Japan Compatibility Testing Market Size, Share, and COVID-19 Impact Analysis, By Type (Hardware, Software, and Operating Systems), By Application (Large Enterprises, Small and Medium-Sized Enterprises (SMEs)), and Japan Compatibility Testing Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyJapan Compatibility Testing Market Insights Forecasts to 2035

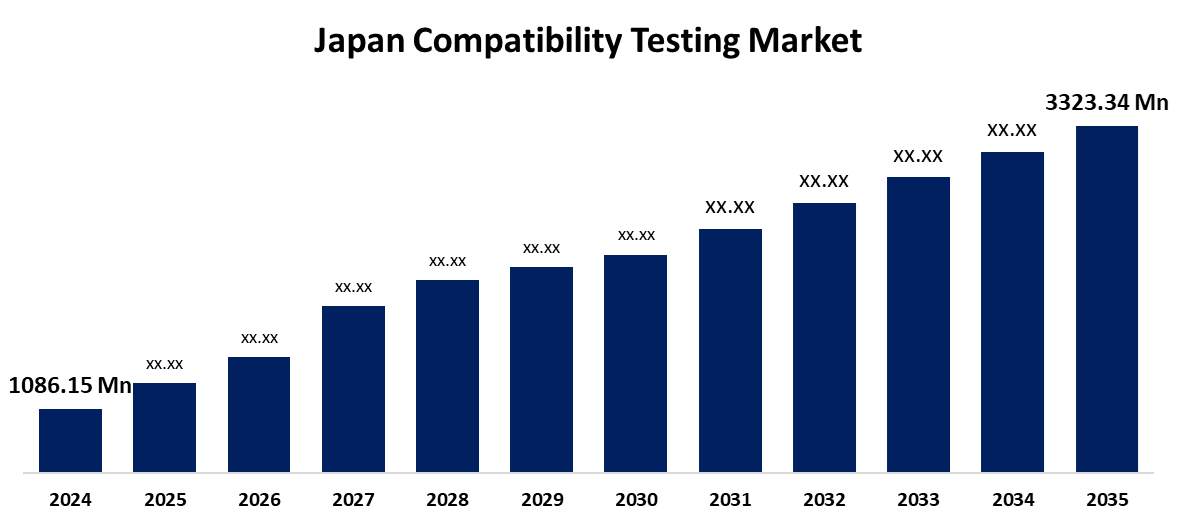

- The Japan Compatibility Testing Market Size Was Estimated at USD 1086.15 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 10.70% from 2025 to 2035

- The Japan Compatibility Testing Market Size is Expected to Reach USD 3,323.34 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Japan Compatibility Testing Market Size is anticipated to Reach USD 3,323.34 Million by 2035, Growing at a CAGR of 10.70% from 2025 to 2035. The market is driven by rapid adoption of emerging technologies like IoT, 5G, and AI, which require rigorous testing for interoperability.

Market Overview

The Japan Compatibility Testing Market Size involves evaluating software, hardware, and systems to ensure they function seamlessly across various devices, operating systems, browsers, and network environments. The market for compatibility testing in Japan is mostly driven by the quick development of new technologies and their uptake. Robust compatibility testing is becoming increasingly important as enterprises incorporate technologies like IoT, 5G networks, AI, and ML into their processes. To guarantee correct operation in a variety of settings, IoT devices, for example, need to communicate seamlessly across several platforms, protocols, and networks, which calls for thorough compatibility testing. New issues with device compatibility, network performance, and interoperability with current systems are brought about by the introduction of 5G networks. By ensuring that new hardware and software can function effectively within these sophisticated networks, compatibility testing reduces operational interruptions and improves user experience.

Report Coverage

This research report categorizes the market for the Japan compatibility testing market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan compatibility testing market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan compatibility testing market.

Japan Compatibility Testing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1086.15 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 10.70% |

| 2035 Value Projection: | USD 3,323.34 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 103 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Fujitsu Limited, NEC Corporation, NTT Data Corporation, Rakuten Software, TestFirst, CyberAgent, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

This industry is mostly driven by the quick uptake of new technologies like IoT, 5G, and AI, which need to be thoroughly tested to make sure they work with current systems. Furthermore, the desire to reduce the risks of software malfunctions and the increasing focus on user experience are driving up demand for compatibility testing services. Additionally, market trends indicate a rise in the outsourcing of testing services to specialist vendors, which is anticipated to fuel additional market growth. As hardware and software systems get more complex, there is a need for thorough testing to guarantee smooth compatibility across many platforms and devices, which is driving this strong growth trajectory. As companies emphasize compatibility testing to improve product reliability and user pleasure, the industry is seeing an increase in demand.

Restraining Factors

The market challenges high testing costs and a shortage of trained workers, particularly for advanced platforms, despite rising demand. Long validation periods caused by regulatory compliance requirements might postpone product releases. Device and platform fragmentation increases complexity and lengthens the time needed for thorough testing. Additionally, small and medium-sized businesses (SMEs) can find it difficult to afford the infrastructure and costs associated with internal testing, which could force them to rely on outside providers.

Market Segmentation

The Japan compatibility testing market share is classified into type and application.

- The hardware segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan compatibility testing market is segmented by type into hardware, software, and operating systems. Among these, the hardware segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. In Japan's varied consumer electronics and industrial machinery sectors, hardware compatibility testing is crucial. It improves customer happiness throughout the nation's technologically evolved terrain and helps avoid operational failures.

- The large enterprises segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan compatibility testing market is segmented by application into large enterprises, small and medium-sized enterprises (SMEs). Among these, the large enterprises segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Compatibility testing is crucial for large Japanese businesses, particularly those with international operations, to guarantee smooth interoperability across their diverse hardware and software systems.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan compatibility testing market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Fujitsu Limited

- NEC Corporation

- NTT Data Corporation

- Rakuten Software

- TestFirst

- CyberAgent

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Compatibility Testing Market based on the following segments:

Japan Compatibility Testing Market, By Type

- Hardware

- Software

- Operating Systems

Japan Compatibility Testing Market, By Application

- Large Enterprises

- Small and Medium-Sized Enterprises (SMEs)

Need help to buy this report?