Japan Cosmetics ODM Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Skin Care, Hair Care, Makeup, Body Care, and Others), By Packaging Format (Bottles, Compact Cases, Droppers, Folding Cartons, Jars, Pouches, Pumps and Dispensers, Roll-Ons, Roll-On Sticks, Sachets, Sticks, and Tubes), By End Use (Prestige Brands, Private Brands, Mass Brands, and Indie Brands), and Japan Cosmetics ODM Market Insights, Industry Trend, Forecasts to 2035.

Industry: Consumer GoodsJapan Cosmetics ODM Market Insights Forecasts to 2035

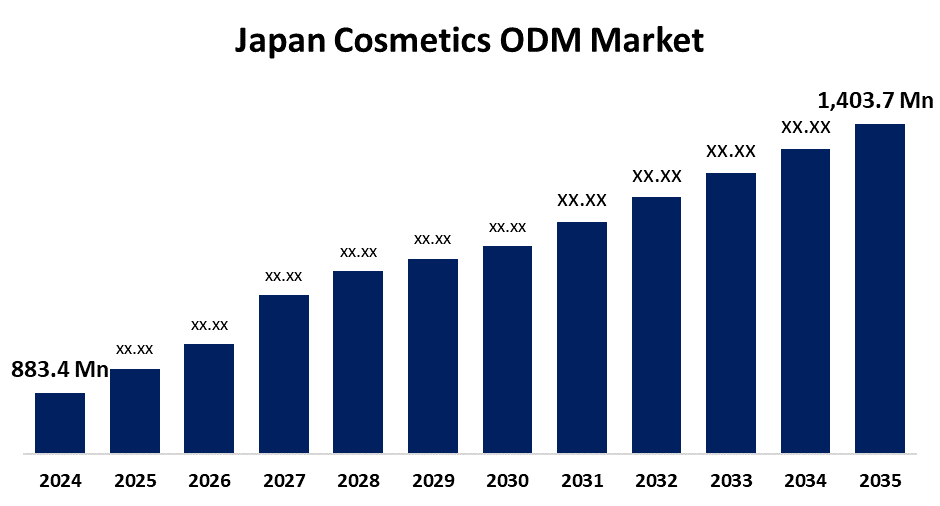

- The Japan Cosmetics ODM Market Size Was Estimated at USD 883.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.3% from 2025 to 2035

- The Japan Cosmetics ODM Market Size is Expected to Reach USD 1,403.7 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan Cosmetics ODM Market Size is anticipated to reach USD 1,403.7 Million by 2035, growing at a CAGR of 4.3% from 2025 to 2035. The Japan ODM (original design manufacturing) cosmetics market is growing because of numerous reasons such as growing demand for high-value and customized products, the growth of e-commerce and private labeling, and advances in product and packaging technologies.

Market Overview

The Japan ODM (original design manufacturing) cosmetics market refers to firms that produce, design, and make-up cosmetic products internally for other firms. They are items that range from skincare, make-up, and hair care to personal care products, hence enabling manufacturers to concentrate on sales and marketing while having the manufacturing process outsourced. ODMs are used worldwide by foreign as well as local firms in pursuit of high-quality, innovative, as well as compliant products with a focus on the Japanese market. Market growth is fueled by rising demand for tailor-made beauty products, rising desire for J-Beauty, and keen interest in product safety and performance. Japan's cutting-edge techno powerhouse image, higher manufacturing quality, and R&D capability drive the ODM business in Japan. Organic and natural makeup, anti-aging, and men's grooming are opportunities. Growing demand for clean beauty and greener packaging keeps surging, therefore fueling the growth. Government policies like assistance to small and medium enterprises (SMEs), regulatory transparency, and export promotion programs drive innovation and international competitiveness.

Report Coverage

This research report categorizes the market for the Japan cosmetics ODM market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan cosmetics ODM market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan cosmetics ODM market.

