Japan Contract pharmaceutical manufacturing Market Size, Share, and COVID-19 Impact Analysis, By Service Type (Contract Manufacturing Organization (CMO), API Manufacturing, Final Dosage Form Manufacturing, Packaging, and Contract Research Organization (CRO)), By Molecule Type (Small Molecule and Large Molecule), and Japan Contract Pharmaceutical Manufacturing Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareJapan Contract Pharmaceutical Manufacturing Market Insights Forecasts to 2035

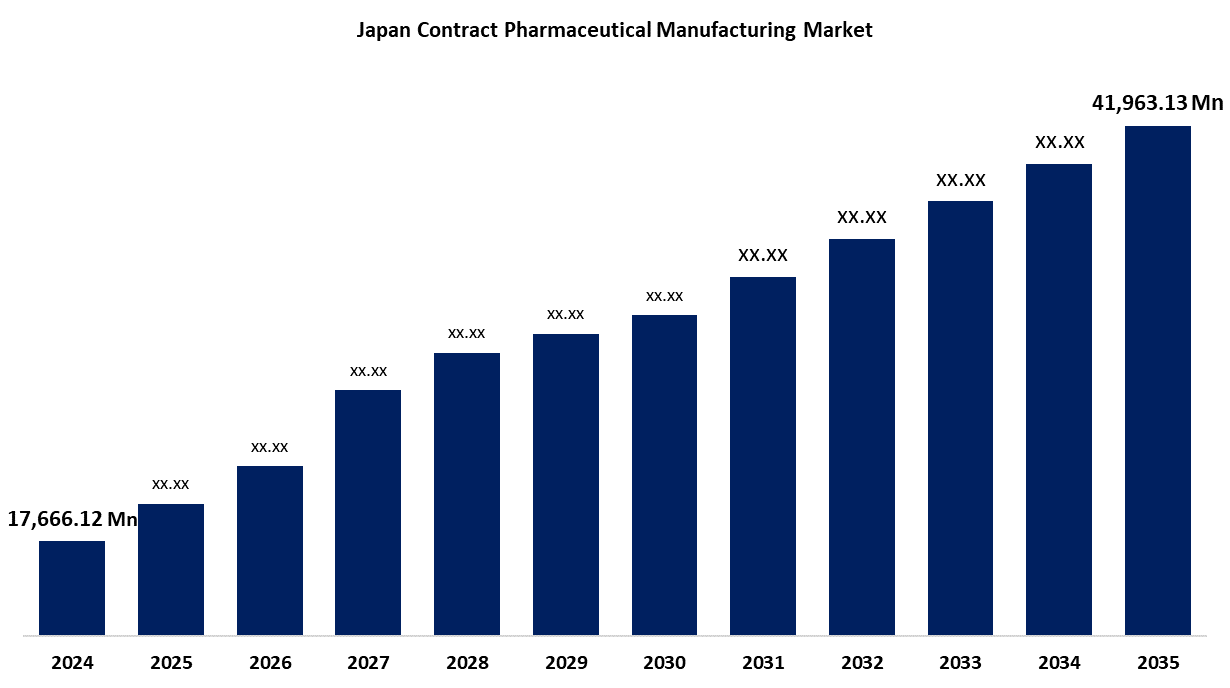

- The Japan Contract Pharmaceutical Manufacturing Market Size Was Estimated at USD 17,666.12 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.18% from 2025 to 2035

- The Japan Contract Pharmaceutical Manufacturing Market Size is Expected to Reach USD 41,963.13 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the Japan Contract Pharmaceutical Manufacturing Market Size is Anticipated to Reach USD 41,963.13 Million by 2035, Growing at a CAGR of 8.18% from 2025 to 2035. Contract manufacturing is expanding in Japan due to growing demand for cost-effective production, particularly from small and mid-sized pharmaceutical companies. Additionally, businesses are being forced to depend on specialist CMOs due to the growing complexity of medicinal formulations.

