Japan Dental Suction Systems Market Size, Share, and COVID-19 Impact Analysis, By Type (Wet and Dry), By Design (Compact and Standalone), By End Use (Dental Clinics and Hospitals), and Japan Dental Suction Systems Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareJapan Dental Suction Systems Market Size Insights Forecasts to 2035

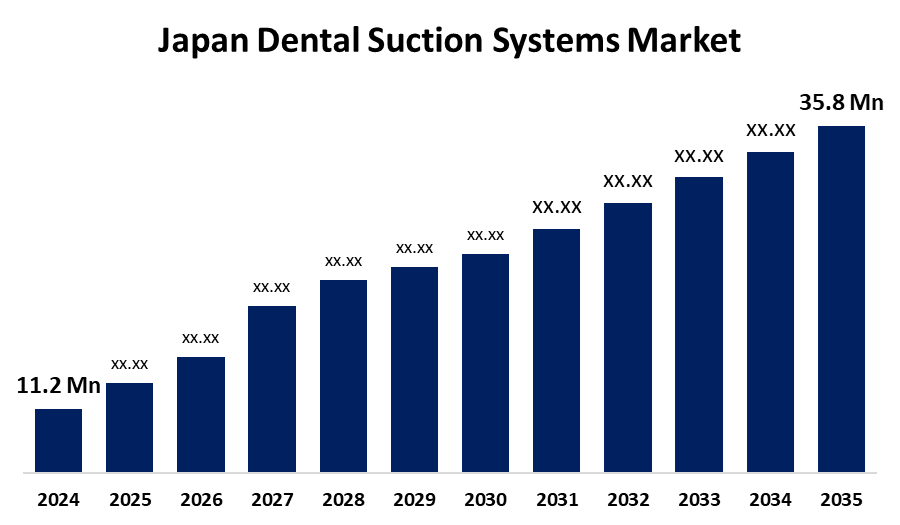

- The Japan Dental Suction Systems Market Size Was Estimated at USD 11.2 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 11.14% from 2025 to 2035

- The Japan Dental Suction Systems Market Size is Expected to Reach USD 35.8 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan Dental Suction Systems Market Size is anticipated to reach USD 35.8 million by 2035, growing at a CAGR of 11.14% from 2025 to 2035. The Japan dental suction systems market is growing as a result of various reasons such as increasing focus on infection control, an aging population, and technological growth. In particular, the growing interest in infection control, fueled by the COVID-19 pandemic, has increased the demand for sophisticated aerosol suction systems in dental clinics.

Market Overview

The Japan for dental suction systems refers to dental care by effectively evacuating fluids and debris during dental procedures. It is widely used in clinics and hospitals; these systems support infection control, patient comfort, and procedural efficiency. Strengths of the Japanese market are its sophisticated healthcare infrastructure, high standards of hygiene regulation, and broad usage of compact technology, increased suction devices in city clinics. Opportunities are found in portable suction units for mobile dentistry, remote care, and environmentally friendly systems with HEPA/mercury filtration, meeting new needs in urban and rural areas. Major drivers for the market are growing dental procedures because of growing oral health consciousness, infection control needs, and technological advancements like energy-saving, noise-suppressed systems with better filtration. The government of Japan, through healthcare equipment upgrade programs, encourages hospital and homecare equipment modernization, thus driving market expansion.

Report Coverage

This research report categorizes the market for the Japan dental suction systems market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan dental suction systems market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan dental suction systems market.

Japan Dental Suction Systems Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 11.2 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 11.14% |

| 2035 Value Projection: | USD 35.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 163 |

| Tables, Charts & Figures: | 123 |

| Segments covered: | By Type, By Design, By End Use and COVID-19 Impact Analysis |

| Companies covered:: | J. Morita Manufacturing Corp., Denken-Highdental Co., Ltd., Becker Pumps Corporation, ADS Dental System, Planmeca Japan K.K., KaVo Dental Systems Japan, Todoroki Dental Equipment Co., Ltd., The Yoshida Dental Mfg. Co., Ltd., Dentsply Sirona K.K., Cattani, DentalEZ, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan dental suction systems market is fueled by increasing oral health consciousness, growing numbers of dental treatments, and increasing demand for infection control for clinics. Technology developments, including quieter and energy-saving suction systems with better filtration, boost adoption. Also fueling the market is Japan's aging population, which results in increased utilization of dental services. Robust healthcare infrastructure, favorable government policies for equipment upgradation, and the move towards smaller and environmentally friendly systems also propel market growth in both urban and rural dental care environments.

Restraining Factors

High initial expenditures on sophisticated wet and dry suction equipment discourage small practices, as these systems demand considerable investment, and regular upkeep is constrained in the Japan dental suction systems market. Also, competition from lower-end, portable, and manual suction equipment, generally considered cheaper and less demanding to maintain, restrains the adoption of high-performance fixed systems.

Market Segmentation

The Japan dental suction systems market share is classified into type, design, and end use.

- The wet segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan dental suction systems market is segmented by type into wet and dry. Among these, the wet segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to suction systems that utilize a steady stream of water to collect dental debris, saliva, and fluids during treatment, thus increasing infection control. This aspect is greatly desired by dental clinics that are determined to provide hygienic conditions and patient safety during treatment.

- The compact segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan dental suction systems market is segmented by design into compact and standalone. Among these, the compact segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to these systems are engineered for installation in reduced spaces, suitable for clinics seeking to minimize space consumption. Miniature formats substitute for large, cumbersome older equipment, maximizing workflow and giving practitioners greater space to comfortably interface with their tools throughout procedures.

- The dental clinics segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan dental suction systems market is segmented by end use into dental clinics and hospitals. Among these, the dental clinics segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the need for consistent suction systems to handle waste produced during procedures, ranging from regular check-ups to complicated operations. Increased consciousness of oral aesthetics and health is boosting dental procedures, and demand for efficient suction increases accordingly. With the extension of clinic services, effective waste management solutions are becoming more important for safe and hygienic operations.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan dental suction systems market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- J. Morita Manufacturing Corp.

- Denken-Highdental Co., Ltd.

- Becker Pumps Corporation

- ADS Dental System

- Planmeca Japan K.K.

- KaVo Dental Systems Japan

- Todoroki Dental Equipment Co., Ltd.

- The Yoshida Dental Mfg. Co., Ltd.

- Dentsply Sirona K.K.

- Cattani

- DentalEZ

- Others

Recent Developments:

- In January 2021, Dentsply Sirona acquired Byte, a direct-to-consumer clear aligner business. The acquisition improves Dentsply Sirona's product portfolio as well as provides the company with opportunities to leverage growth in the orthodontic market.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan dental suction systems market based on the below-mentioned segments:

Japan Dental Suction Systems Market, By Type

- Wet

- Dry

Japan Dental Suction Systems Market, By Design

- Compact

- Standalone

Japan Dental Suction Systems Market, By End Use

- Dental Clinics

- Hospitals

Need help to buy this report?