Japan Corporate E-Learning Market Size, Share, and COVID-19 Impact Analysis, By Learning Type (Distance Learning, Instructor-led Training, and Blended Learning), By Organization Size (Large Enterprises and SMEs), By Vertical (IT, Healthcare, BFSI, Retail, Manufacturing, and Others), and Japan Corporate E-Learning Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyJapan Corporate E-Learning Market Insights Forecasts to 2035

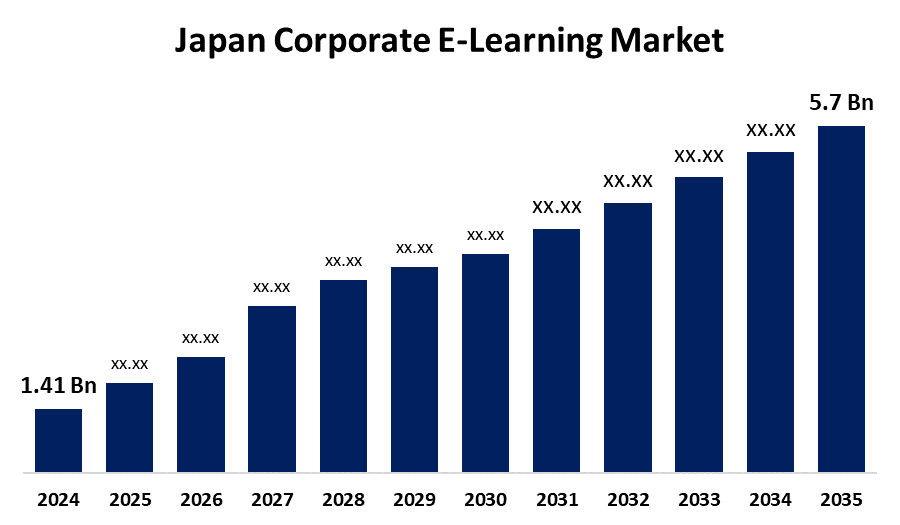

- The Japan Corporate E-Learning Market Size Was Estimated at USD 1.41 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 13.54% from 2025 to 2035

- The Japan Corporate E-Learning Market Size is Expected to Reach USD 5.7 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Japan Corporate E-Learning Market Size is anticipated to Reach USD 5.7 Billion by 2035, Growing at a CAGR of 13.54% from 2025 to 2035. The Japan corporate e-learning market is growing due to increasing demand for adaptive learning, growing investment in employee training, and growing technological capabilities, leading to the deployment of platforms for upskilling, professional growth, and regulatory training across sectors.

Market Overview

The Japan Corporate E-Learning Market Size refers to digital training programs and platforms, such as learning management systems (LMS), online modules, instructor-led virtual classes, and mixed programs, provided to companies for employee development. Application adherence to training, leadership development, technical competencies, language training, and reskilling or upskilling in industries. Strengths in the Japanese market are rooted in modern business demand for standardized, scalable company training and partnering with established business school providers like Globis. Opportunities exist in microlearning, mobile learning, gamification, AI-based personalized learning, and SME adoption. The most important drivers are accelerated digital transformation, increased remote and hybrid working, talent shortages, and pressing requirements for AI and technology focused skills development. Government policies, such as Society 5.0, Digital Agency principles, and MEXT grants for LMS integration, facilitate e-learning growth in academic and corporate sectors.

Report Coverage

This research report categorizes the market for the Japan corporate e-learning market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan corporate e-learning market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan corporate e-learning market.

Japan Corporate E-Learning Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.41 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 13.54% |

| 2035 Value Projection: | USD 5.7 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 193 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Learning Type, By Organization |

| Companies covered:: | Globis Corporation, Polycom, Fujitsu, SoftBank, NEC, Gakken Holdings, Dai Nippon Printing, Rakuten, Hitachi, Benesse Corporation, Classroom Technologies, DreamBox Learning, Nihon Unisy, Mitsubishi Corporation, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan corporate e-learning market is driven by swift digitalization, growing use of remote and hybrid work styles, and the pressing necessity for upskilling and reskilling in new technologies such as AI and data science. The shortages of labor, along with an aging population, are compelling organizations to adopt scalable, flexible training methodologies. Moreover, the need for cost-efficient, standardized learning and ongoing employee development is on the increase. Supportive government initiatives and an IT-aware business culture continue to drive the use of digital learning platforms across sectors.

Restraining Factors

The Japan corporate e-learning market is also hindered by factors like high upfront setup costs, change resistance from established training practices, and limited digital literacy among older workforce members. Even content localization and engagement issues may pose challenges to effective implementation and retention among learners.

Market Segmentation

The Japan corporate e-learning market share is classified into learning type, organization size, and vertical.

- The distance learning segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan corporate e-learning market is segmented by learning type into distance learning, instructor-led training, and blended learning. Among these, the distance learning segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the need for flexible learning solutions that address the demands of the geographically dispersed, heterogeneous workforce in today's organizations. Distance education enables access by employees to learn from where they are, at any time, without the constraint of travel costs.

- The large enterprises segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan corporate e-learning market is segmented by organization size into large enterprises and SMEs. Among these, the large enterprises segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to the growing necessity of organizations to give adequate importance to building the workforce. E-learning is extremely efficient, particularly for large companies with various teams spread across numerous geographical areas is the reason why large companies can save tons of money and utilize it efficiently when applying e-learning in the training of employees.

- The IT segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan corporate e-learning market is segmented by vertical into IT, healthcare, BFSI, retail, manufacturing, and others. Among these, the IT segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the rapid innovation in technology demands frequent upskilling and reskilling of the IT talent pool. With experts needing to catch up on emerging technologies like cloud computing, artificial intelligence, blockchain, and cybersecurity at a fast pace, e-learning platforms provide effective and cost-efficient solutions to skill employees.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan corporate e-learning market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Globis Corporation

- Polycom

- Fujitsu

- SoftBank

- NEC

- Gakken Holdings

- Dai Nippon Printing

- Rakuten

- Hitachi

- Benesse Corporation

- Classroom Technologies

- DreamBox Learning

- Nihon Unisy

- Mitsubishi Corporation

- Others

Recent Developments:

- In April 2025, Fujitsu announced a training platform co-developed with Seven-Eleven Japan, launched in select stores on March 25. Using Fujitsu's Digital Touchpoint, it offers tailored learning, real-time skill tracking, boosts employee readiness, retention, and reduces training burdens on franchise owners and store managers.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan corporate e-learning market based on the below-mentioned segments:

Japan Corporate E-Learning Market, By Learning Type

- Distance Learning

- Instructor-led Training

- Blended Learning

Japan Corporate E-Learning Market, By Organization Size

- Large Enterprises

- SMEs

Japan Corporate E-Learning Market, By Vertical

- IT

- Healthcare

- BFSI

- Retail

- Manufacturing

- Others

Need help to buy this report?