Market Overview

The Japanese contract pharmaceutical manufacturing market involves outsourcing drug manufacturing services such as formulation, production, packaging, and quality control to third-party contract manufacturing organizations (CMOs). It enables pharmaceutical companies to reduce production costs and focus on core R&D activities. Japan has one of the oldest populations in the world, and the prevalence of age-related chronic diseases like diabetes, cancer, and heart disease has significantly increased. The need for drugs to treat these illnesses has increased as the number of elderly people rises. The need for effective, economical manufacturing solutions is being driven by the rise in the demand for medications. Contract pharmaceutical companies are in a good position to satisfy these expanding demands by offering specialized services that make it possible to produce essential treatments more quickly and affordably.

Report Coverage

This research report categorizes the market for the Japan contract pharmaceutical manufacturing market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan contract pharmaceutical manufacturing market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan contract pharmaceutical manufacturing market.

Japan Contract Pharmaceutical Manufacturing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 17,666.12 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 8.18% |

| 2035 Value Projection: | USD 41,963.13 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Service Type, By Molecule Type and COVID-19 Impact Analysis. |

| Companies covered:: | Lonza Group, Fuji Pharma Co., Ltd., Kaken Pharmaceutical Co., Ltd., JCR Pharmaceuticals Co., Ltd., Daiichi Sankyo Company, Limited, Eisai Co., Ltd and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing need for affordable and superior medication production solutions is propelling the Japan contract pharmaceutical manufacturing market. Japan's highly qualified population and sophisticated technology infrastructure, along with the growing outsourcing trend among pharmaceutical corporations, have propelled industry expansion. Furthermore, two important factors driving market expansion are the growing need for biopharmaceutical production and the growth of contract manufacturing organizations (CMOs). The nation's appeal as a manufacturing hub is further increased by its strict regulatory framework and commitment to international quality standards. Trends that increase production efficiency and lower costs include the use of new manufacturing technology, such as continuous manufacturing and biotechnological developments.

Restraining Factors

High entry barriers for new CMOs are caused by Japan's stringent regulatory frameworks, which include PMDA compliance and Good Manufacturing Practice (GMP) regulations. Time-to-market and scalability for new medications might be hampered by regulatory procedure delays. Furthermore, some pharmaceutical businesses are deterred from outsourcing by issues with intellectual property and a lack of control over supply chains. High-end contract manufacturing is further limited by domestic CMOs' inferior sophisticated manufacturing infrastructure when compared to international companies.

Market Segmentation

The Japan contract pharmaceutical manufacturing market share is classified into service type and molecule type.

- The final dosage form manufacturing segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan contract pharmaceutical manufacturing market is segmented by service type into contract manufacturing organization (CMO), API manufacturing, final dosage form manufacturing, packaging, and contract research organization (CRO). Among these, the final dosage form manufacturing segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. The growing need for ready-to-use pharmaceutical products, such as tablets, capsules, and injectables, has made final dosage form manufacturing a leading service in the Japanese contract pharmaceutical manufacturing market.

- The small-molecule segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan contract pharmaceutical manufacturing market is segmented by molecule type into small-molecule and large molecule. Among these, the small-molecule segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. The most common are small molecules, which make up a sizable portion of contract pharmaceutical production. These compounds are frequently linked to conventional drug formulations and are employed in a broad range of therapy.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan contract pharmaceutical manufacturing market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Lonza Group

- Fuji Pharma Co., Ltd.

- Kaken Pharmaceutical Co., Ltd.

- JCR Pharmaceuticals Co., Ltd.

- Daiichi Sankyo Company, Limited

- Eisai Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Contract Pharmaceutical Manufacturing Market based on the below-mentioned segments:

Japan Contract Pharmaceutical Manufacturing Market, By Service Type

- Contract Manufacturing Organization (CMO)

- API Manufacturing

- Final Dosage Form Manufacturing

- Packaging

- Contract Research Organization (CRO)

Japan Contract Pharmaceutical Manufacturing Market, By Molecule Type

- Small Molecule

- Large Molecule

Need help to buy this report?