Japan Data Center Market Size, Share, and COVID-19 Impact Analysis, By Type (Enterprise Data Center, Managed Services Data Center, Colocation Data Centers, and Cloud Data Centers), By Tier Type (Tier 1, Tier 2, Tier 3, Tier 4), By End-User (BFSI, Telecom and IT, Media and Entertainment, E-Commerce, Government, Healthcare, Others), and Japan Data Center Market Insights Forecasts to 2032

Industry: Information & TechnologyJapan Data Center Market Insights Forecasts to 2032

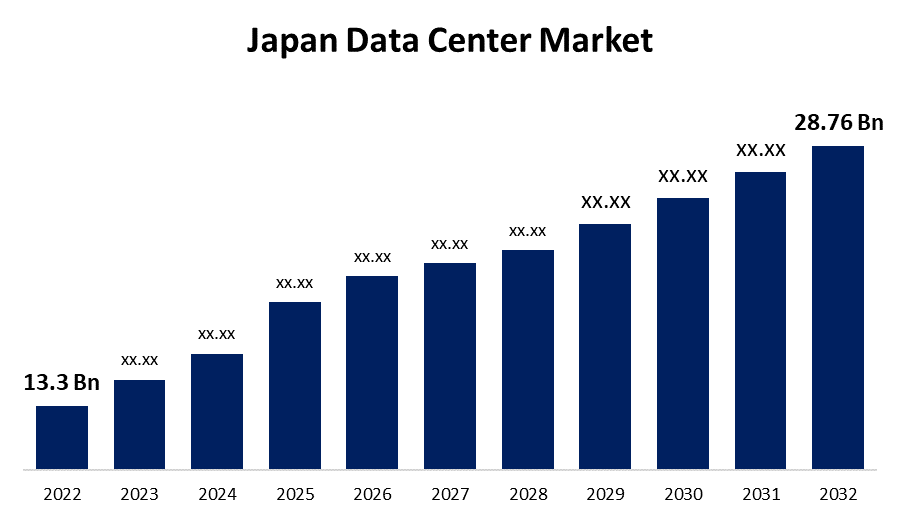

- The Japan Data Center Market Size was valued at USD 13.3 Billion in 2022.

- The Market is Growing at a CAGR of 8.02% from 2022 to 2032.

- The Japan Data Center Market Size is expected to reach USD 28.76 Bllion by 2032.

- Japan is expected to grow the fastest during the forecast period.

Get more details on this report -

The Japan Data Center Market Size is expected to reach USD 28.76 Billion by 2032, at a CAGR of 8.02% during the forecast period 2022 to 2032. With regard to an accelerating rise in the amount of data and the growing popularity of data-generating devices such as smartphones, wearable technology, Internet of Things (IoT) devices, and so on, Japan's data center market is gaining significant growth. Furthermore, the rise in the number of commercial and colocation data centers is expected to enhance the Japan data center market during the period of forecasting.

Market Overview

A data center is a structure, a specialized space within a structure, or a collection of facilities that house computer systems and other components such as telecommunication and storage facilities. Data centers constitute centralized platforms that collect, archive, analyze, and transmit huge amounts of data. They are made up of networks, servers, storage devices, routers, switches, and other components. Companies with sufficient financial resources construct their individual data centers in order to operate more effectively and to conveniently access their private data. Small and medium-sized businesses, on the other hand, frequently choose cost-effective colocation data centers.

Report Coverage

This research report categorizes the market for Japan Data Center Market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan Data Center Market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the Japan Data Center Market.

Japan Data Center Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 13.3 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 8.02% |

| 2032 Value Projection: | USD 28.76 Bllion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Type, By Tier Type, By End-User, and COVID-19 Impact Analysis |

| Companies covered:: | Digital Realty Trust, Inc., Equinix, Colt Data Centre Services, AT TOKYO, Fujitsu, Meiho Facility Works, ARTERIA Networks, netXDC (SCSK Corporation), NTT Ltd., Hibiya Engineering, Hitachi Vantara, Nikken Sekkei, Verizon Japan Ltd, NEC Corporation, Keihanshin Building, Telehouse (KDDI Corporation), Japan Telecommunications Corporation |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The widespread use of social networking sites and the internet is being fueled by the roll-out of 5G services, more effective and faster inland interoperability, the accessibility of clean electricity and cost-effective cooling solutions, and other factors, offering Japan an appealing market for investment. As data traffic grows, Japan will require an increasing number of data centers. Furthermore, the market for data centers in Japan is expanding because of Japan's large concentration of high-tech enterprises that invest much in adopting sophisticated technology.

The Japanese government and commercial parties are investing heavily in the construction of new data centers and the expansion of those currently in operation. Furthermore, firms are opting for more environmentally friendly options, such as solar electricity, for supplying electricity to data centers. Equinix, Colt Data Centre Services, Telehouse, NTT Communications, AT TOKYO, Fujitsu, ARTERIA Networks, and SCSK Corporation (netXDC) are among the domestic and worldwide data center operators present in the country. Furthermore, by purchasing data center operators or investing in the organization, the operators are boosting their market share and visibility across the entirety of the nation. Vantage Data Centers, for example, established its footprint in the Japanese data center industry with its acquisition of Agile Data Centers.

