Japan Commercial and Video Telematics Market Size, Share, and COVID-19 Impact Analysis, By Vehicle Type (LCV, MCV, and HCV), By Deployment (Cloud-Base and On-Premises), By Application (Fleet Management, Insurance Telematics, Law Enforcement, and Others), By Component (Hardware, Software, and Services), By End-Use Industry (Transportation and Logistics, Media and Entertainment, Government and Utilities, Travel and Tourism, Construction, Healthcare, and Others), and Japan Commercial & Video Telematics Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyJapan Commercial and Video Telematics Market Insights Forecasts to 2035

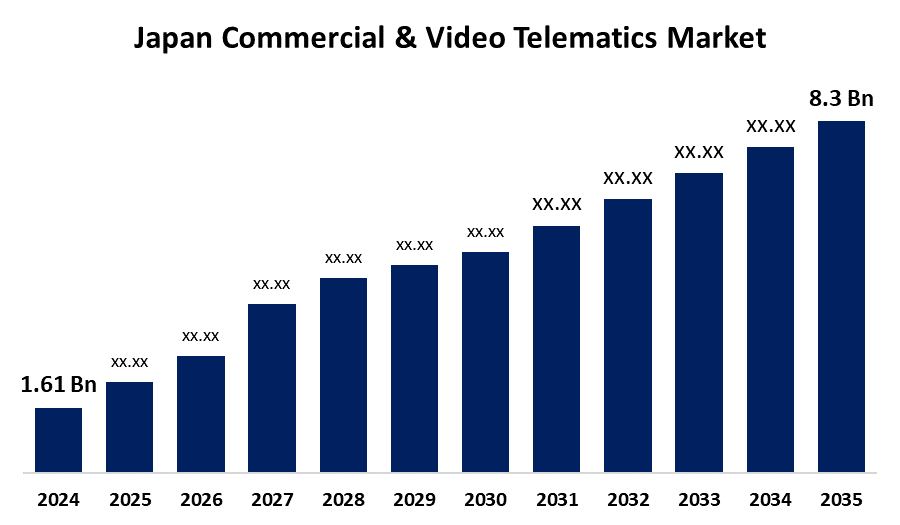

- The Japan Commercial and Video Telematics Market Size Was Estimated at USD 1.61 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 15.98% from 2025 to 2035

- The Japan Commercial & Video Telematics Market Size is Expected to Reach USD 8.3 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Japan Commercial and Video Telematics Market Size is anticipated to reach USD 8.3 Billion by 2035, growing at a CAGR of 15.98 % from 2025 to 2035. The Japan commercial & video telematics market presents opportunities through AI-driven predictive analytics, 5G-enabled real-time tracking, integration with electric and autonomous vehicles, strengthened regulatory compliance, and increasing demand for efficient, cost-effective fleet management solutions.

Market Overview

The Japan commercial & video telematics market refers to the industry focused on integrating telecommunications and informatics to improve vehicle monitoring, fleet management, and driver safety through GPS tracking, video surveillance, and data analytics. This market is gaining strong momentum in Japan due to government initiatives promoting road safety, smart transportation systems, and stricter compliance with vehicle safety regulations. Programs such as Japan’s Intelligent Transport System (ITS) and regulatory support for advanced driver-assistance systems (ADAS) are accelerating adoption. Key driving factors include the rapid expansion of logistics and e-commerce, increasing demand for real-time fleet monitoring, rising concerns for driver and passenger safety, and the adoption of 5G and AI technologies that enhance operational efficiency and reduce transportation costs.

Report Coverage

This research report categorizes the market for the Japan commercial & video telematics market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan commercial & video telematics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan commercial & video telematics market.

Japan Commercial and Video Telematics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.61 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 15.98 % |

| 2035 Value Projection: | USD 8.3 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Vehicle Type, By Deployment, By Application, By Component and By End-Use Industry |

| Companies covered:: | Mitsubishi Electric, Toyota Connected, Hino Motors, Panasonic, Fujitsu, Webfleet Solutions (Bridgestone), Mix Telematics, Hitachi Construction Machinery, Trimble Inc., Nissan, Zonar Systems, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan commercial & video telematics market is driven by several critical factors. Growing demand for real-time fleet monitoring and optimization in logistics and transportation is a major driver. The expansion of e-commerce has further accelerated the need for efficient delivery operations. Rising concerns about road safety and driver accountability are fueling adoption of video-based telematics solutions. Additionally, government initiatives promoting smart mobility, intelligent transport systems (ITS), and regulatory compliance for safety standards are boosting market growth. Technological advancements such as 5G connectivity, artificial intelligence, and predictive analytics are further enhancing efficiency, reducing costs, and driving widespread adoption across industries.

