Japan Dental Adhesives and Sealants Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Self-Etch, Total-Etch, Universal Adhesives, and Others), By Application (Restorative Dentistry, Orthodontics, Prosthodontics, and Others), By End-User (Dental Clinics, Hospitals, and Others), and Japan Dental Adhesives and Sealants Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareJapan Dental Adhesives and Sealants Market Insights Forecasts to 2035

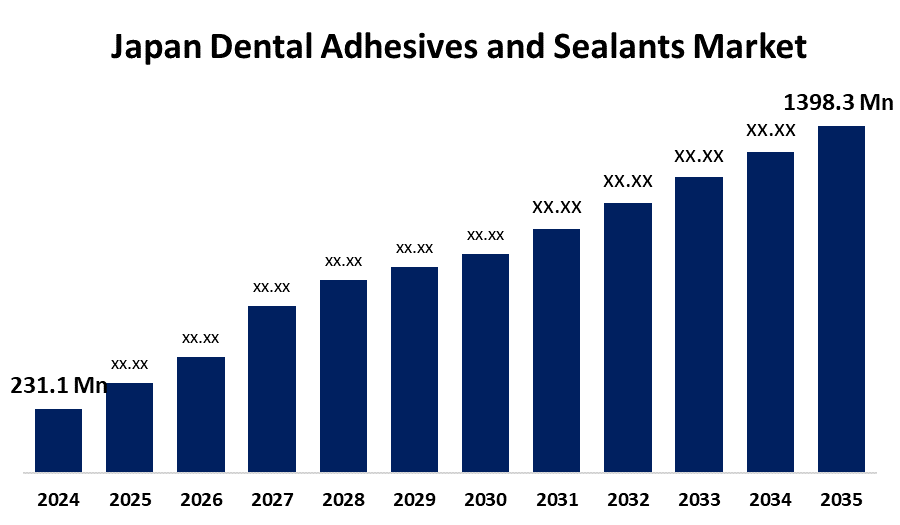

- The Japan Dental Adhesives and Sealants Market Size Was Estimated at USD 231.1 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 17.78% from 2025 to 2035

- The Japan Dental Adhesives and Sealants Market Size is Expected to Reach USD 1398.3 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan dental adhesives and sealants market is anticipated to reach USD 1398.3 million by 2035, growing at a CAGR of 17.78% from 2025 to 2035. The Japan dental adhesives and sealants market is increasing due to the aging population, rising awareness of oral health, and higher disposable incomes. These are complemented by a growth in dental care facilities and government initiatives targeting dental hygiene practices, further contributing to general market expansion.

Market Overview

The Japan dental adhesives and sealants market refers to a vital segment of the country's dental health industry, involving products like restorative adhesives, denture adhesives, and preventive sealants. They are key elements in procedures like cavity fillings, crown fittings, and preventive treatment, assuring robust and effective dental therapy. High-tech medical centers in Japan and stringent regulatory regimes ensure the availability of superior dental products. The expansion in cosmetic dentistry and computerized procedures provides an opportunity for new adhesive and sealant technologies. Approximately 49% of all cosmetic dental treatments include the use of adhesives for veneers, composite bonding, and laminates. Market drivers are an increasing aging population, growing dental caries among children, and a heightened awareness of oral health. About 60% of school-age children have tooth decay; hence, more demand for dental sealants. Public health programs that promote preventive oral care, especially among children, will most likely result in the application of dental sealants.

Report Coverage

This research report categorizes the market for the Japan dental adhesives and sealants market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan dental adhesives and sealants market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan dental adhesives and sealants market.

Japan Dental Adhesives and Sealants Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 231.1 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 17.78% |

| 2035 Value Projection: | USD 1398.3 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 101 |

| Segments covered: | By Product Type, By Application, By End-User and COVID-19 Impact Analysis |

| Companies covered:: | GC Corporation, The Yoshida Dental Mfg. Co., Ltd., Mitsui & Co., Kuraray Noritake Dental Inc., Sika AG, Tokuyama Dental Corporation, Dentsply Sirona Inc., Shofu Dental Corporation, J. Morita Corp., Mani Inc., Shin-Etsu Chemical Co., Ltd., Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The increase in the aging population requiring restorative care, dental caries in children, and rising oral health awareness, Japan's dental adhesives and sealants market is growing. Rising demand for cosmetic dental treatment and advanced dental technologies also propels the market. The widespread use of adhesives in crowns, dentures, and veneers treatments and preventive care programs also drives demand for reliable and innovative adhesive and sealant products.

Restraining Factors

There are several challenges in Japan's dental adhesives and sealants market, including unaffordable treatments, a lack of insurance coverage for some of the procedures, and a lack of well-trained experts. In addition, the possibility of infection from improper use or degradation of the materials poses a danger to patient safety and treatment outcomes

Market Segmentation

The Japan dental adhesives and sealants market share is classified into product type, application, and end-user.

- The self-etch segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan dental adhesives and sealants market is segmented by product type into self-etch, total-etch, universal adhesives, and others. Among these, the self-etch segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to they are simple to use and time-saving. Self-Etch adhesives do away with the necessity of a separate etching procedure, which makes the bonding process uncomplicated and reduces the risk of post-operative sensitivity. This means that they are particularly ideal for general dental practice where efficiency and patient comfort are important.

- The restorative dentistry segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan dental adhesives and sealants market is segmented by application into restorative dentistry, orthodontics, prosthodontics, and others. Among these, the restorative dentistry segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to they are primarily used in the field of cavity filling and repairing broken or damaged teeth. Materials of higher strength with enhanced bonding strength and aesthetics are greatly favored in restorative procedures.

- The dental clinics segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan dental adhesives and sealants market is segmented by end-user into dental clinics, hospitals, and others. Among these, the dental clinics segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to the dental procedures are undertaken in these clinics. The ease and accessibility offered by dental clinics make them the most convenient for patients requiring dental care.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan dental adhesives and sealants market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- GC Corporation

- The Yoshida Dental Mfg. Co., Ltd.

- Mitsui & Co.

- Kuraray Noritake Dental Inc.

- Sika AG

- Tokuyama Dental Corporation

- Dentsply Sirona Inc.

- Shofu Dental Corporation

- J. Morita Corp.

- Mani Inc.

- Shin-Etsu Chemical Co., Ltd.

- Others

Recent Developments:

- In April 2021, Sika AG signed an agreement to acquire The Yokohama Rubber Co. Ltd's adhesives division, Hamatite, based in Japan. Hamatite offers polyurethanes, hot melts, and modified silicones technology adhesives and sealants for the automotive and construction industries.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan dental adhesives and sealants market based on the below-mentioned segments:

Japan Dental Adhesives and Sealants Market, By Product Type

- Self-Etch

- Total-Etch

- Universal Adhesives

- Others

Japan Dental Adhesives and Sealants Market, By Application

- Restorative Dentistry

- Orthodontics

- Prosthodontics

- Others

Japan Dental Adhesives and Sealants Market, By End-User

- Dental Clinics

- Hospitals

- Others

Need help to buy this report?