Japan Commercial Refrigeration Equipment Market Size, Share, and COVID-19 Impact Analysis, By Type (Refrigerator & Freezer, Transport Refrigeration, Refrigerated Display Cases, Ice Machines, and Others), By Application (Food & Beverage, Retail Stores, Hotels & Restaurants, Chemicals & Pharmaceuticals, and Others), and Japan Commercial Refrigeration Equipment Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsJapan Commercial Refrigeration Equipment Market Insights Forecasts to 2035

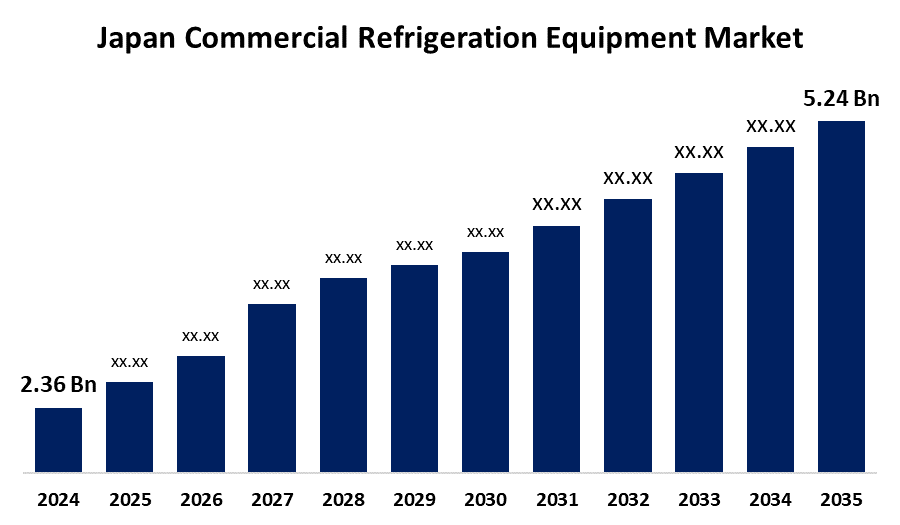

- The Japan Commercial Refrigeration Equipment Market Size Was Estimated at USD 2.36 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.52% from 2025 to 2035

- The Japan Commercial Refrigeration Equipment Market Size is Expected to Reach USD 5.24 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Japan Commercial Refrigeration Equipment Market Size is anticipated to reach USD 5.24 Billion by 2035, growing at a CAGR of 7.52% from 2025 to 2035. The Japan market for commercial refrigeration equipment is growing due to the thriving food and beverage industry, urbanization, and a higher demand for energy-efficient options. More particularly, the growth in food retailing, consumption of ready-to-eat meals and convenience foods, and increased specialized beverage consumption (such as craft beer and cold brew) are key drivers.

Market Overview

The Japan commercial refrigeration equipment market refers to equipment like refrigerators, freezers, drink coolers, display cases, and transport refrigeration equipment. These devices play critical roles in all industries like food retail, hospitality, and pharmaceuticals, in providing safe storage and transport of perishable products. Major strengths include Japan's emphasis on technology development, which brings in innovative solutions in the form of IoT-integrated systems for maximum performance with minimal energy consumption. Opportunities exist in increasing the adoption of environmentally friendly refrigerants and growth in the healthcare sector, which demands efficient biomedical refrigeration. This is fueled by growth in the food retail and hospitality industries as well as the need for energy-efficient and intelligent refrigeration systems. The Japanese government imposes strict energy efficiency regulations and encourages natural refrigerant use to mitigate greenhouse gas emissions, facilitating the shift towards sustainable refrigeration technology.

Report Coverage

This research report categorizes the market for the Japan commercial refrigeration equipment market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan commercial refrigeration equipment market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan commercial refrigeration equipment market.

Japan Commercial Refrigeration Equipment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.36 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 7.52% |

| 2035 Value Projection: | USD 5.24 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 244 |

| Tables, Charts & Figures: | 101 |

| Segments covered: | By Type and By Application |

| Companies covered:: | Altus Group Ltd, Daikin Industries Ltd, Fujimak Corporation, Dover Corp, Ashford Hospitality Trust Inc., Hoshizaki Corporation, Lennox International Inc., Whirlpool Corp, Electrolux AB ADR, Illinois Tool Works Inc, Panasonic Corporation, Johnson Controls International PLC, Dover Corp, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan commercial refrigeration equipment market is driven by growing demand from the food and beverage industry, particularly supermarkets, restaurants, and convenience stores, for effective storage of ready-to-eat, frozen, and chilled foods. Energy-efficient inverter compressors, LED lights, and IoT-based smart solutions are technologies that enhance efficiency and lower costs. Cold chain logistics expansion, driven by the expansion of e-commerce, also fuels demand. Increased focus on sustainability promotes the use of environment-friendly refrigerants and energy-efficient technologies.

Restraining Factors

The Japan market for commercial refrigeration equipment is hindered by high upfront costs, regulations, and maintenance costs. Moreover, unstable raw material prices and competition from used equipment constrain market growth and slow down the uptake of advanced refrigeration technologies.

Market Segmentation

The Japan Commercial Refrigeration Equipment Market Share is classified into type and application.

- The transport refrigeration segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan commercial refrigeration equipment market is segmented by type into refrigerator & freezer, transport refrigeration, refrigerated display cases, ice machines, and others. Among these, the transport refrigeration segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the surge in web-based grocery shopping, which has boosted demand for refrigerated trucks to transport perishable products. The rising e-commerce and voracity for perishables have made refrigerated transportation facilitate product quality and safety over long distances.

- The food & beverage segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan commercial refrigeration equipment market is segmented by application into food & beverage, retail stores, hotels & restaurants, chemicals & pharmaceuticals, and others. Among these, the food & beverage segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to the rising consumer demand for healthy and convenient ready-to-eat meal choices across the globe. Offering a broad variety of dishes, these meals emerged as a sought-after food option for those who do not have time to spend in the kitchen. Ready-to-eat meals need proper refrigeration so they can retain their taste and quality.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan commercial refrigeration equipment market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Altus Group Ltd

- Daikin Industries Ltd

- Fujimak Corporation

- Dover Corp

- Ashford Hospitality Trust Inc.

- Hoshizaki Corporation

- Lennox International Inc.

- Whirlpool Corp

- Electrolux AB ADR

- Illinois Tool Works Inc

- Panasonic Corporation

- Johnson Controls International PLC

- Dover Corp

- Others

Recent Developments:

- In December 2024, Hoshizaki Corporation revealed the release of 364 new commercial refrigerators, freezer, and refrigerator-freezer models for the Japanese market, all featuring natural refrigerants. This move brings the company's shift away from hydrofluorocarbons (HFCs) to near completion, making a huge contribution to environmental conservation.

- In November 2024, Daikin launched a new range of full-electric and plug-in hybrid transport refrigeration units at SOLUTRANS Lyon. This product release demonstrates the dedication of Daikin to leading commercial and industrial refrigeration technologies.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan commercial refrigeration equipment market based on the below-mentioned segments:

Japan Commercial Refrigeration Equipment Market, By Type

- Refrigerator & Freezer

- Transport Refrigeration

- Refrigerated Display Cases

- Ice Machines

- Others

Japan Commercial Refrigeration Equipment Market, By Application

- Food & Beverage

- Retail Stores

- Hotels & Restaurants

- Chemicals & Pharmaceuticals

- Others

Need help to buy this report?