Japan Clean Label Ingredients Market Size, Share, and COVID-19 Impact Analysis, By Type (Natural Colors, Natural Flavors), By Application (Food Sector, Bakery, and Confectionery Industry), and Japan Clean Label Ingredients Market Insights, Industry Trend, Forecasts to 2035.

Industry: Food & BeveragesJapan Clean Label Ingredients Market Insights Forecasts to 2035

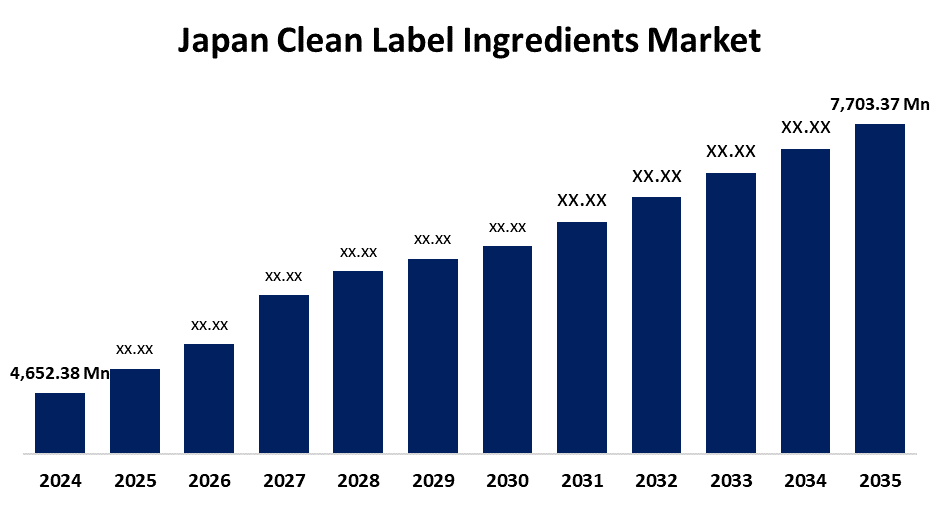

- The Japan Clean Label Ingredients Market Size Was Estimated at USD 4,652.38 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.69% from 2025 to 2035

- The Japan Clean Label Ingredients Market Size is Expected to Reach USD 7,703.37 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan Clean Label Ingredients Market Size is anticipated to reach USD 7,703.37 Million by 2035, growing at a CAGR of 4.69% from 2025 to 2035. The market is driven by rising health consciousness, especially among younger consumers, and growing demand for organic and non-GMO products.

Market Overview

The Japan clean label ingredients market refers to the segment of the food and beverage industry focused on natural, minimally processed ingredients that are free from artificial additives, preservatives, and genetically modified organisms (GMOs). These ingredients are used to meet consumer demand for transparency, health, and sustainability in food production. Growing consumer preferences for organic and non-GMO products, as well as a move toward more transparent food labeling, are major factors propelling this industry. The need for clean label components is also being driven by the move toward better lifestyles and the increasing impact of social media on consumer decisions. In order to comply with clean label regulations, manufacturers are concentrating on reformulating their products, which should boost market expansion. Growing customer desire for natural and minimally processed ingredients, along with increased knowledge of the health advantages of clean label products and food safety, are the main drivers of this rise.

Report Coverage

This research report categorizes the market for the Japan clean label ingredients market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan clean label ingredients market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan clean label ingredients market.

Japan Clean Label Ingredients Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4,652.38 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.69% |

| 2035 Value Projection: | USD 7,703.37 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 234 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Cargill, Archer Daniels Midland (ADM), Koninklijke DSM N.V., DuPont de Nemours and Company, Kerry Group Plc, Tate & Lyle Plc, Corbion Inc., and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for clean-label ingredients is mostly driven by Japan's stringent regulations and food safety standards. The government has put laws into place to ban artificial additives and encourage natural components. For example, new regulations limiting the use of specific artificial food coloring and preservatives were adopted by the Ministry of Health, Labour, and Welfare in 2021. According to industry statistics, this resulted in a 30% rise in demand for natural substitutes such as fruit and vegetable extracts the next year. Since 2019, the number of certified organic farms has increased by 12% annually, reflecting the growing popularity of the Japan Agricultural Standards (JAS) certification for organic products. Sales of packaged foods with JAS certification increased by 18% in 2023, according to government data.

Restraining Factors

The market nevertheless faces significant production and reformulation expenses despite its great pace, especially when it comes to substituting natural additives for synthetic ones. Supply chains may become more complex due to seasonal sourcing issues, limited availability of specific clean ingredients, and shorter shelf lives. Furthermore, conflicting labeling requirements and consumer concern about greenwashing could impede confidence and delay adoption. Smaller producers might also find it difficult to provide the infrastructure and technological know-how required to satisfy clean label requirements.

Market Segmentation

The Japan clean label ingredients market share is classified into type and application.

- The natural colors segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan clean label ingredients market is segmented by type into natural colors, natural flavors. Among these, the natural colors segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Natural colors have become increasingly popular, especially in drinks and candies, as consumers look for aesthetically pleasing goods free of artificial coloring.

- The food sector segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan clean label ingredients market is segmented by application into food sector, bakery, and confectionery industry. Among these, the food sector segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Natural colors and tastes have been popular in the confectionery sector, as evidenced by a government survey showing a significant rise in the number of chocolate and candy items with clean label claims.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan clean label ingredients market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cargill

- Archer Daniels Midland (ADM)

- Koninklijke DSM N.V.

- DuPont de Nemours and Company

- Kerry Group Plc

- Tate & Lyle Plc

- Corbion Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Clean Label Ingredients Market based on the following segments:

Japan Clean Label Ingredients Market, By Type

- Natural Colors

- Natural Flavors

Japan Clean Label Ingredients Market, By Application

- Food Sector

- Bakery

- Confectionery Industry

Need help to buy this report?