Japan Continuous Glucose Monitoring (CGM) Market Size, Share, and COVID-19 Impact Analysis, By Type (Self-monitoring Blood Glucose and Continuous Glucose Monitoring), By Component (Glucometer Devices, Test Strips, Lancets, Sensors, and Durables), and Japan Continuous Glucose Monitoring (CGM) Market Insights, Industry Trend, Forecasts to 2032.

Industry: HealthcareJapan Continuous Glucose Monitoring (CGM) Market Insights Forecasts to 2032

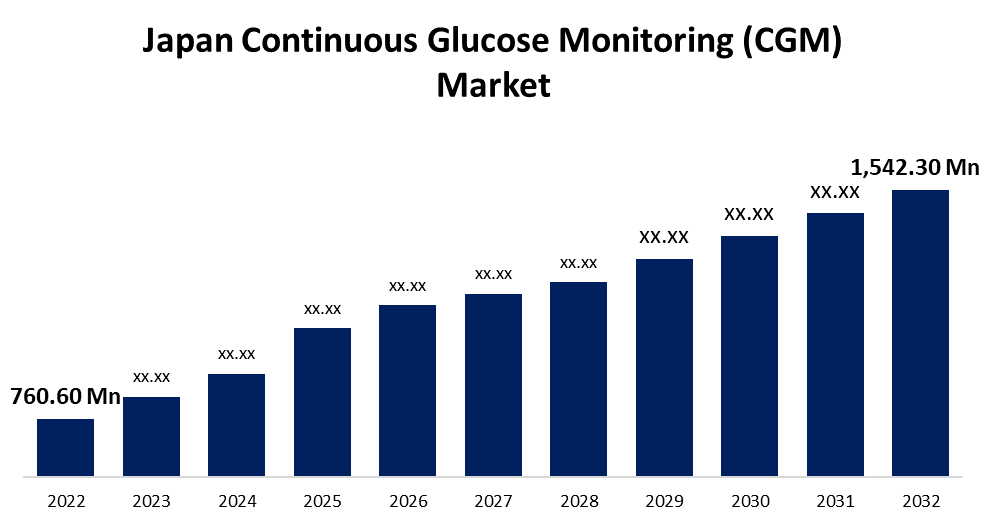

- The Japan Continuous Glucose Monitoring (CGM) Market Size was valued at USD 760.60 Million in 2022.

- The Market is Growing at a CAGR of 7.3% from 2022 to 2032

- The Japan Continuous Glucose Monitoring (CGM) Market Size is expected to reach USD 1,542.30 Million by 2032.

Get more details on this report -

The Japan Continuous Glucose Monitoring (CGM) Market Size was valued at USD 760.60 Million in 2022 and is expected to Grow to USD 1,542.30 Million by 2032, at a CAGR of 7.3% during the forecast period (2022-2032).

Market Overview

Continuous sugar monitoring (CGM), also known as sugar continuous glucose monitoring, automatically checks blood glucose levels throughout the day. Making better-informed decisions regarding daily medication usage, a balanced diet, and physical activity can be improved with real-time glucose monitoring. A tiny sensor used in CGM is implanted beneath the skin, usually on the arm or belly. The sensor detects interstitial glucose, which is present in the intercellular fluid. The sensor checks the glucose level every few minutes, and wireless data transfer relays the results to a monitor. Furthermore, CGMS-based technologies have provided a blueprint for the closed-loop bionic/artificial pancreas. As a result, companies that make glucose monitoring devices focus heavily on developing unique and cutting-edge CGMS. It has a wide range of uses in healthcare settings (hospital ICUs, diagnostic centers, and clinics), for people of various ages, and in different geographical areas. The primary market drivers for the CGM Market include a growing awareness of diabetes preventative care, new product launches, government activities, and the CGM device market.

Report Coverage

This research report categorizes the market of Japan Continuous glucose monitoring (CGM) market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan continuous glucose monitoring (CGM) market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the Japan continuous glucose monitoring (CGM) market.

