Japan Dental Imaging Software Market Size, Share, and COVID-19 Impact Analysis, By Deployment Mode (On-Premises and Cloud-Based), By Application (Orthodontics, Endodontics, Oral and Maxillofacial Surgery, Implantology, and Others), By End-User (Dental Clinics, Hospitals, Academic and Research Institutes, and Others), and Japan Dental Imaging Software Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareJapan Dental Imaging Software Market Insights Forecasts to 2035

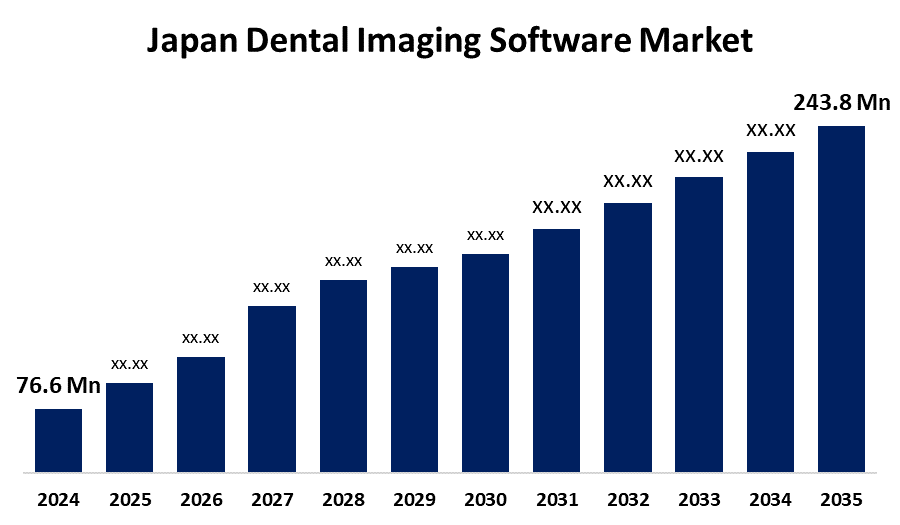

- The Japan Dental Imaging Software Market Size Was Estimated at USD 76.6 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 11.1% from 2025 to 2035

- The Japan Dental Imaging Software Market Size is Expected to Reach USD 243.8 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Japan Dental Imaging Software Market Size is anticipated to reach USD 243.8 Million by 2035, growing at a CAGR of 11.1% from 2025 to 2035. The Japan dental imaging software market is expanding due to a growing population, rising dental ailments among the elderly population, advances in technology, and friendly government healthcare policies. Increased use of digital image technologies in dental clinics also helps boost market growth in the country.

Market Overview

The Japan dental imaging software market refers to digital solutions for capturing, processing, and storing dental imagery like X-rays, 3D scans, and intraoral images. These software platforms aid dentists in diagnostics, treatment planning, and patient education. The diagnostic accuracy capability of the software is improved, workflow is automated, and the incidence of human error is minimized is a critical strength. Further, compatibility with cutting-edge technologies such as AI and cloud-based solutions provides enormous opportunities for innovation and scalability. Growing awareness of oral health, an aging population, and increasing demand for cosmetic dentistry are the main drivers driving market growth. Japan's established healthcare infrastructure and high technology adoption rate further bolster market growth. Government programs to foster digital health solutions and increase access to advanced dental care also serve as major drivers. Initiatives in favor of healthcare IT development and subsidies for dental clinics that use digital solutions favor the market environment.

Report Coverage

This research report categorizes the market for the Japan dental imaging software market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan dental imaging software market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan dental imaging software market.

Japan Dental Imaging Software Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 76.6 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 11.1% |

| 2035 Value Projection: | USD 243.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 278 |

| Tables, Charts & Figures: | 107 |

| Segments covered: | By Deployment Mode, By Application and By End-User |

| Companies covered:: | Fujifilm Holdings, Shimadzu Corporation, Hitachi Medical Systems, Planmeca, Carestream Dental, J. Morita Mfg. Corp., Asahi RoEntgen Ind. Co. Ltd., Dentsply Sirona, Nakanishi Inc., Koninklijke Philips N.V., Canon Medical Systems, Acteon Group, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japanese dental imaging software market is fueled by rising demand for accurate and fast diagnostic tools, a rapidly aging population in need of advanced dental care, and growing awareness of oral health. Cosmetic dentistry growth and the adoption of AI and cloud-based technologies further improve growth. Furthermore, financially supportive government policies geared towards digital healthcare transformation and the robust technological framework of the nation inspire clinics to implement advanced imaging solutions, improving both clinical productivity and patient outcomes within the dental care industry.

Restraining Factors

The Japan dental imaging software market is constrained by high initial expenses, difficulty in incorporating new systems with existing infrastructure, and shortages in skilled professionals. Moreover, data security concerns and limited uptake in small clinics inhibit growth.

Market Segmentation

The Japan dental imaging software market share is classified into deployment mode, application, and end-user.

- The on-premise segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan dental imaging software market is segmented by deployment mode into on-premise and cloud-based. Among these, the on-premise segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to they provide complete control of data, increased security, and customization of the software to suit individual requirements. This delivery mode supports quicker access to patient information and imaging reports, facilitating timely diagnosis and efficient treatment planning.

- The orthodontics segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan dental imaging software market is segmented by application into orthodontics, endodontics, oral and maxillofacial surgery, implantology, and others. Among these, the orthodontics segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to their providing precise images of teeth and jaw components to ensure proper treatment planning and assessment. Increasing demand for orthodontic procedures, spurred by improved awareness of dental appearance and technological improvement, is likely to fuel software usage in the sector.

- The dental clinics segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan dental imaging software market is segmented by end-user into dental clinics, hospitals, academic and research institutes, and others. Among these, the dental clinics segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the increasing number of dental clinics and the need for sophisticated diagnostics, creating growth in imaging software adoption by clinics. Utilized for exams, treatment planning, and patient education, digital imaging increases diagnostic accuracy, increases outcomes, and improves overall patient satisfaction for dental care.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan dental imaging software market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Fujifilm Holdings

- Shimadzu Corporation

- Hitachi Medical Systems

- Planmeca

- Carestream Dental

- J. Morita Mfg. Corp.

- Asahi RoEntgen Ind. Co. Ltd.

- Dentsply Sirona

- Nakanishi Inc.

- Koninklijke Philips N.V.

- Canon Medical Systems

- Acteon Group

- Others

Recent Developments:

- In March 2024, Carestream Dental introduced AI Insights, a cloud-based tool for automated analysis of panoramic X-rays, and SMOP Surgical Guides, a cloud-based implant planning platform. These innovations aim to improve diagnostic accuracy and streamline dental implant planning for improved clinical efficiency and patient care.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan dental imaging software market based on the below-mentioned segments:

Japan Dental Imaging Software Market, By Deployment Mode

- On-Premises

- Cloud-Based

Japan Dental Imaging Software Market, By Application

- Orthodontics

- Endodontics

- Oral and Maxillofacial Surgery

- Implantology

- Others

Japan Dental Imaging Software Market, By End-User

- Dental Clinics

- Hospitals

- Academic and Research Institutes

- Others

Need help to buy this report?