Japan Commercial Vehicle Market Size, Share, and COVID-19 Impact Analysis, By Vehicle Type (Light Commercial Vehicles, Medium & Heavy Commercial Vehicles, Bus, Coaches, Others), By Engine Type (ICE, Hybrid & Electric Vehicles), By End-use (Industrial, Mining & Construction, Logistics, Passenger Transportation, Others), and Japan Commercial Vehicle Market Insights Forecasts to 2032

Industry: Automotive & TransportationJapan Commercial Vehicle Market Insights Forecasts to 2032

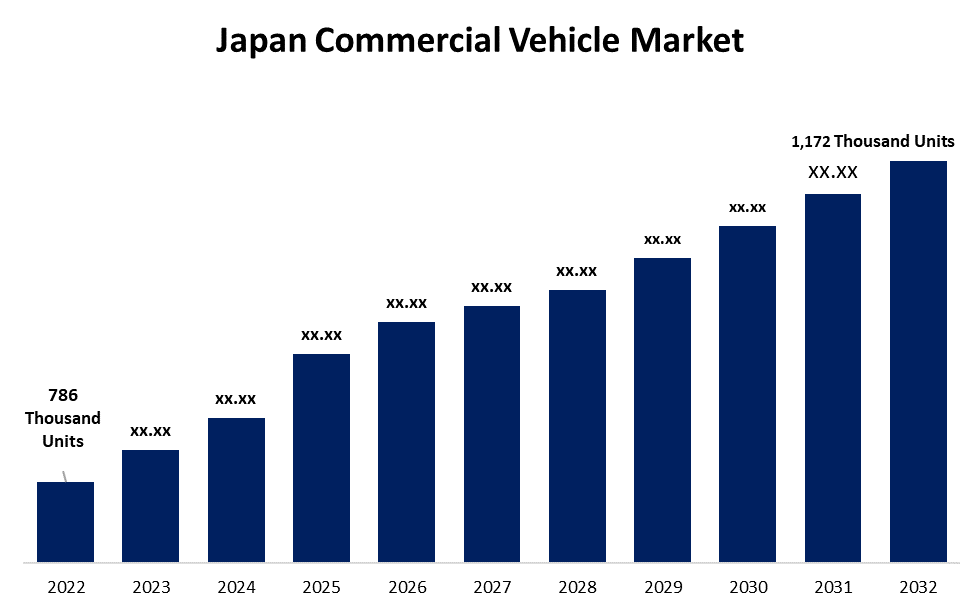

- The Japan Commercial Vehicle Market Size was valued at 786 Thousand Units in 2022.

- The Market Size is growing at a CAGR of 4.1% from 2022 to 2032.

- The Japan Commercial Vehicle Market Size is expected to reach 1,172 Thousand Units by 2032.

Get more details on this report -

The Japan Commercial Vehicle Market Size is expected to reach 1,172 Thousand Units by 2032, at a CAGR of 4.1% during the forecast period 2022 to 2032.

Market Overview

The automotive sector in Japan continues to be a pillar of the country's economy, with companies such as Toyota, Honda, Nissan, and Mitsubishi achieving global prominence. This capability continues to the commercial vehicle industry, where Isuzu, Hino, and Fuso are leading in the industry. Japan's technological prowess is well-known. This has resulted in advancements in fuel economy, vehicle safety, and increasingly, alternative energy sources such as hybrid and electric systems. The advent of e-commerce has accompanied an increase in demand for transportation vehicles ranging from tiny vans to larger trucks. Additionally, public transportation investments have influenced the demand for buses and coaches. The drive for more sustainable transportation, coupled with the possibility of increasing digitalization and automation, illustrates a rapidly changing market scenario. Demand for various types of commercial vehicles is going to be driven by the rise of e-commerce, growing urbanization, and infrastructural development.

Report Coverage

This research report categorizes the market for Japan Commercial Vehicle Market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan Commercial Vehicle Market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the Japan Commercial Vehicle Market.

Japan Commercial Vehicle Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | 786 Thousand Units |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 4.1% |

| 2032 Value Projection: | 1,172 Thousand Units |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | COVID-19 Impact Analysis, By Vehicle Type, By Engine Type, By End-use |

| Companies covered:: | Isuzu Motors Ltd., Nissan Motor, Hino Motors, Ltd., Toyota Motor Corporation, Mitsubishi Fuso Truck and Bus Corporation, Honda Motor Company, Ltd., Mazda Motor Corporation, Mitsubishi Motors Corporation, Daihatsu Motor Co., Ltd., Suzuki Motor Corporation, UD Trucks Corporation, and Other key venders |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan commercial vehicle market includes a diverse range of vehicles mostly utilized for the transportation of goods and passengers. These types of vehicles serve a major part in the nation's logistics, transportation, construction, and other industries. Construction and heavy-duty vehicle demand is being driven by major urban development projects and infrastructure enhancements. In order to meet consumer demands, the growth of online shopping has increased the demand for effective and rapid delivery trucks. With worldwide movements toward long-term sustainability, there is a growing drive for environmentally efficient commercial vehicles. Japan, a pioneer in hybrid vehicle technology with brands such as Toyota at the forefront, anticipates an increase in demand for hybrid and electric vehicles and buses. In addition, the incorporation of modern technologies such as self-driving systems, IoT, and AI into commercial vehicles is becoming increasingly common to improve logistics to improve productivity and security. Japan has an immense opportunity to export commercial vehicles, particularly to emerging nations, because of its internationally recognized manufacturers and track record for quality. As urbanization continues to rise and e-commerce becomes more common, the desire for cost-effective and environmentally friendly logistics solutions will drive the commercial vehicle industry even higher.

