Japan Communications Platform as a Service Market Size, Share, and COVID-19 Impact Analysis, By Solution (Software and Services), By Enterprise Size (Small & Medium Enterprises, and Large Enterprises), By Industry (IT & Telecom, BFSI, Manufacturing, Healthcare, Retail & CPG, and Others), and Japan Communications Platform as a Service Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyJapan Communications Platform as a Service Market Insights Forecasts to 2035

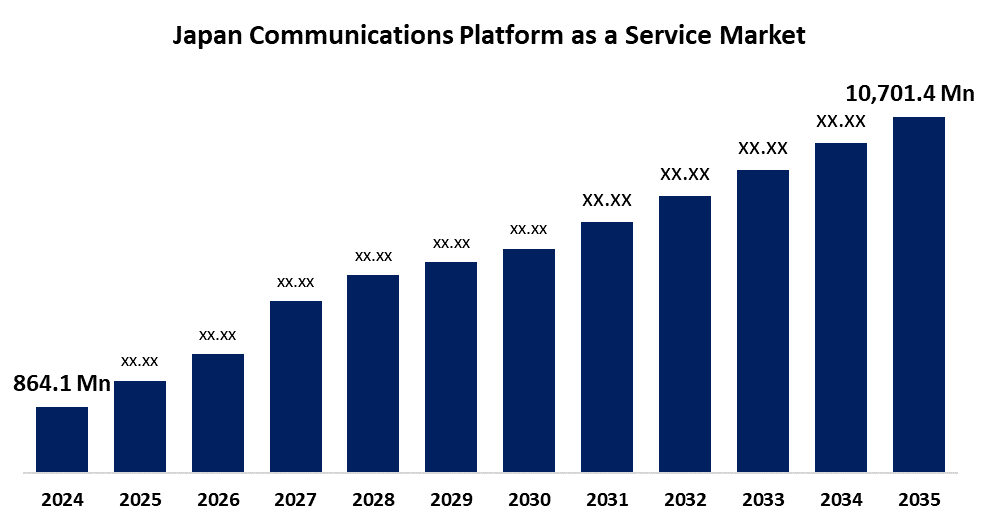

- The Japan Communications Platform as a Service Market Size Was Estimated at USD 864.1 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 25.7% from 2025 to 2035

- The Japan Communications Platform as a Service Market Size is Expected to Reach USD 10,701.4 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Japan Communications Platform As A Service Market Size is anticipated to reach USD 10,701.4 Million by 2035, growing at a CAGR of 25.7% from 2025 to 2035. The Japan communications platform as a service market is growing as a result of heightened digitalization, government initiatives supporting startups, and expanding adoption of cloud communication services. Drivers are the need for scalable, flexible communication offerings, especially in BFSI, healthcare, and IT sectors, and the need for compliance and security communication solutions.

Market Overview

The Japan communications platform as a service market refers to the designation given to cloud-based platforms that allow developers to add real-time communication capabilities voice, video, messaging, and authentication, to apps without having to use backend infrastructure. communications platform as a service is utilized extensively across customer engagement, telemedicine, e-commerce, and work-from-home solutions to boost communication efficiency and user experience. Japan's mature IT infrastructure, robust enterprise adoption, and high mobile connectivity are major strengths behind communications platform as a service growth. Opportunities exist through the embedding of emerging technologies such as 5G, AI, and IoT to provide more personalized and scalable communication solutions. Market expansion is fueled by growing smartphone penetration, IT transformation in industries, and expanding demand for omnichannel communication. Besides, government initiatives for digital innovation, such as Society 5.0 and cloud adoption, drive market growth.

Report Coverage

This research report categorizes the market for the Japan communications platform as a service market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan communications platform as a service market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan communications platform as a service market.

Japan Communications Platform as a Service Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 864.1 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 25.7% |

| 2035 Value Projection: | USD 10,701.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 252 |

| Tables, Charts & Figures: | 98 |

| Segments covered: | By Solution, By Enterprise Size and By Industry |

| Companies covered:: | NTT Communications Corporation, Karakuri Inc., SoftBank, Twilio Japan G.K., Rakuten Viber Japan, JSAT Corporation, KDDI Web Communications, Socket Inc., Internet Initiative Japan, LINE WORKS, Infobip Japan, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The Japan communications platform as a service market is fueled by fast-paced digitalization, mass adoption of smartphones, and escalating need for instant, seamless communication across sectors such as healthcare, retail, and finance. Remote working and e-commerce growth drive demand for voice, video, and messaging converged solutions. Sophisticated IT infrastructure and government policies that encourage the adoption of cloud technology and 5G rollout further speed up communications platform as a service adoption to improve customer interaction and business processes.

Restraining Factors

The Japan communications platform as a service market encounters challenges like stringent data protection laws, security risks, and difficulty in integrating with older systems. Moreover, limited availability of skilled IT personnel, high upfront costs, and vendor lock-in risks prevent mass adoption, particularly by smaller companies.

Market Segmentation

The Japan Communications Platform As A Service Market share is classified into solution, enterprise size, and industry.

- The software segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan communications platform as a service market is segmented by solution into software and services. Among these, the software segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to they provide increased capabilities such as programmable voice, SMS, and video APIs, AI-driven chatbots, and analytics capabilities, allowing businesses to customize customer interactions and optimize their operations.

- The small & medium enterprises segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan communications platform as a service market is segmented by enterprise size into small & medium enterprises, and large enterprises. Among these, the small & medium enterprises segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to the increasing use of low-cost, scalable, and elastic communication solutions that allow SMEs to embed real-time voice, messaging, and video capabilities into applications without the necessity for expensive infrastructure investment.

- The IT & telecom segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan communications platform as a service market is segmented by industry into IT & telecom, BFSI, manufacturing, healthcare, retail & CPG, and others. Among these, the IT & telecom segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the early and extensive adoption of communications platform as a service solutions across the IT and telecommunications industry. Businesses within this realm bank on communication paths that are real-time, secure, and dependable to facilitate customer interactions, operate the network, and provide multiple services like voice calling, SMS, video conferencing, and chat support.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan communications platform as a service market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- NTT Communications Corporation

- Karakuri Inc.

- SoftBank

- Twilio Japan G.K.

- Rakuten Viber Japan

- JSAT Corporation

- KDDI Web Communications

- Socket Inc.

- Internet Initiative Japan

- LINE WORKS

- Infobip Japan

- Others

Recent Developments:

- In August 2024, Twilio Japan partnered with Mercari and ZOZOTOWN to streamline SMS-based identity authentication and voice fallback mechanisms during e-commerce peak periods at seasonal times of sales.

- In October 2024, the Rakuten Travel and All Nippon Airways mobile apps, powered by Infobip Japan, launched RCS Business Messaging, sending users itinerary reminders and flight check-ins via branded messaging.

- In January 2025, KDDI Web Communications began a joint development initiative to introduce telehealth notifications and appointment scheduling using CPaaS with Kyoto University Hospital and LINE API.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan communications platform as a service market based on the below-mentioned segments:

Japan Communications Platform as a Service Market, By Solution

- Software

- Services

Japan Communications Platform as a Service Market, By Enterprise Size

- Small & Medium Enterprises

- Large Enterprise

Japan Communications Platform as a Service Market, By Industry

- IT & Telecom

- BFSI

- Manufacturing

- Healthcare

- Retail & CPG

- Others

Need help to buy this report?