Japan Confectionery Packaging Market Size, Share, and COVID-19 Impact Analysis, By Material Type (Plastic, Paper and Paperboard, Glass, and Metal), By Confectionery Type (Chocolate Confectionery, Sugar Confectionery, Gums, Fruit and Nuts, and Other Confectionery Types), By Packaging Type (Flexible Packaging and Rigid Packaging), and Japan Confectionery Packaging Market Insights, Industry Trend, Forecasts to 2035.

Industry: Food & BeveragesJapan Confectionery Packaging Market Insights Forecasts to 2035

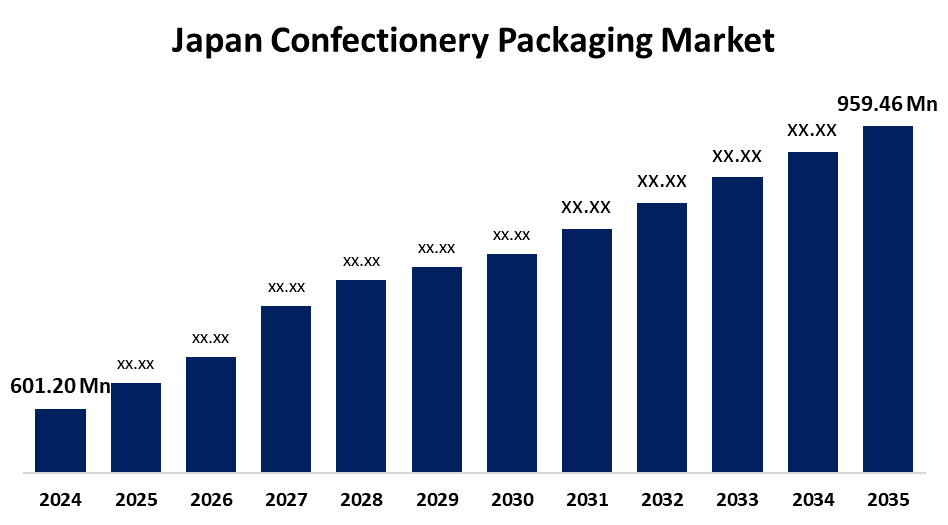

- The Japan Confectionery Packaging Market Size was estimated at USD 601.20 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.34% from 2025 to 2035

- The Japan Confectionery Packaging Market Size is Expected to Reach USD 959.46 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan Confectionery Packaging Market Size is anticipated to reach USD 959.46 Million by 2035, growing at a CAGR of 4.34% from 2025 to 2035. The market for Japan confectionery packaging is growing due to the higher consumer demand for premium, convenience, and culturally significant packaging. It is driven by aspects such as higher disposable incomes, evolving lifestyles, and a desire for healthy, natural ingredients.

Market Overview

The Japan confectionery packaging market refers to the manufacture, design, and application of packaging materials that are specifically for chocolates, sweets, snacks, and other confectionery items. Packaging helps to safeguard these items from damage, maintain freshness, improve shelf life, and improve visual attractiveness to entice consumers. Japan's strengths are premium packaging technology, high-quality standards, and high consumer desire for visually appealing, functional packages. Opportunities are sustainable packaging innovations, such as biodegradable and smart packaging with freshness indicators, addressing consumers' care for the environment. The market is stimulated by growing demand for high-quality and convenient confectionery products, growing health consciousness leading to creative packaging solutions such as resealable and environmentally friendly packs, and increasing online sales. Government policies supporting sustainability and waste minimization, such as plastic regulations and the inducement of recyclable materials, also influence market development.

Report Coverage

This research report categorizes the market for the Japan confectionery packaging market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan confectionery packaging market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan confectionery packaging market.

Japan Confectionery Packaging Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 601.20 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.34% |

| 2035 Value Projection: | USD 959.46 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Material Type, By Confectionery Type, By Packaging Type |

| Companies covered:: | Rengo Co., Ltd., Toppan Inc., Nestle SA, Meiji Holdings Co., Ltd., Morinaga & Co., Ltd., Ezaki Glico Co., Ltd., Printpack Inc., Guangzhou Novel Packaging, Stanpac Inc., Fujiya Co., Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The confectionery packaging market in Japan is driven by a growing consumer base demanding decorative, convenient, and eco-friendly packaging solutions. Growing health awareness prompts innovations such as resealing and eco-friendly packages. E-commerce growth increases demand for strong, protective packaging. Apart from this, the high gift culture in Japan drives sales for upscale and visually pleasing packages. Government support in the form of regulation for sustainability and reducing waste also compels makers to implement recyclable and biodegradable packaging, fueling market growth and innovation.

Restraining Factors

The Japan confectionery packaging industry is confronted with constraints, including expensive production, stringent regulations on plastic usage, and difficulties in balancing product preservation and sustainability. Fluctuating raw material prices and consumer concern over packaging waste also affect market growth.

Market Segmentation

The Japan confectionery packaging market share is classified into material type, confectionery type, and packaging type.

- The plastic segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan confectionery packaging market is segmented by material type into plastic, paper and paperboard, glass, and metal. Among these, the plastic segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to its versatility in offering different shapes, sizes, and barrier properties that can increase product protection and appearance. The material also safeguards confectionery products from outside destructive factors, such as dust, UV light, and others.

- The chocolate confectionery segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan confectionery packaging market is segmented by confectionery type into chocolate confectionery, sugar confectionery, gums, fruit and nuts, and other confectionery types. Among these, the chocolate confectionery segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to aims at preserving product freshness, preventing temperature fluctuations, and adding visual appeal to attract consumers. The rising use of intelligent devices, rising internet penetration, and growing availability of chocolates on online platforms, the demand for chocolates and drives segment growth.

- The flexible packaging segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan confectionery packaging market is segmented by packaging type into flexible packaging and rigid packaging. Among these, the flexible packaging segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to its hygienic, convenient, and easy-to-use nature, which increases the demand for confectionery items packed in this form of packaging. Flexible packing arrangements are marked by their capacity to conform to the shape and size of the confectionery products, creating a protective cover against external influences like light, moisture, and air while presenting convenience in transportation and storage.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan confectionery packaging market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Rengo Co., Ltd.

- Toppan Inc.

- Nestle SA

- Meiji Holdings Co., Ltd.

- Morinaga & Co., Ltd.

- Ezaki Glico Co., Ltd.

- Printpack Inc.

- Guangzhou Novel Packaging

- Stanpac Inc.

- Fujiya Co., Ltd.

- Others

Recent Developments:

- In December 2024, Toppan Holdings stated that it would acquire Sonoco's Thermoformed & Flexible Packaging business for USD 1.8 billion. The transaction enhances Toppan's packaging solutions, combining Sonoco's capability with Toppan's superior manufacturing and technical capabilities, enhancing confectionery and bakery packaging offerings.

- In April 2025, New KitKat varieties, such as Pine Ame and Sakura, were rolled out by Nestle in Japan. They are packaged in single boxes with 10 separately wrapped KitKats and represent new packaging strategies by the company to entice both local consumers and overseas tourists at the Osaka Expo, which affects the Japanese confectionery packaging market.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan confectionery packaging market based on the below-mentioned segments:

Japan Confectionery Packaging Market, By Material Type

- Plastic

- Paper and Paperboard

- Glass

- Metal

Japan Confectionery Packaging Market, By Confectionery Type

- Chocolate Confectionery

- Sugar Confectionery

- Gums

- Fruit and Nuts

- Other Confectionery Types

Japan Confectionery Packaging Market, By Packaging Type

- Flexible Packaging

- Rigid Packaging

Need help to buy this report?