Market Segment

- In 2022, the light commercial vehicles segment is witnessing a higher growth rate over the forecast period.

Based on the vehicle type, the Japan Commercial Vehicle Market is segmented into light commercial vehicles, medium & heavy commercial vehicles, bus, coaches, and others. Among these, the light commercial vehicles segment is witnessing a higher growth rate over the forecast period. This can be ascribed to the rise of e-commerce, which has raised consumer interest in last-mile delivery solutions in densely inhabited regions, as well as the versatility of LCVs for a variety of activities in highly populated locations such as Tokyo, Osaka, and Yokohama. LCVs are primarily intended for the transportation of commodities rather than people. They have a gross vehicle weight of up to 3.5 tons in most cases. LCVs are becoming more popular as e-commerce grows and the necessity for last-mile delivery options grows in crowded urban areas.

- In 2022, the ICE segment accounted for the largest revenue share of more than 37.8% over the forecast period.

On the basis of Engine Type, the Japan Commercial Vehicle Market is segmented into ICE, Hybrid & Electric Vehicles. Among these, the ICE segment is dominating the market with the largest revenue share of 37.8% over the forecast period. This advantage can be due to their traditional predominance, established refueling infrastructure, and diversity in terms of mobility and load-carrying capability. ICE vehicles use traditional engines that generate power by burning fuel, often gasoline or diesel. While Japan is moving toward cleaner, greener transportation alternatives, ICE commercial vehicles continue to dominate the market due to their longer range, developed maintenance infrastructure, and lower starting costs. However, regulatory pressures, urban emission standards, and green vehicle incentives are gradually driving the market away from ICE.

- In 2022, the logistics segment accounted for the largest revenue share of more than 34.2% over the forecast period.

On the basis of end-use, the Japan Commercial Vehicle Market is segmented into industrial, mining & construction, logistics, passenger transportation, and others. Among these, the logistics segment is dominating the market with the largest revenue share of 34.2% over the forecast period. Because of Japan's crowded metropolitan areas, rising e-commerce sector, and requirement for rapid delivery of goods across the archipelago, logistics is a critical component of the country's commercial demand for vehicles. Logistics vehicles are critical for efficiently delivering goods around the country and connecting supply chains and distribution networks. Furthermore, they are essential for e-commerce, retail distribution, and ensuring items arrive on schedule. Japan's logistics business is thriving, mainly to a developed e-commerce economy and a high level of daily life. To lower the carbon footprint, the emphasis is on streamlining logistical operations, cutting delivery times, and adopting sustainable vehicles.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan Commercial Vehicle Market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Isuzu Motors Ltd.

- Nissan Motor

- Hino Motors, Ltd.

- Toyota Motor Corporation

- Mitsubishi Fuso Truck and Bus Corporation

- Honda Motor Company, Ltd.

- Mazda Motor Corporation

- Mitsubishi Motors Corporation

- Daihatsu Motor Co., Ltd.

- Suzuki Motor Corporation

- UD Trucks Corporation

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- On May 2023, Toyota, Suzuki, and Daihatsu Motor have just announced that they have collaborated to build a fully electric vehicle platform. It will be used in the next generation of mini-commercial electric vans. The three automakers collaborated to create a battery-electric vehicle (BEV) technology designed for mini-commercial EVs. Commercial Japan Partnership Technologies Corporation is also assisting the manufacturers with the efficiency and last-mile logistics of electric vans. The firm will mostly assist with the electric vans' operating range, which is expected to be around 200 kilometers on a single charge.

- On May 2023, Hino Motors, a Toyota Motor group subsidiary, and Mitsubishi Fuso Truck and Bus, which is majority-owned by Daimler Truck, want to integrate their activities in order to compete more effectively in the freight-hauling vehicle market. The four companies agreed to merge Hino and Mitsubishi Fuso into a single business that would be jointly controlled by Toyota and Daimler Truck.

- On July 2022, Isuzu, Toyota, Hino, and CJPT have joined forces to advance mass-market light-duty fuel cell electric truck planning and research. The collaborative effort is intended to contribute to the acceptance of a hydrogen society as well as carbon neutrality by expanding customer options and increasing interest in hydrogen.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the Japan Commercial Vehicle Market based on the below-mentioned segments:

Japan Commercial Vehicle Market, By Vehicle Type

- Light Commercial Vehicles

- Medium & Heavy Commercial Vehicles

- Bus

- Coaches

- Others

Japan Commercial Vehicle Market, By Engine Type

- ICE

- Hybrid & Electric Vehicles

- Others

Japan Commercial Vehicle Market, By End-use

- Industrial

- Mining & Construction

- Logistics

- Passenger Transportation

- Others

Need help to buy this report?