Market Segment

- In 2022, the enterprise data center segment is witnessing a higher growth rate over the forecast period.

Based on type, the Japan Data Center Market is segmented into enterprise data center, managed services data center, colocation data centers, and cloud data centers. Among these, the enterprise data center segment is witnessing a higher growth rate over the forecast period. Because of the large number of big and major corporations such as Toyota, Nippon Telegraph & Telephone, Mitsubishi UFJ Financial Group, and others, the enterprise data center category accounts for the largest market share.

- In 2022, the tier 3 segment accounted for the largest revenue share of more than 32.8% over the forecast period.

On the basis of tier type, the Japan Data Center Market is segmented into tier 1, tier 2, tier 3, and tier 4. Among these, the tier 3 segment is dominating the market with the largest revenue share of 32.8% over the forecast period. Tier 3 data centers are favored by SMBs (small and medium-sized organizations) because of their significantly stronger redundancy protection options. Tier 3 data centers are preferred by the majority of facilities because of their long time financial and operational viability. Tier 3 is the industry's most extensively used standard.

- In 2022, the BFSI segment accounted for the largest revenue share of more than 38.2% over the forecast period.

On the basis of end-user, the Japan Data Center Market is segmented into BFSI, telecom and IT, media and entertainment, e-commerce, government, healthcare, and others. Among these, the BFSI segment is dominating the market with the largest revenue share of 38.2% over the forecast period. This is attributable to a greater dependence on internet-based banking, along with a rise in the integration of mobile wallets and online payment systems. Furthermore, the demand of the BFSI sector to continue operations around the clock in order to maintain trade and economic activity is a crucial driver driving the rise of the Japan data center business.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan Data Center Market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Digital Realty Trust, Inc.

- Equinix

- Colt Data Centre Services

- AT TOKYO

- Fujitsu

- Meiho Facility Works

- ARTERIA Networks

- netXDC (SCSK Corporation)

- NTT Ltd.

- Hibiya Engineering

- Hitachi Vantara

- Nikken Sekkei

- Verizon Japan Ltd

- NEC Corporation

- Keihanshin Building

- Telehouse (KDDI Corporation)

- Japan Telecommunications Corporation

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- On May 2023, CyrusOne is collaborating with the Japanese energy company Kansai Electric Power Company, Inc. (KEPCO) to build new data centers throughout Japan. The businesses established a 50:50 joint venture dubbed CyrusOne KEP this week, with intentions to invest at least one trillion yen ($7 billion) over the next decade and build up to 900MW.

- On May 2023, Mapletree Industrial Trust has acquired a data center in Osaka, Japan, making it the company's first foray into the country's data center sector. MIT has agreed to buy a 98.47 percent ownership in the property through a conditional trust beneficial interest purchase and sale agreement with Suma Tokutei Mokuteki Kaisha.

- On April 2023, Datadog, Inc., the monitoring and security platform for cloud applications, announced the launch of its new data center. Located in Tokyo, Japan, the data center is Datadog's first in Asia and adds to existing locations in the United States, Europe and AWS GovCloud. The new data center in Japan will store and process data locally and help Datadog and its customers comply with local data privacy and security regulations.

- On February 2023, NTT Data, in collaboration with Sekisui Chemical Co., Ltd, intends to install lightweight solar cells on the outer walls of its Japanese data centers and offices. The weight of solar systems, according to the business, can be significant, with installation potentially surpassing the design load of buildings, particularly on retrofits. As a result, NTT chose lightweight perovskite solar cells for testing, with the goal of validating the installation method for outside walls as well as generating efficiency.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the Japan Data Center Market based on the below-mentioned segments:

Japan Data Center Market, By Type

- Enterprise Data Center

- Managed Services Data Center

- Colocation Data Centers

- Cloud Data Centers

Japan Data Center Market, By IT Infrastructure

- Servers

- Storage Systems

- Network Infrastructure

Japan Data Center Market, By Electrical Infrastructure

- UPS Systems

- Generators

- Transfer Switches & Switchgears

- PDUs

- Other Electrical Infrastructure

Japan Data Center Market, By Mechanical Infrastructure

- Cooling Systems

- Rack Cabinets

- Other Mechanical Infrastructure

Japan Data Center Market, By Cooling Systems

- CRAC & CRAH Units

- Chiller Units

- Cooling Towers, Condensers & Dry Coolers

- Economizers & Evaporative Coolers

- Other Cooling Units

Japan Data Center Market, By Tier Type

- Tier 1

- Tier 2

- Tier 3

- Tier 4

Japan Data Center Market, By Data Center Size

- Large

- Massive

- Medium

- Mega

- Small

Japan Data Center Market, By End-User

- BFSI

- Telecom and IT

- Media and Entertainment

- E-Commerce

- Government

- Healthcare

- Others

Need help to buy this report?