Japan Commercial Telematics Market Size, Share, and COVID-19 Impact Analysis, By Type (Solution and Services), By System Type (Embedded, Tethered, and Smartphone Integrated), By End Use (Transportation and Logistics, Media and Entertainment, Government and Utilities, Travel and Tourism, Construction, Healthcare, and Others), and Japan Commercial Telematics Market Insights, Industry Trend, Forecasts to 2035.

Industry: Automotive & TransportationJapan Commercial Telematics Market Insights Forecasts to 2035

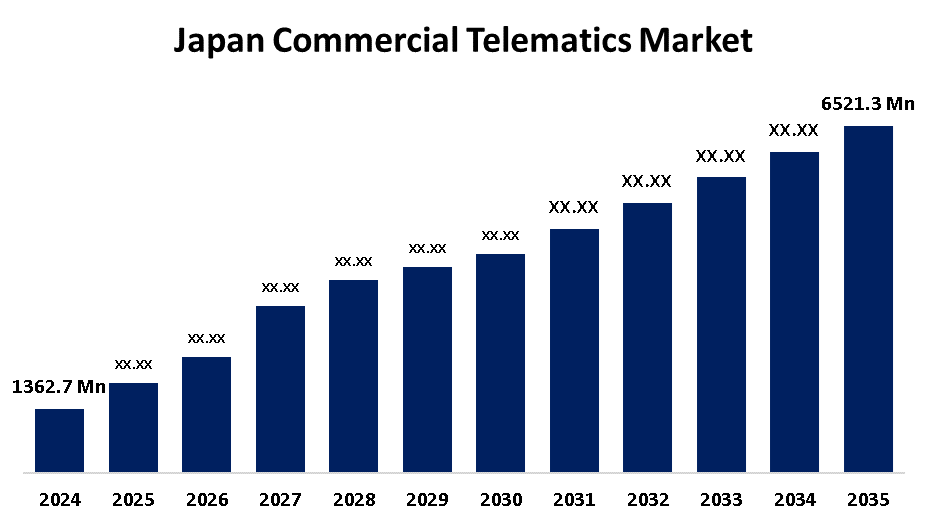

- The Japan Commercial Telematics Market Size Was Estimated at USD 1362.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 15.3% from 2025 to 2035

- The Japan Commercial Telematics Market Size is Expected to Reach USD 6521.3 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan commercial telematics market is anticipated to reach USD 6521.3 million by 2035, growing at a CAGR of 15.3% from 2025 to 2035. The Japan market for commercial telematics is expanding due to increasing adoption of connected vehicle technologies, demand for effective fleet management, better route optimization, lower fuel consumption, increased safety, intelligent transport projects, and growing e-commerce businesses.

Market Overview

The Japan commercial telematics market is defined as technologies integrated into commercial vehicles, a mix of GPS, onboard diagnostics, and telecommunications systems, to monitor immediate location, behavior, safety, and performance of vehicles. Japan benefits from its advanced automotive and semiconductor industries, strong 4G/5G connectivity, and expertise in embedded telematics and IoT integration. Growth opportunities include AI-driven analytics, predictive maintenance, connected and autonomous vehicles, smart city initiatives, and emerging sectors like construction and healthcare fleet operations. It is driven by the strict safety and emissions rules that require vehicle tracking and compliance, growing demand for transportation and logistics efficiency, and adoption of custom insurance schemes based on concurrent driving data. Government programs, including national smart transport strategy initiatives by the Ministry of Land, Infrastructure, Transport and Tourism, and mandated adoption in alignment with connected/autonomous mobility roadmaps, drive additional adoption by industries.

Report Coverage

This research report categorizes the market for the Japan commercial telematics market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan commercial telematics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan commercial telematics market.

Japan Commercial Telematics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1362.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 15.3% |

| 2035 Value Projection: | USD 6521.3 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 167 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By End, By System and COVID-19 Impact Analysis |

| Companies covered:: | Nissan Corporation, Denso Corporation, Toyota Motor Corporation, continental, Honda, Fujitsu Limited, Bosch, Panasonic corporation, Visteon, SoftBank Corp., NTT Docomo, Marelli, Others, and others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan commercial telematics is fueled by the increasing need for fleet effectiveness, safety, and regulatory compliance within the transportation and logistics industries. Strict government regulations on emissions, vehicle monitoring, and driver behaviour monitoring drive adoption. Increasing usage of practice insurance and predictive maintenance, along with developments in 5G connectivity and IoT integration, further drive growth. Additionally, Japan’s strong automotive and semiconductor industries provide a solid foundation for telematics solutions, improving performance, data analytics, and concurrent decision-making capabilities.

Restraining Factors

The Japan commercial telematics market faces restraints such as high installation and maintenance costs, data privacy concerns, and integration challenges with legacy vehicle systems. Limited awareness among small fleet operators also hinders widespread adoption across the industry.

Market Segmentation

The Japan commercial telematics market share is classified into type, system type, and end use

- The solution segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan commercial telematics market is segmented by type into solution and services. Among these, the solution segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to these supporting real-time fuel monitoring, diagnostics, and tracking. This includes telematics system hardware and software such as GPS tracking units, OBD devices, cameras, sensors, and data platforms. The demand is increasing due to the requirement for actionable insights to enhance fleet operational efficiency, safety, and optimization across various industries.

- The embedded segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan commercial telematics market is segmented by system type into embedded, tethered, and smartphone integrated. Among these, the embedded segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to they provide permanent, dependable connectivity for real-time location monitoring, remote diagnostic analysis, and smooth fleet management integration. Popular among large fleets and automakers, they enable the support of ADAS and predictive maintenance features, providing assured performance even in areas of poor coverage, perfect for logistics, transportation, and construction applications.

- The transportation and logistics segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan commercial telematics market is segmented by end use into transportation and logistics, media and entertainment, government and utilities, travel and tourism, construction, healthcare, and others. Among these, the transportation and logistics segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the Telematics technology is essential for efficient fleet management, facilitating optimized routes and live monitoring. Using GPS, sensors, and data analytics, companies optimize fuel efficiency, lower operations costs, maintain asset and driver safety, and enhance delivery times, making telematics a must for logistics and goods transport companies.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations companies involved within the Japan commercial telematics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nissan Corporation

- Denso Corporation

- Toyota Motor Corporation

- Continental

- Honda

- Fujitsu Limited

- Bosch

- Panasonic Corporation

- Visteon

- SoftBank Corp

- NTT Docomo

- Marelli

- Others

Recent Developments:

- In April 2024, Toyota Motor Corporation introduced the new 250 series to its Land Cruiser lineup in Japan. Additionally, it launched special edition ZX "First Edition" and VX "First Edition" models, limited to 8,000 units, improving exclusivity and customer appeal.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan commercial telematics market based on the below-mentioned segments:

Japan Commercial Telematics Market, By Type

- Solution

- Services

Japan Commercial Telematics Market, By System Type

- Embedded

- Tethered

- Smartphone Integrated

Japan Commercial Telematics Market, By End Use

- Transportation and Logistics

- Media and Entertainment

- Government and Utilities

- Travel and Tourism

- Construction

- Healthcare

- Others

Need help to buy this report?