Japan Construction Chemicals Market Size, Share, and COVID-19 Impact Analysis, By Product (Waterproofing Chemicals, Protective Coatings, Concrete Admixtures, Adhesives and Sealants, and Asphalt Additives), By Application (Residential, Commercial & Industrial, and Infrastructure), and Japan Construction Chemicals Market Insights, Industry Trend, Forecasts to 2035.

Industry: Chemicals & MaterialsJapan Construction Chemicals Market Insights Forecasts to 2035

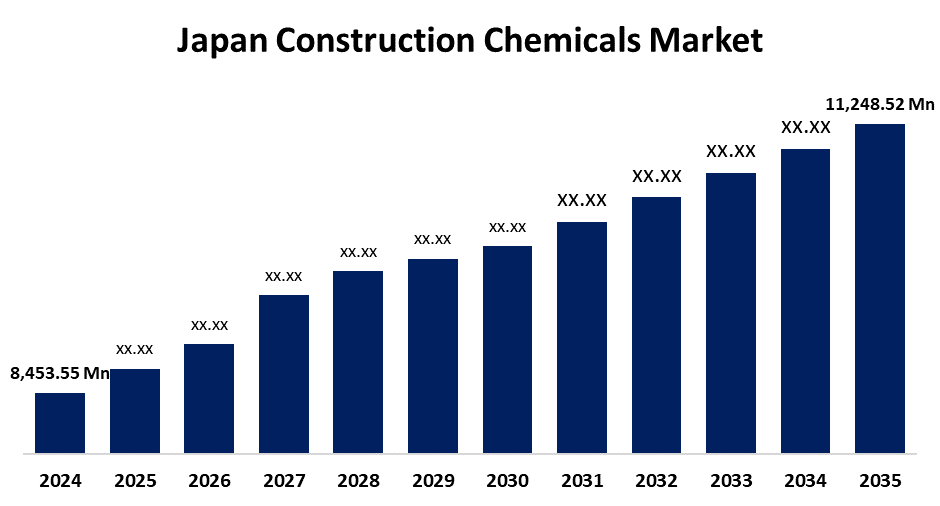

- The Japan Construction Chemicals Market Size Was Estimated at USD 8,453.55 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 2.63% from 2025 to 2035

- The Japan Construction Chemicals Market Size is Expected to Reach USD 11,248.52 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan Construction Chemicals Market Size is anticipated to reach USD 11,248.52 Million by 2035, growing at a CAGR of 2.63% from 2025 to 2035. Government initiatives and technological innovations in construction compounds are also fueling market growth.

Market Overview

The Japan construction chemicals market refers to the industry segment that produces and supplies chemical formulations used in construction activities to enhance the strength, durability, and sustainability of structures. These include admixtures, waterproofing agents, sealants, adhesives, and protective coatings used in residential, commercial, and infrastructure projects. The market for building chemicals in Japan is also significantly influenced by the movement toward environmentally friendly and sustainable development. The use of environmentally friendly chemicals and building materials is rapidly growing as people become more conscious of the effects on the environment. Strict government laws designed to lower carbon emissions and advance green building standards support this trend. Low-VOC paints, coatings, and other green building materials are in high demand as architects, contractors, and developers strive to obtain sustainability certifications and comply with new regulations. In Japan, for example, the use of green building techniques has increased dramatically in the last five years.

Report Coverage

This research report categorizes the market for the Japan construction chemicals market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan construction chemicals market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan construction chemicals market.

Japan Construction Chemicals Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 8,453.55 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 2.63% |

| 2035 Value Projection: | USD 11,248.52 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 235 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product, By Application |

| Companies covered:: | Sika AG, BASF SE, Dow Chemical Company, Henkel AG & Co. KGaA, RPM International Inc., Fosroc International Limited, MAPEI Corporation, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for construction chemicals in Japan is mostly driven by the nation's deteriorating infrastructure. Many public facilities, bridges, and buildings built during previous economic booms are now nearing the end of their useful lives. In order to maintain safety and increase asset lifespans, this aging infrastructure has led to an increasing requirement for rehabilitation, maintenance, and repair efforts. As a result, there is a greater need for construction chemicals such as adhesives, sealants, and protective coatings that are necessary for preserving and repairing different types of building materials. For example, a significant number of Japan's bridges are over 50 years old and urgently need repair. The market has grown as a result of government initiatives and more public spending on infrastructure rehabilitation projects. This has resulted to a continued need for innovative construction chemicals that offer excellent performance and durability in restoration projects.

Restraining Factors

The market is constrained by factors including the high cost of producing sustainable and innovative chemicals, which may make them unaffordable for smaller enterprises. Operational complexity is increased by strict environmental standards that demand constant innovation and compliance. Furthermore, Japan's population decline and low demand for new homes could impede market growth. The sector is particularly vulnerable to price volatility and disruptions in global supply chains because to its reliance on imported raw materials.

Market Segmentation

The Japan construction chemicals market share is classified into product and application.

- The concrete admixtures segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan construction chemicals market is segmented by product into waterproofing chemicals, protective coatings, concrete admixtures, adhesives and sealants, and asphalt additives. Among these, the concrete admixtures segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to their application in improving the strength, workability, and durability of concrete, and admixtures account for a significant portion. There is a growing need for sustainable, high-performing admixtures as urbanization rises.

- The infrastructure segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan construction chemicals market is segmented by application into residential, commercial & industrial, and infrastructure. Among these, the infrastructure segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Japan's aged infrastructure, which necessitates significant rehabilitation, upkeep, and seismic fortification, is the main cause of its supremacy.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan construction chemicals market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sika AG

- BASF SE

- Dow Chemical Company

- Henkel AG & Co. KGaA

- RPM International Inc.

- Fosroc International Limited

- MAPEI Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Construction Chemicals Market based on the following segments:

Japan Construction Chemicals Market, By Product

- Waterproofing Chemicals

- Protective Coatings

- Concrete Admixtures

- Adhesives and Sealants

- Asphalt Additives

Japan Construction Chemicals Market, By Application

- Residential

- Commercial & Industrial

- Infrastructure

Need help to buy this report?