Japan Cosmetics ODM Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 883.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.3% |

| 2035 Value Projection: | USD 1,403.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 224 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Packaging Format, By End Use |

| Companies covered:: | Nippon Shikizai, Intercos Group, Cosmo Beauty Inc., Shiseido, Colmar Co. Ltd, BioTruly Group, Toyo Shinyaku Co., Kao Corporation, Viaderm Limited, Tokiwa Co., Herrco Ltd, Nihon Kolmar, Toyo Beauty Co., Ltd, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan cosmetics ODM market is driven by the increasing need for bespoke and high-performance beauty products, increasing international interest in J-Beauty, and robust consumer demand for effective but safe ingredients. Players outsource more to take advantage of Japan's advanced R&D, production expertise, and regulatory support. Additionally, the growth of natural, organic, and anti-aging products fuels ODM's potential. The market is also driven by shifting consumer trends like clean beauty and sustainability, driving innovation and attracting domestic and international cosmetic brands.

Restraining Factors

The Japan ODM cosmetics market is constrained by stiff competition, high regulatory compliance, and high production and development expenses. There is limited leverage for small brands, and there are large product development cycles that can impede innovation in some segments as well as constrain market entry.

Market Segmentation

The Japan cosmetics ODM market share is classified into product type, packaging format, and end use.

- The skin care segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan cosmetics ODM market is segmented by product type into skin care, hair care, makeup, body care, and others. Among these, the skin care segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the growing consumer interest in well-being, aging, and prevention of skin ailments creates demand for innovative skincare solutions. In order to counter emerging consumer trends, ODM partners are increasingly formulating special products like facial creams, serums, sunscreens, and eye care products.

- The tubes segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan cosmetics ODM market is segmented by packaging format into bottles, compact cases, droppers, folding cartons, jars, pouches, pumps and dispensers, roll-ons, roll-on sticks, sachets, sticks, and tubes. Among these, the tubes segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to they are easy to dispense and ideal for those products where precise application is required. Japanese consumers take importance in precision and convenience when it comes to their personal care routine, and tubes deliver on both fronts. They are cost-effective for ODM production, easy to design, and available in biodegradable packaging at ease.

- The indie brands segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan cosmetics ODM market is segmented by end use into prestige brands, private brands, mass brands, and indie brands. Among these, the indie brands segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to the growing consumer demand for clean beauty, niche, and new products. They depend on ODMs for speed-to-market, flexibility, and personalization, with coordination of personalization, sustainability, and digital-first brand engagement strategies trends.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan cosmetics ODM market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nippon Shikizai

- Intercos Group

- Cosmo Beauty Inc.

- Shiseido

- Colmar Co. Ltd

- BioTruly Group

- Toyo Shinyaku Co.

- Kao Corporation

- Viaderm Limited

- Tokiwa Co.

- Herrco Ltd

- Nihon Kolmar

- Toyo Beauty Co., Ltd

- Others

Recent Developments:

- In September 2024, Kao Corporation will introduce KANEBO FUSION-ING SOLUTION, a prestige serum priced at 13,000 yen. It moisturizes and regenerates skin, and the refill can be purchased. The launch fits KANEBO's "I HOPE" brand concept of spreading confidence and positivity with highly developed, high-quality skincare solutions.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan cosmetics ODM market based on the below-mentioned segments:

Japan Cosmetics ODM Market, By Product Type

- Skin Care

- Hair Care

- Makeup

- Body Care

- Others

Japan Cosmetics ODM Market, By Packaging Format

- Bottles

- Compact Cases

- Droppers

- Folding Cartons

- Jars

- Pouches

- Pumps and Dispensers

- Roll-Ons

- Roll-On Sticks

- Sachets

- Sticks

- Tubes

Japan Cosmetics ODM Market, By End Use

- Prestige Brands

- Private Brands

- Mass Brands

- Indie Brands

Need help to buy this report?