Restraining Factors

High implementation costs, data privacy concerns, a limited skilled workforce, and resistance from traditional fleet operators are key restraining factors hindering the widespread adoption of Japan’s commercial & video telematics market.

Market Segmentation

The Japan commercial & video telematics market share is classified into vehicle type, deployment, application, component, and end-use industry.

- The Light Commercial Vehicles (LCV) segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan commercial & video telematics market is segmented by Vehicle Type into LCV, MCV, and HCV. Among these, the Light Commercial Vehicles (LCV) segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This growth is driven by the rapid expansion of e-commerce and last-mile delivery services in Japan, which rely heavily on LCVs for efficient transportation. Additionally, government emphasis on road safety, adoption of video-based telematics for driver monitoring, and the increasing need for cost-effective fleet management solutions further support strong demand in this segment.

- The cloud-base segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan commercial & video telematics market is segmented by deployment into cloud-base and on-premises. Among these, the cloud-base segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Growth is supported by the increasing adoption of digital fleet management solutions, scalability of cloud platforms, lower upfront infrastructure costs, and ease of integration with advanced technologies like AI and 5G. Additionally, Japan’s strong push toward digital transformation and government-backed smart mobility initiatives further accelerate the shift from on-premises systems to cloud-based telematics, making it the preferred deployment model for both large and small fleet operators.

- The fleet management segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan commercial & video telematics market is segmented by application into fleet management, insurance telematics, law enforcement, and others. Among these, the fleet management segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This dominance is driven by the rapid expansion of logistics, e-commerce, and last-mile delivery services in Japan, which demand real-time vehicle tracking, route optimization, and driver performance monitoring. Additionally, rising fuel costs and the need for cost-efficient operations are pushing companies toward advanced fleet telematics solutions. Government initiatives promoting road safety and smart transportation further strengthen adoption, making fleet management the most influential and fastest-growing application segment in this market.

- The software segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan commercial & video telematics market is segmented by component into hardware, software, and services. Among these, the software segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growing demand for cloud-based fleet management platforms, AI-powered analytics, real-time monitoring dashboards, and integration with 5G connectivity is fueling software adoption. Software solutions enable predictive maintenance, driver behavior analysis, route optimization, and compliance tracking, which are increasingly essential for logistics and transportation companies. Furthermore, Japan’s push toward digital transformation and smart mobility initiatives is accelerating the shift from hardware-dependent systems to advanced software solutions, driving sustained growth in this segment.

- The transportation and logistics segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan commercial & video telematics market is segmented by end-use industry into transportation and logistics, media and entertainment, government and utilities, travel and tourism, construction, healthcare, and others. Among these, the transportation and logistics segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This dominance is attributed to the rapid growth of e-commerce, increasing demand for efficient last-mile delivery, and rising fuel and operational costs that drive fleet operators to adopt telematics for route optimization and real-time monitoring. Government initiatives promoting road safety and smart mobility also accelerate adoption. Additionally, integration of AI, 5G, and video analytics in fleet management enhances efficiency and compliance, solidifying transportation and logistics as the leading growth segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan commercial & video telematics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mitsubishi Electric

- Toyota Connected

- Hino Motors

- Panasonic

- Fujitsu

- Webfleet Solutions (Bridgestone)

- Mix Telematics

- Hitachi Construction Machinery

- Trimble Inc.

- Nissan

- Zonar Systems

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2025, Mitsubishi launched an EV battery swap network in Tokyo for cars and trucks, boosting fleet efficiency and minimizing downtime an advancement that complements Japan’s growing commercial & video telematics market.

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan commercial & video telematics market based on the following segments:

Japan Commercial & Video Telematics Market, By Vehicle Type

- LCV

- MCV

- HCV

Japan Commercial & Video Telematics Market, By Deployment

- Cloud-Base

- On-Premises

Japan Commercial & Video Telematics Market, By Application

- Fleet Management

- Insurance Telematics

- Law Enforcement

- Others

Japan Commercial & Video Telematics Market, By Component

- Hardwar

- Software

- Services

Japan Commercial & Video Telematics Market, By End-Use Industry

- Transportation and Logistics

- Media and Entertainment

- Government and Utilities

- Travel and Tourism

- Construction

- Healthcare

- Others

Need help to buy this report?