Japan Delivery Drones Market Size, Share, and COVID-19 Impact Analysis, By Drone Type (Multi-rotor Wing, Fixed Wing, and Hybrid Wing), By Operation Mode (Remotely Piloted, Partially Autonomous, and Fully Autonomous), By End User (Retail and E-Commerce, Healthcare, Logistics and Transportation, Food and Beverages, Military and Defense, Agriculture, and Others), and Japan Delivery Drones Market Insights, Industry Trend, Forecasts to 2035

Industry: Aerospace & DefenseJapan Delivery Drones Market Insights Forecasts to 2035

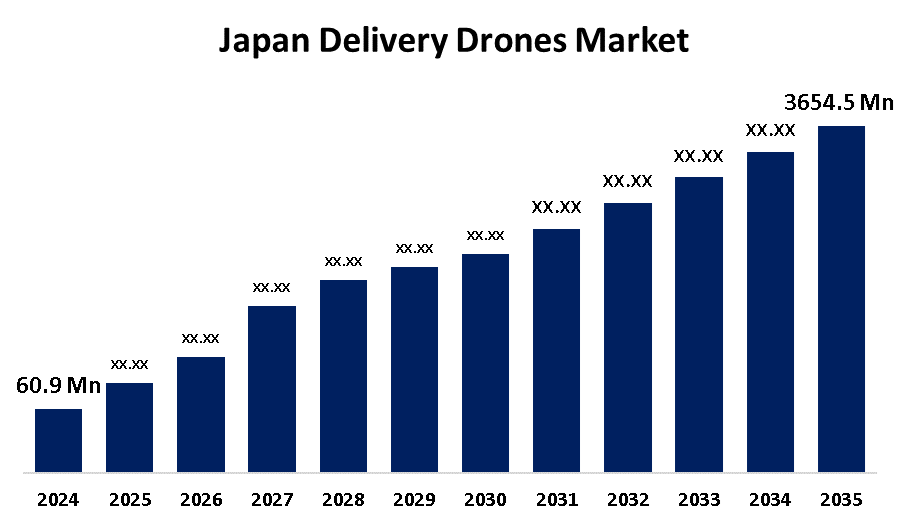

- The Japan Delivery Drones Market Size Was Estimated at USD 60.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 45.1% from 2025 to 2035

- The Japan Delivery Drones Market Size is Expected to Reach USD 3654.5 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan delivery drones market is anticipated to reach USD 3654.5 million by 2035, growing at a CAGR of 45.1% from 2025 to 2035. The Japan market for delivery drones is expanding with the support of the government, advancements in technology, and increased demand across industries such as e-commerce and healthcare, allowing timely, economical, and efficient deliveries, especially to remote and underserved areas.

Market Overview

The Japan delivery drones market refers to unmanned aerial vehicles deployed to carry products, including medical equipment, food, and parcels, especially in the final phase of logistics and remote areas. Use cases are for fast delivery to remote islands and hilly areas, contactless medical delivery, and digital marketplace integration. Strengths are in innovative technology cover, robust partnerships (e.g., Zipline and Toyota Tsusho), and customized drone platforms for medical logistics along the Goto Islands. Key opportunities are growing drone delivery networks, systems, and solutions business models, and integration within smart city and autonomous logistics programs in Japan. Market drivers are Japan aging population and rural labor shortage, logistics labor reform, disaster response requirements, and growth in demand for efficient, urban, and distant deliveries. Government initiatives are regulatory changes under the Aeronautical Act to support BVLOS flights, with subsidies and innovation incentives under national drone and robotics strategies focused on disaster management and rural logistics optimization.

Report Coverage

This research report categorizes the market for the Japan delivery drones market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan delivery drones market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan delivery drones market.

Japan Delivery Drones Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 60.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 45.1% |

| 2035 Value Projection: | USD 3654.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 177 |

| Tables, Charts & Figures: | 99 |

| Segments covered: | By Drone Type, By Operation, By End and COVID-19 Impact Analysis |

| Companies covered:: | Terra Drone Corporation, Aerosense Inc, DJI, Airbus, SkyDrive, Flytrex, Yamaha Motor, ACSL Ltd., Mitsubishi Electric, Spiral Inc., SENSYN Robotics, AeroVironment, Zipline International, Blue Innovation, Others, and others key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan drones for delivery market is propelled by a mix of demographic, technological, and logistics drivers. Japan is experiencing an aging population as well as rural labor shortages that have only intensified the demand for automated delivery. Increasing demand for fast, contactless, and economical final mile logistics, especially in remote and affected by disaster areas, is also driving growth. Technological improvements in drones, supportive regulatory reforms, and interfacing with e-commerce and pharmaceutical supply chains continue to support market momentum and usage across industries and geographies.

Restraining Factors

The Japan delivery drones market is hindered by stringent regulations such as sightline restrictions and urban area flight limits. High infrastructure, low payloads, sensitivity to weather, battery limitations, privacy issues, and low public acceptance also delay wider commercial use.

Market Segmentation

The Japan delivery drones market share is classified into drone type, operation mode, and end user.

- The multi-rotor wing segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan delivery drones market is segmented by drone type into multi-rotor wing, fixed wing, and hybrid wing. Among these, the multi-rotor wing segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to their hovering and stability properties make them suitable for precision operations such as surveillance, aerial photography, and most of all final phase delivery in urban and remote areas. Multi-rotor drones usually are quadcopters or hexacopters with several rotors for vertical liftoff and landing, as well as better maneuverability.

- The remotely piloted segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan delivery drones market is segmented by operation mode into remotely piloted, partially autonomous, and fully autonomous. Among these, the remotely piloted segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the remotely piloted unmanned aerial vehicles are operated by human controllers in ground stations, providing fine control and concurrent responsiveness. With advances in sensors, machine learning, and AI, drones today have increased autonomy to detect obstacles, navigate dynamically, and make real-time adjustments for safer, more efficient operation in challenging delivery terrain.

- The retail and e-commerce segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan delivery drones market is segmented by end user into retail and e-commerce, healthcare, logistics and transportation, food and beverages, military and defense, agriculture, and others. Among these, the retail and e-commerce segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Drone technology is transforming logistics by assisting retailers and e-commerce companies in cutting down delivery times and overcoming final mile hurdles. Increasing demand extends to parcel delivery, shore power, and postal services, with companies and local governments introducing drone-based services to cover remote islands, hilly areas, and cities effectively.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan delivery drones market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Terra Drone Corporation

- Aerosense Inc

- DJI

- Airbus

- SkyDrive

- Flytrex

- Yamaha Motor

- ACSL Ltd.

- Mitsubishi Electric

- Spiral Inc.

- SENSYN Robotics

- AeroVironment

- Zipline International

- Blue Innovation

- Others

Recent Developments:

- In January 2025, Terra Drone Corporation, the world's top drone service provider in 2024, launched its first indoor inspection drone, Terra Xross 1, in Japan and the U.S. It offers stable flight in challenging indoor environments and costs about one-third of competitors prices, increasing accessibility.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan delivery drones market based on the below-mentioned segments:

Japan Delivery Drones Market, By Drone Type

- Multi-rotor Wing

- Fixed Wing

- Hybrid Wing

Japan Delivery Drones Market, By Operation Mode

- Remotely Piloted

- Partially Autonomous

- Fully Autonomous

Japan Delivery Drones Market, By End User

- Retail and E-Commerce

- Healthcare

- Logistics and Transportation

- Food and Beverages

- Military and Defense

- Agriculture

- Others

Need help to buy this report?