Japan Connected Logistics Market Size, Share, and COVID-19 Impact Analysis, By Component (Hardware, Solutions, and Services), By Transportation Mode (Roadways, Railways, Airways, and Seaways), By End Use (Automotive, Manufacturing, Oil and Gas, IT and Telecom, Healthcare, IT and Telecommunication, Retail, Food and Beverage, and Others), and Japan Connected Logistics Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationJapan Connected Logistics Market Insights Forecasts to 2035

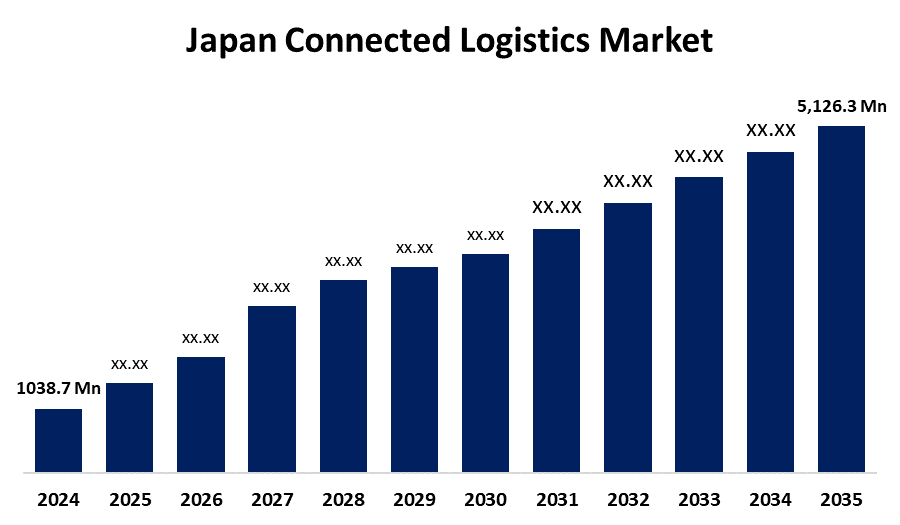

- The Japan Connected Logistics Market Size Was Estimated at USD 1038.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 15.62% from 2025 to 2035

- The Japan Connected Logistics Market Size is Expected to Reach USD 5,126.3 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Japan Connected Logistics Market Size is anticipated to reach USD 5,126.3 Million by 2035, growing at a CAGR of 15.62% from 2025 to 2035. The Japan connected logistics market is expanding due to a host of factors, including the rise in e-commerce, higher uptake of IoT and other technologies, and focus on efficient supply chain management.

Market Overview

The Japan connected logistics market refers to the integration of digital technologies such as IoT, AI, and automation into logistics operations to increase supply chain visibility, efficiency, and responsiveness. The industry serves sectors like e-commerce, manufacturing, healthcare, and retailing for real-time tracking, predictive reporting, and route planning. The market has Japan's advanced technological infrastructure, high internet penetration, and high innovation focus as its strengths. The opportunities in segments like smart warehousing, cold chain logistics, and cross-border e-commerce are huge. The key drivers are the rapid growth of e-commerce, a growing aging population, and the need for environmentally friendly logistics solutions. Government initiatives, such as the "Visionary Logistics 2030" program, aim to reduce logistics costs by 10% with the implementation of technology and efficiency improvement. On an industrial scale, developments such as the proposed 310-mile driverless cargo transport link between Tokyo and Osaka are set to revolutionize freight haulage, ending shortages of drivers and reducing carbon emissions.

Report Coverage

This research report categorizes the market for the Japan connected logistics market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan connected logistics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan connected logistics market.

Japan Connected Logistics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1038.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 15.62% |

| 2035 Value Projection: | USD 5,126.3 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 271 |

| Tables, Charts & Figures: | 101 |

| Segments covered: | By Component, By Transportation Mode and By End Use |

| Companies covered:: | Yamato Holdings, FedEx Corporation, Sagawa Express, DHL Japan, Nippon Express, Schenker-Seino, Japan Post, Rakuten, Mitsubishi Logistics Corporation, Blue Dart, Kintetsu World Express, DTDC, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The main drivers of Japan's connected logistics sector are the rise in e-commerce, the rising demand for real-time visibility in the supply chain, and coping with labor shortages due to the aging population. Technological advancements in IoT, AI, and automation also contribute to efficiency and cost reduction. Sustainability goals and government initiatives promoting smart infrastructure and digitalization are also pushing industries to adopt connected logistics solutions.

Restraining Factors

The Japan connected logistics market is constrained by the lack of manpower owing to the new driver work-hour regulations, costly technology implementation costs, stringent environmental controls, and complexity in incorporating new advanced systems with the existing logistics infrastructure.

Market Segmentation

The Japan Connected Logistics Market Share is classified into component, transportation mode, and end use.

- The solutions segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan connected logistics market is segmented by component into hardware, solutions, and services. Among these, the solutions segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the application of emerging technologies, such as the Internet of Things (IoT), artificial intelligence (AI), and data analytics, to coordinate and drive the flow of goods and information across the end-to-end supply chain. Predictive knowledge and automation are facilitated by interconnected logistics solutions that redefine how logistics operations are planned and executed.

- The roadways segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan connected logistics market is segmented by transportation mode into roadways, railways, airways, and seaways. Among these, the roadways segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to that they offer real-time visibility to the movement of trucks and goods on roads. Logistics operators can track vehicle location, speed, and status using technologies such as GPS, sensors, and telematics, which allows them to better manage and monitor the whole supply chain.

- The manufacturing segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan connected logistics market is segmented by end use into automotive, manufacturing, oil and gas, IT and telecom, healthcare, IT and telecommunication, retail, food and beverage, and others. Among these, the manufacturing segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to its use of connected logistics to revolutionize the production, distribution, and delivery of products. Connected logistics, enabled by new technologies and data-driven solutions, presents numerous benefits to the manufacturing industry, making it more efficient, reducing costs, and increasing overall performance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan connected logistics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Yamato Holdings

- FedEx Corporation

- Sagawa Express

- DHL Japan

- Nippon Express

- Schenker-Seino

- Japan Post

- Rakuten

- Mitsubishi Logistics Corporation

- Blue Dart

- Kintetsu World Express

- DTDC

- Others

Recent Developments:

- In March 2024, FedEx disclosed deploying AI and robotics to streamline inbound logistics procedures. The effort is to improve the speed and accuracy of sorting and delivering inbound merchandise, cutting operational expenses, and shortening delivery times.

- In February 2024, DHL pledged to reach zero emissions in its logistics by 2050. To support this pledge, DHL is moving into electric vehicles and green fuel options to decrease the carbon footprint of its inbound logistics.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan connected logistics market based on the below-mentioned segments:

Japan Connected Logistics Market, By Component

- Hardware

- Solutions

- Services

Japan Connected Logistics Market, By Transportation Mode

- Roadways

- Railways

- Airways

- Seaways

Japan Connected Logistics Market, By End Use

- Automotive

- Manufacturing

- Oil and Gas

- IT and Telecom

- Healthcare

- IT and Telecommunication,

- Retail

- Food and Beverage

- Others

Need help to buy this report?