Japan Diabetes Care Devices Market Size, Share, and COVID-19 Impact Analysis, By Type (Monitoring and Delivery), By Monitoring Devices (Continuous Monitoring Devices, Lancets, and Test Strips), and Japan Diabetes Care Devices Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareJapan Diabetes Care Devices Market Insights Forecasts to 2035

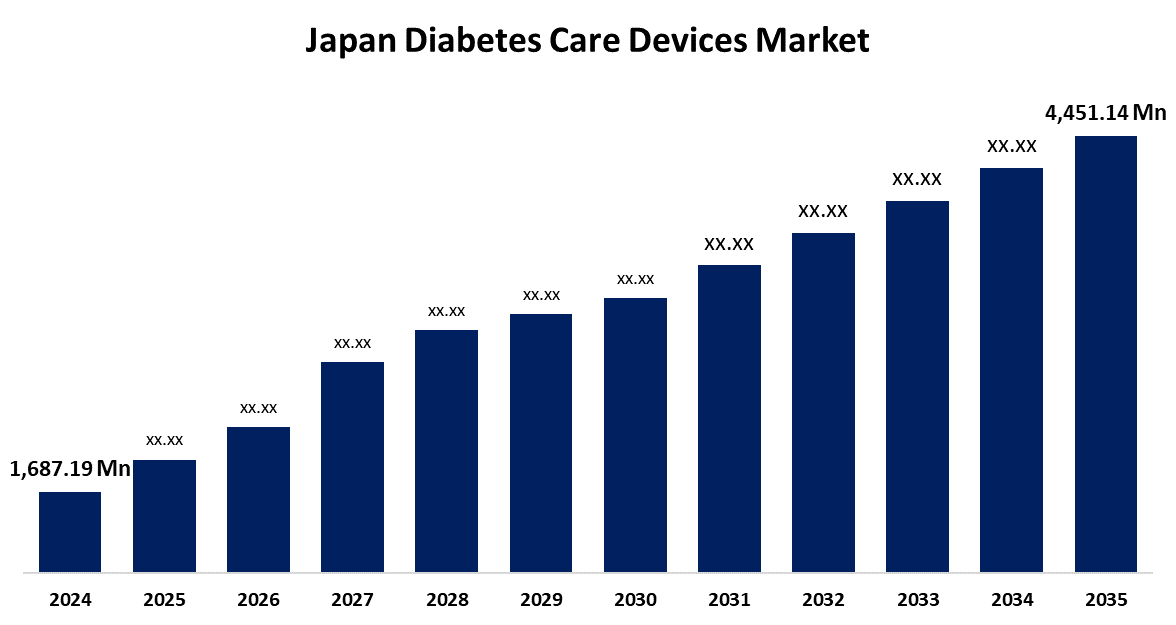

- The Japan Diabetes Care Devices Market Size Was Estimated at USD 1,687.19 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 9.22% from 2025 to 2035

- The Japan Diabetes Care Devices Market Size is Expected to Reach USD 4,451.14 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan Diabetes Care Devices Market Size is Anticipated to Reach USD 4,451.14 Million by 2035, Growing at a CAGR of 9.22% from 2025 to 2035. The market is primarily driven by Japan's rapidly aging population, which has led to a higher prevalence of age-related disorders such as arthritis, osteoporosis, and stroke, Diabetes Care Devices solutions.

Market Overview

The Japan diabetes care devices market encompasses medical instruments used for monitoring and managing diabetes, including glucose meters, continuous glucose monitoring (CGM) systems, insulin pens and pumps, and related consumables. Diabetes is becoming more and more common in Japan due to dietary and lifestyle changes. Diabetes incidence has increased as a result of a move toward Western diets, which are frequently high in processed foods, and a more sedentary lifestyle. This pattern emphasizes the rising demand for cutting-edge diabetes care tools that let people efficiently monitor and manage their illness. Because they give patients real-time data and increased convenience, products like insulin pumps, CGMs, and smart glucose meters are becoming more and more popular. The need for cutting-edge diabetic treatment technologies is significantly shaped by these lifestyle and health issues.

Report Coverage

This research report categorizes the market for the Japan diabetes care devices market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan diabetes care devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan diabetes care devices market.

Japan Diabetes Care Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1,687.19 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 9.22% |

| 2035 Value Projection: | USD 4,451.14 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 160 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Type, By Monitoring Devices and COVID-19 Impact Analysis. |

| Companies covered:: | Abbott Laboratories, ACON Laboratories, Inc., Terumo Corporation Holdings AG, Becton, Dickinson and Company, Dexcom, Inc., Hoffmann-La Roche Ltd and Others. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The aging population, growing diabetes prevalence, and growing knowledge of disease management are the main factors propelling the diabetic care devices market in Japan. Continuous glucose monitors (CGMs) and insulin pumps are two examples of technological developments in glucose monitoring systems that are improving patient care and propelling market expansion. As patients look for less intrusive and more comfortable treatment choices, the demand for non-invasive technology is also rising. The market expansion is also supported by government programs that raise health awareness and encourage the use of digital health solutions. Two major trends influencing the market are the growing emphasis on individualized care and the incorporation of data analytics and artificial intelligence (AI) into diabetes management systems. These developments are lessening the strain on healthcare systems and increasing the precision of diagnosis and treatment.

Restraining Factors

Adoption is hampered by a number of factors, including the high cost of advanced devices (particularly insulin pumps and CGMs), the lengthy regulatory approval process, the possibility that newer technologies won't be fully covered by national health insurance reimbursement policies, the lack of qualified diabetes educators, and competition from more conventional diabetes management strategies (diet, lifestyle modification).

Market Segmentation

The Japan diabetes care devices market share is classified into type and monitoring devices.

- The monitoring segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan diabetes care devices market is segmented by type into monitoring and delivery. Among these, the monitoring segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the rising incidence of diabetes and the growing demand for precise and trustworthy diagnostic instruments, monitoring devices currently have a dominant market share.

- The continuous monitoring devices segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan diabetes care devices market is segmented by monitoring devices into continuous monitoring devices, lancets, and test strips. Among these, the continuous monitoring devices segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. The ability of continuous glucose monitoring (CGM) systems to offer real-time insights into glucose changes has made them the front-runners.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan diabetes care devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Abbott Laboratories

- ACON Laboratories, Inc.

- Terumo Corporation Holdings AG

- Becton, Dickinson and Company

- Dexcom, Inc.

- Hoffmann-La Roche Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Diabetes Care Devices Market based on the below-mentioned segments:

Japan Diabetes Care Devices Market, By Type

- Monitoring

- Delivery

Japan Diabetes Care Devices Market, By Monitoring Devices

- Continuous Monitoring Devices

- Lancets

- Test Strips

Need help to buy this report?