Japan Coffee Beans Market Size, Share, and COVID-19 Impact Analysis, By Product (Arabica, Robusta, and Others), By End User (Personal Care, Food and Beverages, and Pharmaceutical), By Distribution Channel (Online and Offline), and Japan Coffee Beans Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesJapan Coffee Beans Market Insights Forecasts to 2035

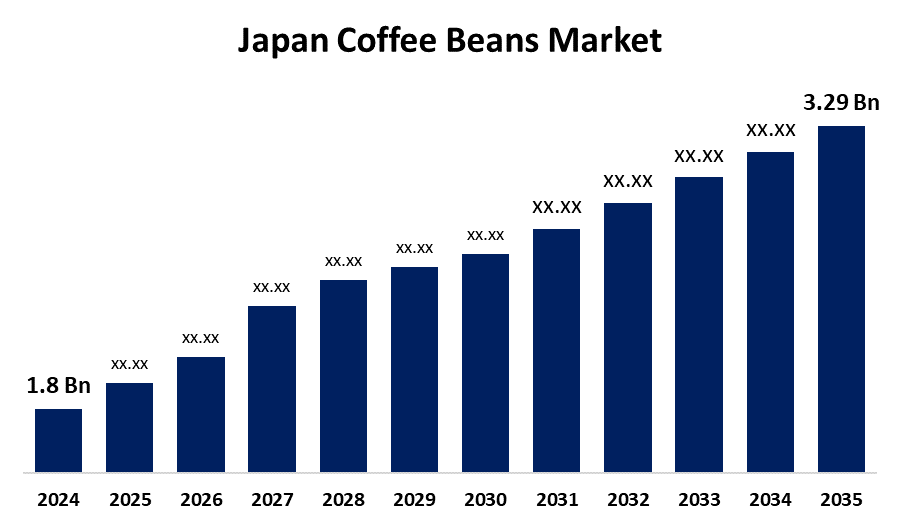

- The Japan Coffee Beans Market Size Was Estimated at USD 1.8 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.64% from 2025 to 2035

- The Japan Coffee Beans Market Size is Expected to Reach USD 3.29 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Japan coffee beans market size is anticipated to reach USD 3.29 Billion by 2035, growing at a CAGR of 5.64% from 2025 to 2035. The Japan market for coffee beans is increasing due to expanding consumption, thriving cafe culture, and rising demand for special and high-end coffee. Convenience and nutritional advantages also add to the market growth.

Market Overview

The Japan coffee beans market refers to the importation, processing, and marketing of Arabica and Robusta coffee beans used in whole beans, ground coffee, and ready-to-drink forms. Coffee is culturally significant in Japan, and there exists a strong demand for premium, specialty, and ethical coffee products. Japanese consumers are moving towards single-origin beans, high-quality blends, and ready-to-drink coffee. Strengths in Japan include a mature coffee culture, advanced brewing technology, and consumer values of quality and flavor diversity. Increasing demand for specialty coffee products and increased distribution offer opportunities for specialty coffee products to expand consumption of coffee bean products, other distribution habits, and establish sustainable programs. One of the key drivers of market expansion has to do with the rising demand for high-quality coffee, which includes premium and specialty coffee with an increased demand for distinctive flavor profiles. Additionally, the growth in the use of coffee at home through instituted at-home work policies and stay-at-home orders has driven the coffee beans market. Market growth as a target on sustainability is being spurred by the government's interest in sustainable farm practices and a learn in the export balance from Japan through international trade agreements.

Report Coverage

This research report categorizes the market for the Japan coffee beans market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan coffee beans market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan coffee beans market.

Japan Coffee Beans Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.8 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 5.64% |

| 2035 Value Projection: | USD 3.29 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 257 |

| Tables, Charts & Figures: | 107 |

| Segments covered: | By Product, By End User and By Distribution Channel |

| Companies covered:: | Doutor Nichires Holdings Co., Ltd., UCC Ueshima Coffee Co., Ltd., The Kraft Heinz Company, Key Coffee Inc., Ito En, Ltd., S. Ishimitsu & Co., Ltd., Nestlé Japan Ltd., Ajinomoto Co., Inc., Asahi Group Holdings, Ltd., Saza Coffee, Komeda Holdings Co., Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan coffee beans market is experiencing growth due to a rise in demand for higher-quality and specialty coffee, reflecting a more sophisticated coffee culture and evolving consumer taste preferences. Increased consumption at home, particularly in the post-pandemic period, drives growth for the market. The popularity of ready-to-consume coffee and innovation in brewing technology drive convenience. Also, rising consumer interest in sustainably sourced and ethically produced products drives purchasing behavior and further fuels the growth and diversification of the market.

Restraining Factors

The Japan coffee bean market is confronted with restraints like changes in coffee bean prices, reliance on imports, and weather-related supply interruptions. Moreover, increasing operating expenses and competition from other beverages pose threats to long-term market growth and profitability.

Market Segmentation

The Japan coffee beans market share is classified into product, end user, and distribution channel.

- The arabica segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan coffee beans market is segmented by product into arabica, robusta, and others. Among these, the arabica segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to it tasting finer, less bitter, and lighter than other varieties, like Robusta. It contains less caffeine, which makes its taste lighter and less complex, and thus it is the best for specialty and premium coffee markets. Arabica beans are usually grown at high altitudes, which raises their quality and aroma.

- The food and beverages segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan coffee beans market is segmented by end user into personal care, food and beverages, and pharmaceutical. Among these, the food and beverages segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the high domestic usage of coffee in restaurants, cafés, commercial stores, and homes. Increased demand for specialty coffee, cold brew, and instant-ready-to-consume coffee has fueled market growth. Increased home brewing culture, instant coffee, and high-quality blends further propel demand.

- The online segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan coffee beans market is segmented by distribution channel into online and offline. Among these, the online segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the popularity of direct-to-consumer (DTC) brands, e-commerce websites, and coffee subscription schemes. This has been driven by availability, diversity, and convenience offered by online shopping, thus making them want to consume premium, organic, and specialty coffee from across the world.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan coffee beans market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Doutor Nichires Holdings Co., Ltd.

- UCC Ueshima Coffee Co., Ltd.

- The Kraft Heinz Company

- Key Coffee Inc.

- Ito En, Ltd.

- S. Ishimitsu & Co., Ltd.

- Nestlé Japan Ltd.

- Ajinomoto Co., Inc.

- Asahi Group Holdings, Ltd.

- Saza Coffee

- Komeda Holdings Co., Ltd.

- Others

Recent Developments:

- In Nov 2024, Nestle Japan Ltd. announced the release of "Nescafe Gold Blend Caffeine Half," a regular soluble coffee with 50% less caffeine compared to typical coffee extracts.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan coffee beans market based on the below-mentioned segments:

Japan Coffee Beans Market, By Product

- Arabica

- Robusta

- Others

Japan Coffee Beans Market, By End User

- Personal Care

- Food and Beverages

- Pharmaceutical

Japan Coffee Beans Market, By Distribution Channel

- Online

- Offline

Need help to buy this report?