating their universal application over more complicated therapies such as radiotherapy or physiotherapy.

- The hospital pharmacies segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan diabetic neuropathy treatment market is segmented by distribution channel into hospital pharmacies, retail pharmacies, and online pharmacies. Among these, the hospital pharmacies segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to they provide emergency and specialized care, and pharmacies provide access to required medications. Strong demand, fueled by population increases, aging populations, and chronic disease conditions, supports the leadership of hospitals and pharmacies in providing necessary and regular healthcare services in Japan.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan diabetic neuropathy treatment market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Daiichi Sankyo Company Limited

- Pfizer Inc.

- Astellas Pharma Inc.

- Teva Pharmaceutical Industries Ltd.

- Eli Lilly and Company

- Mitsubishi Tanabe Pharma Corporation

- Janssen Pharmaceutica

- Novartis

- Abbott

- Boehringer Ingelheim GmbH

- Others

Recent Developments:

- In February 2025, Eli Lilly Japan and Mitsubishi Tanabe Pharma introduced Mounjaro, a once-weekly subcutaneous injection and the first sustained-release dual GIP and GLP-1 receptor agonist. Administered via the easy-to-use ATEOS autoinjector, it enhances blood glucose by stimulating both receptors with a single, altered molecule.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan diabetic neuropathy treatment market based on the below-mentioned segments:

Japan Diabetic Neuropathy Treatment Market, By Disease Type

- Peripheral Neuropathy

- Autonomic Neuropathy

- Proximal Neuropathy

- Focal Neuropathy

Japan Diabetic Neuropathy Treatment Market, By Treatment

- Drug Class

- Radiotherapy and Physiotherapy

- Other Treatments

Japan Diabetic Neuropathy Treatment Market, By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Need help to buy this report?