Japan Continuous Glucose Monitoring (CGM) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 760.60 Million |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 7.3% |

| 2032 Value Projection: | USD 1,542.30 Million |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 145 |

| Tables, Charts & Figures: | 107 |

| Segments covered: | By Type, By Component and Country Statistics (Demand, Price, Growth, Competitors, Challenges) |

| Companies covered:: | Dexcom, Medtronic, Abbott, Everesense, Ascensia. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Continuous sugar monitoring (CGM) technology has undergone significant advancements in recent years, leading to improved accuracy, ease of use, and better integration with other diabetes management systems. These technological advancements have made CGM devices more reliable and user-friendly, encouraging their adoption among patients and healthcare professionals in Japan. Also, The Japan government has been proactive in promoting the adoption of advanced medical technologies to improve healthcare outcomes. It has implemented reimbursement policies and incentives that support the use of CGM devices for diabetes management. These policies make CGM more accessible and affordable for patients, thus driving market growth.

Restraining Factors

Regulatory approval processes in Japan can be stringent and time-consuming. Manufacturers of CGM devices need to comply with rigorous regulatory requirements to ensure the safety and effectiveness of their products. Delays in obtaining regulatory approvals can hinder market entry and slow down the introduction of new and advanced CGM technologies in Japan.

Covid 19 Impacts

The epidemic also highlighted prospects for continuing and growing innovations in diabetes device delivery, including virtual consultations between healthcare practitioners and persons with diabetes and the use of diabetes technology. Crisis management has sparked extraordinary interest in remote treatment from patients and providers alike, as well as the removal of several long-standing legislative restrictions. As a result of the COVID-19 epidemic, the Japanese diabetic medications market expanded.

Market Segment

- In 2022, In 2022, the continuous glucose monitoring segment is dominating the highest market share over the forecast period.

Based on the type, the Japan self-monitoring blood glucose and continuous glucose monitoring. Among these segments continuous glucose monitoring is dominating segment during the forecast period. Continuous glucose monitoring devices measure blood sugar levels using glucose oxidase. Glucose oxidase transforms glucose to hydrogen peroxidase, which combines with the platinum inside the sensor to provide an electrical signal that is sent to the transmitter. The most crucial component of continuous glucose monitoring systems is the sensor. During the projected period, technological developments to increase sensor accuracy are likely to boost segment growth.

- In 2022, the sensors segment is influencing the largest market share during the forecast period.

Based on the type, the Japan continuous glucose monitoring (CGM) market is segmented into glucometer devices, test strips, lancets, sensors, and durables. Among these segments, the sensors segment dominates the largest market share during the forecast period. The Sensors Segment is expected to dominate the continuous glucose monitoring devices market over the forecast period, owing to rising demand for CGMs. Continuous glucose monitoring sensors use glucose oxidase to detect blood sugar (glucose) levels.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan biostimulants market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Dexcom

- Medtronic

- Abbott

- Everesense

- Ascensia

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In December 2022, according to a Terumo Company release, the Dexcom G6 CGM System now has expanded payment coverage under the Japanese medical insurance system. Thanks to the newly defined category of "C150," a broader group of diabetic patients in Japan will be eligible to seek payment for using the Dexcom G6 CGM System.

- In March 2022, according to an Abbott statement, the Japanese Ministry of Health, Labour, and Welfare has approved expanding payment coverage for the Freestyle Libre system to include all diabetics who use insulin at least once per day.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2022 to 2032. Spherical Insights has segmented the Japan Continuous Glucose Monitoring (CGM) Market based on the below-mentioned segments:

Japan Continuous Glucose Monitoring (CGM) Market, By Type

- Self-monitoring Blood Glucose

- Continuous Glucose Monitoring

Japan Continuous Glucose Monitoring (CGM) Market, By Component

- Glucometer Devices

- Test Strips

- Lancets

- Sensors

- Durables

Need help to buy this report?